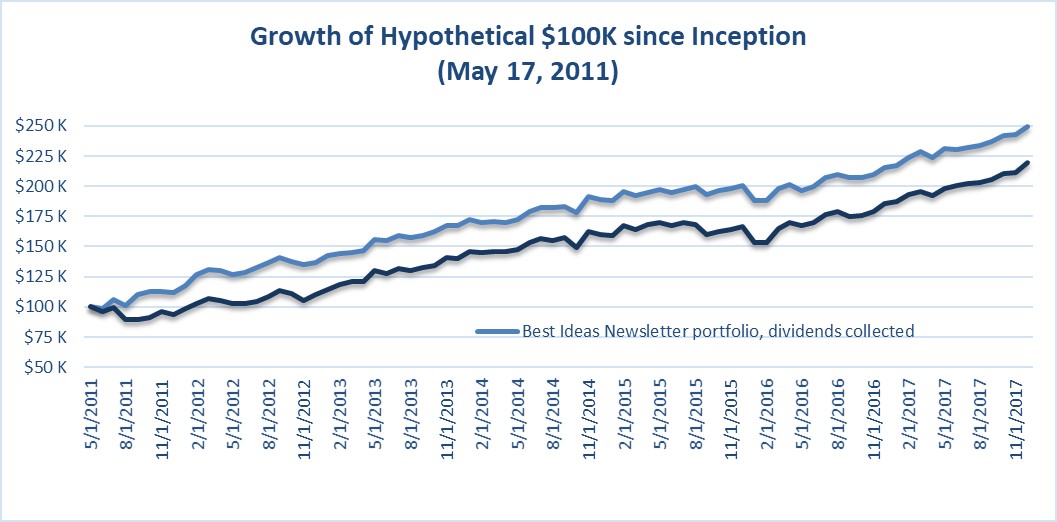

The figure above shows the performance of the simulated Best Ideas Newsletter portfolio from inception May 17, 2011, through December 15, 2017, relative to its declared benchmark, the S&P 500 (SPY), on an apples-to-apples basis, with dividends collected but not reinvested for both the newsletter portfolio and the SPY, as reported in the monthly newsletter. The simulated Best Ideas Newsletter portfolio outperformed the S&P 500, including reinvested dividends in the benchmark, since inception (May 17, 2011) and since the inaugural release of the newsletter (July 13, 2011) through the end of the measurement period (December 15, 2017). The results are hypothetical and do not represent returns that an investor actually earned. Past results are not indicative of future performance. Valuentum moved to weighting ranges for newsletter portfolio constituents at the end of 2017.

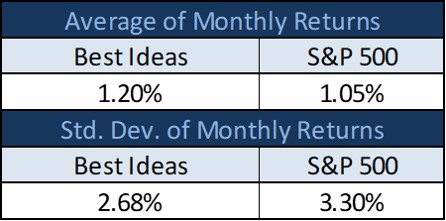

This figure shows the average monthly returns and standard deviation of returns for the simulated Best Ideas Newsletter portfolio relative to its declared benchmark, the S&P 500 (SPY), on an apples-to-apples basis, from inception, May 11, 2017, through December 15, 2017, with dividends collected but not reinvested for both the newsletter portfolio and the SPY. The results are hypothetical and do not represent returns that an investor actually earned. Past results are not indicative of future performance.

By Brian Nelson, CFA

As of the writing of this article, it is still rather early during second-quarter earnings season, but according to the latest tally from FactSet through July 20, “the blended earnings decline for the S&P 500 is -44.0%.” We think the large earnings declines for the second quarter are expected, already factored into the market, and not at all material against a backdrop of a Fed/Treasury that together are supporting just about any and every asset class, from junk-rated debt to the implicit purchase of equities, if need be. Our biggest fears of substantial equity dilution at depressed prices have been assuaged, and we would not be surprised to see this market continue to march ever higher.

Many members of valuentum.com/ took advantage of our highlighting 20 brand new ideas near the depths of the COVID-19 swoon, “Valuentum’s COVID-19 Ideas Have Outperformed Significantly (May 14),” and as with any company in our coverage universe, we seek to derive and update key metrics from fair value estimates to fair value ranges and beyond, as well as write updated commentary associated with the calls we make. Unlike other publishers, we emphasize the importance of the story arc, meaning we just don’t highlight something and forget about it. We continue to measure our success rates and the efficacy of our process, where applicable.

For those seeking restaurant exposure, our favorite restaurant ideas continue to be Domino’s (DPZ) and Chipotle (CMG) as these two companies are uniquely-positioned to capitalize on demand in a post-COVID-19 world. Domino’s remains at the forefront of applying digital technology (online ordering and mobile applications) to drive sales expansion, and its asset-light mostly-franchised business model is a huge driver to excess return on invested capital. During the second quarter, for example, Domino’s showcased U.S. same-store sales growth of 16.1%, helping to drive earnings per share expansion of 36.5%.

Chipotle is scheduled to report its second-quarter numbers after the close July 22, and we think the restaurant is back on track as a new executive team has put many of the food-related issues behind it. Chipotle is doing a wonderful job converting lost foot traffic market share into mobile/pick-up and drive through customers, and the restaurant remains a hit with health-conscious consumers. While results may be a bit choppy in the near term, Chipotle hasn’t even scratched the surface on its myriad long-term opportunities, not the least of which is the potential for a breakfast daypart menu offering. The company has been one of the top performers since we highlighted it as a COVID-19 play March 17.

All things considered, we continue to be bullish on the stock market for the long haul, “ICYMI – Stay Optimistic. Stay Bullish. I Am (May 15).” Enterprise valuation, the framework behind the DCF (discounted cash-flow) process, remains the causal driver behind what we’re seeing in the stock markets today, in my opinion, not only in causing the market crash as investors factored in reduced free cash flow expectations in late February, but also in driving the market recovery, as investors now apply lower cost of capital assumptions within models and as many factor in heightened inflation expectations to augment longer-duration cash flow streams.

The bottom line is that the market is not as frothy as some may believe. The near-term price-to-earnings ratios should be elevated, as share prices are set on normalized conditions, not on either peak or trough performance. While we fully expect a growing dichotomy between outperforming net-cash, free-cash-flow generating secular-growth powerhouses (more succinctly captured in the arbitrary buckets of big-cap tech, large cap growth, and the NASDAQ, more generally), relative to underperforming “old economy” names, including much of the energy (XLE) and banking sectors (XLF)–two areas that continue to be punished–we also believe that a fair price for the S&P 500 based on normalized assumptions in the context of a Fed/Treasury backstop is north of 3,500. Why the market is soaring, in our view >>

What we do at Valuentum is use our research, methodology and experience to roll up our favorite ideas into the newsletter portfolios, meaning our favorite ideas for each approach are in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio and High Yield Dividend Newsletter portfolio. We also include three new ideas each month (outside the portfolio setting) in the Exclusive publication, the success rates of which have been fantastic. Our new options commentary released earlier this year has been a hit, too. We think we have something for everybody, and for those that took part in the survey, please stay tuned as we hope to have some exciting developments on that front!

The July editions of the Best Ideas Newsletter and Dividend Growth Newsletter can be found here (pdf) and here (pdf), respectively. They are released on the 15th and 1st of the month, respectively. The High Yield Dividend Newsletter is released on the 1st of the month, and the Exclusive publication is generally released on the first Saturday of the month, while options commentary is periodic depending on market opportunities and conditions. The archives of the Best Ideas Newsletter and Dividend Growth Newsletter can be found here and here, respectively. In a world where many active fund managers have been underperforming, the newsletter portfolios have done remarkably well.

I wanted to keep some of our research in front of you. Though we have a number of banks on our radar, we continue to steer clear of the space, as it has suffered immensely during the COVID-19 crash and has failed to participate meaningfully in the bounce back. Our latest ‘Banks & Money Centers Industry Report’ can be accessed here (pdf). Wells Fargo (WFC) reported a disaster of a quarter here, while Morgan Stanley (MS) had a quarter of “notable brilliance,” the write-up of which can be accessed here. Our takes on the second quarters of JPMorgan (JPM), Citigroup (C), and Bank of America (BAC) can be accessed here, here, and here, respectively.

The number of shots on goal for a potential vaccine for COVID-19 continues to increase, and the sheer amount of resources being thrown at developing a new vaccine makes me confident that we’re going to eventually beat this terrible virus, “Excited by COVID-19 Vaccine Candidates (May 18).” We address newsletter portfolio J&J’s (JNJ) latest report and vaccine progress here, “Johnson & Johnson Beats Estimates and Raises Guidance (July 21). With remdesivir and dexamethasone, the very small percentage of critically-ill COVID-19 patients now have a viable path to recovery. The world is fighting back and has turned the tide against COVID-19.

As you know, we prefer net-cash rich, free-cash-flow generating, secular-growth powerhouses, including Facebook (FB), Apple (AAPL), Alphabet (GOOG), among other asset-light franchises, but our latest thoughts on IBM (IBM) can be found here. Beyond our favorite retailer Dollar General Corp (DG), we’re not planning on taking on any more brick-and-mortar retail exposure anytime soon, but we’re paying very close attention to developments across the space, “Walgreens Targets Cost Cuts and In-Store Doctors’ Offices (June 20).”

We like Facebook’s new Shops feature, and should we ever seek to add more direct exposure beyond Dollar General, we’d prefer Amazon (AMZN), as it better fits the characteristics of a Valuentum stock. Though we might have included Amazon in the newsletter portfolios in the past were it not for the sensitivity of its fair value estimate to changes in mid-cycle operating-margin expectations, the newsletter portfolios are already heavily weighted in information technology and Internet-related giants that have performed quite well.

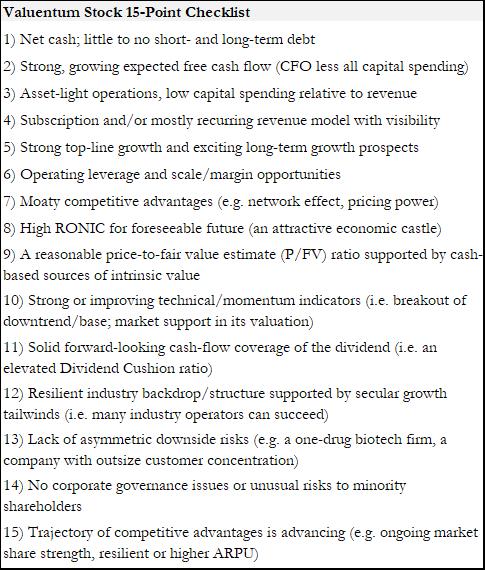

The figure above includes some of the characteristics commonly found in Valuentum stocks.

In fact, top-weighted ideas in the Best Ideas Newsletter portfolio (login required) Facebook, Alphabet, Visa (V) and PayPal (PYPL) have performed incredibly well this year, while the S&P 500 is largely flat. We’ve been somewhat disappointed with Berkshire Hathaway (BRK.B), particularly with respect to Warren Buffett’s blunder with airlines, but we’re also not too enthused by its doubling-down on midstream assets. We never thought we’d say it, but we’d view Berkshire Hathaway as a source of cash in the Best Ideas Newsletter portfolio.

With all this said, we hope you are enjoying your membership to Valuentum very much, and if you have any questions, or if we can be of any further assistance at this time, please just let us know at info@valuentum.com. The second edition of my book Value Trap will be available very soon, and I hope you enjoy it immensely. It has 70 new pages in all, a brand new 40+ page Prologue with commentary on the COVID-19 crisis, a new Appendix, and even some multiple choice questions to hit home the ambiguous nature of valuation multiples. We’ll be following up on the survey as soon as possible. Always our very best, and please stay safe out there!

ETFs purchased by the Fed: LQD, VCIT, VCSH, HYG, JNK, IGSB, SPIB, IGIB, SPSB, USIG, ANGL, HYLB, SLQB, SHYG, USHY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.