At Valuentum, we follow hundreds of stocks and dividends. We serve individual investors, financial advisers, and institutions. Join Today! You’ll gain immediate access to our premium product and service offering (including articles, commentary, stock reports, dividend reports, and more). You’ll also receive the Best Ideas Newsletter and Dividend Growth Newsletter in your inbox every month. You can also order our ultra-premium publications, the High Yield Dividend Newsletter and the Exclusive publication, too!

-

Vertex’s Pipeline Continues to Advance

Image Source: TradingView By Brian Nelson, CFA Vertex Pharmaceuticals (VRTX) recently reported mixed fourth quarter 2025 results with revenue exceeding the consensus forecast, but non-GAAP earnings per share of $5.03 coming in a bit light relative to consensus. Total revenue increased 10% in the quarter, to $3.19 billion compared to the fourth quarter of 2024…

-

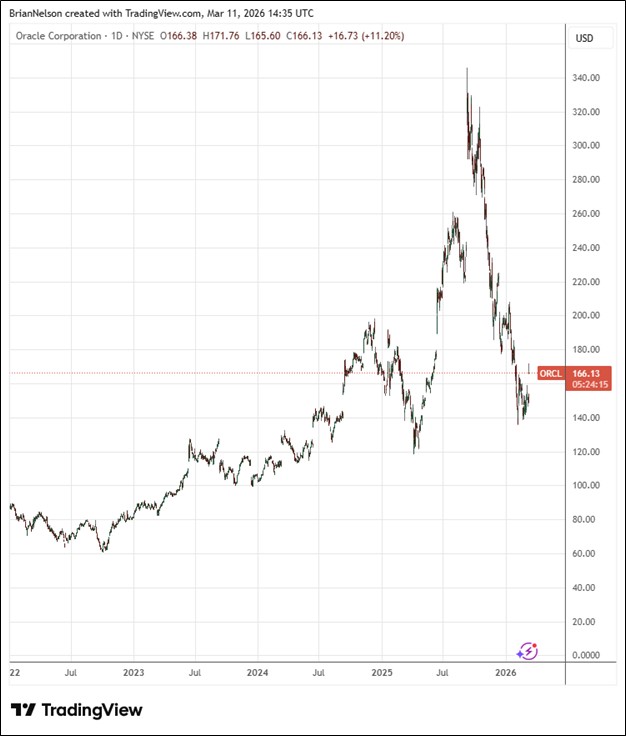

Oracle Posts Best Quarterly Results in 15 Years

Image Source: TradingView By Brian Nelson, CFA On March 10, Oracle (ORCL) reported better than expected third quarter fiscal 2026 results with revenue and non-GAAP earnings per share exceeding the consensus estimates. Third quarter total revenue of $17.2 billion was up 22% in USD and up 18% in constant currency and better than consensus of…

-

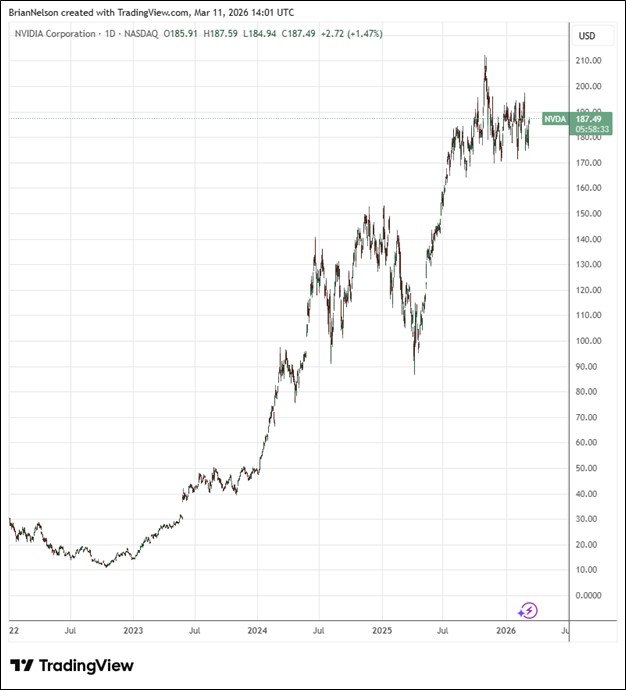

Nvidia Posts Blockbuster Fiscal 2026 Results

Image Source: TradingView By Brian Nelson, CFA Nvidia (NVDA) recently announced fourth quarter fiscal 2026 results with revenue and non-GAAP earnings per share exceeding the respective consensus forecasts. The company posted record revenue for the fourth quarter of $68.1 billion, up 20% sequentially and up 73% from the year-ago period. Data Center revenue in the…

-

Valuentum’s Dividend Growth Newsletter Portfolio

*Portfolio Information as of published date in top, left corner of table. The Dividend Growth Newsletter portfolio is not a real money portfolio. Past results are not a guarantee of future performance, and actual results may differ from simulated information provided. There is substantial risk associated with investing in financial instruments. The Dividend Growth Newsletter portfolio puts into…

-

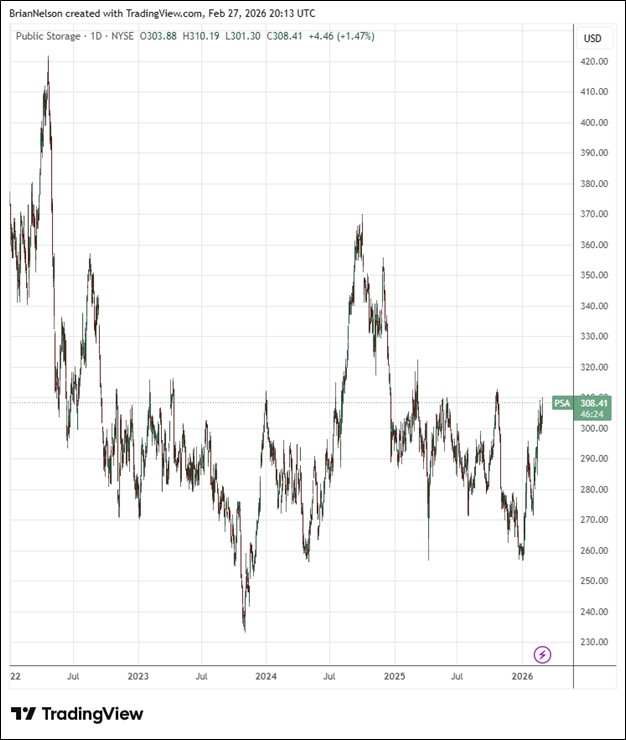

Public Storage Boasts Investment Grade Marks

Image Source: TradingView By Brian Nelson, CFA Public Storage (PSA) recently reported better than expected fourth quarter results with revenue and funds from operations (FFO) exceeding the consensus forecast. Net income fell compared to the same period a year ago, but core FFO increased to $4.26 versus $4.21 in the year-ago period. Among the highlights…