All in all, we think Citigroup management is doing a decent job of navigating this economic downturn. The shares trade at a discount to tangible book value. We think a large part of the reason for this is that this is a very complex bank, operating across a wide variety of products and geographies. If the team can make it through this downcycle without any skeletons coming out of the closest, we think the stock has the potential to re-rate higher.

By Matthew Warren

On July 14, Citigroup (C) posted a difficult second-quarter set of results, though the firm did manage to beat analyst consensus estimates on both the top and bottom lines. Outsize revenue gains in investment banking and FICC (fixed income, currencies, and commodities) markets (trading) helped on one hand, while sizable provisions for upcoming credit losses dented the bottom line on the other hand. As shown in the upcoming graphic down below, revenues advanced 5% compared to last year, while net income fell 73%.

Image Shown: Summary of Citigroup’s 2Q2020 Results. Image Source: Citigroup 2Q2020 Earnings Presentation

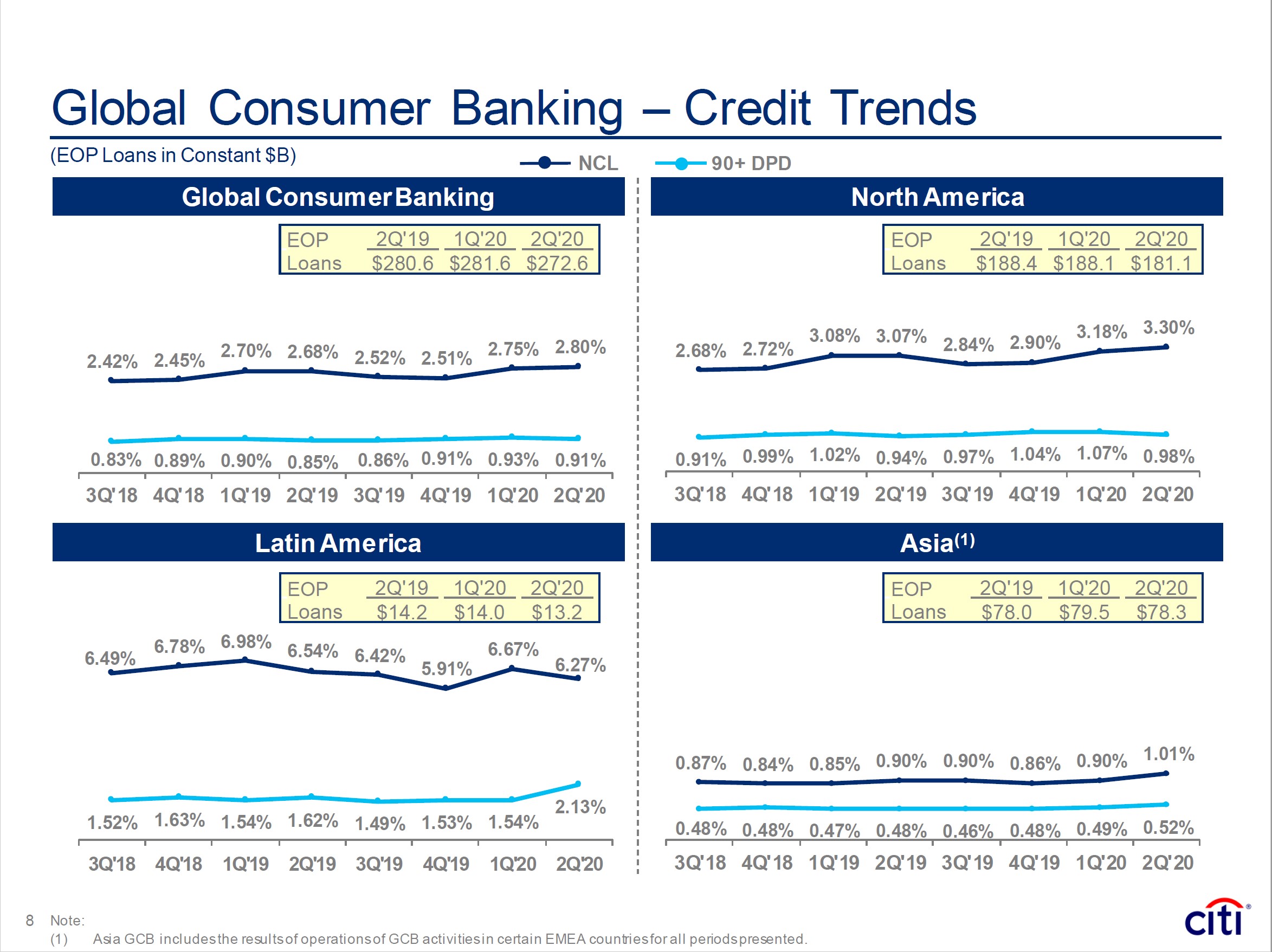

Of note, there was a lot of discussion on the second-quarter conference call about provisioning now for credit losses later. There is a new standard called CECL (current expected credit losses), which means that every quarter banks are supposed to make allowances for future credit losses based on their judgment about the future state of the economy (including key metrics like GDP and especially unemployment). If that view worsens from one quarter to the next, then you get a lot of additional provisioning, just as what happened at Citigroup and its peers during the second quarter of 2020. As shown in the upcoming graphic down below, net credit losses (NCLs) and 90-day-plus past dues are only just starting to climb, even though the economy tanked going back to the March/April timeframe.

Image Shown: Credit charge-offs and delinquencies are just starting to tick up around the world, as forebearance and government stimulus have prevented a worse outcome thus far. Image Source: Citigroup 2Q2020 Earnings Presentation

That said, there are a lot of positives, including the stimulus from Congress/Treasury and the Federal Reserve, that have prevented greater charge-offs in this early stage of this down cycle. There was also talk later in the call that consumer losses will likely come to fruition down the road whether later this year or into 2021. The below quote from CEO Mike Corbat on the second-quarter earnings call describes the situation fairly well:

“…I think that what we’re seeing is that the extraordinary actions of the Fed and the Treasury leave not just ours but industry models kind of wanting for more insight. But we’ve never seen this type of action whether it’s the checks people receive, whether it’s payroll protection 500 plus billion, whether it’s the holiday in terms of income tax payments, but we’re actually seeing a consumer in the US that actually kind of goes into this and it’s not all even but in pretty good shape. Savings rates are up, obviously spending levels are down. Mark talked about some of the delinquencies and some of the positive things that we’re seeing there in terms of the buckets and the roll rates. It’s early but again I think as we look at a potential spike back up in some areas obviously over the weekend stimulus round two came on the table. It seems to be bipartisan and so it’s likely we’re going to get more from that and so again I think those things give us, I won’t say comfort but give us I think a good a view based on what we’ve been through in terms of the consumer in particular to be able to withstand some of these variations and contagion rates as we go forward.”

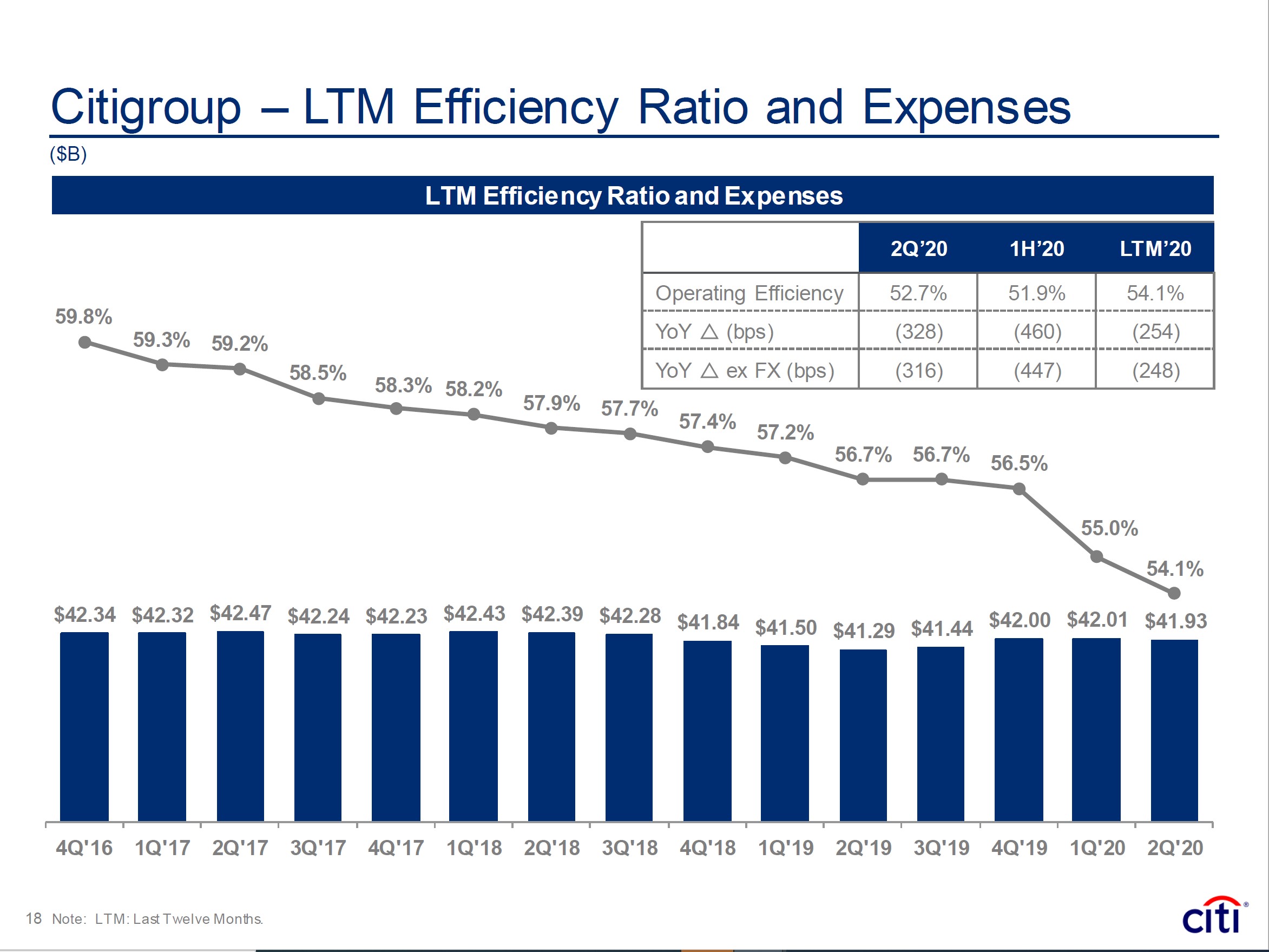

What about the longer-term outlook? As one can see in the upcoming graphic down below, Citigroup management has done a tremendous job improving its efficiency ratio (managing its cost structure relative to revenues) during the past four years. While this year the bank will experience some pressure as management is guiding revenues to be slightly down for the year (as investment banking and market activity normalizes in the back half) and for costs to be roughly flat, so a slight step back in efficiency ratio can only be expected in a year like this.

Image Shown: Citigroup has been improving its efficiency ratio steadily over the past 4 years. Image Source: Citigroup 2Q2020 Earnings Presentation

All in all, we think Citigroup management is doing a decent job of navigating this economic downturn. The shares trade at a discount to tangible book value. We think a large part of the reason for this is that this is a very complex bank, operating across a wide variety of products and geographies. If the team can make it through this downcycle without any skeletons coming out of the closest, we think the stock has the potential to re-rate higher.

—

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.