At Valuentum, we follow hundreds of stocks and dividends. We serve individual investors, financial advisers, and institutions. Join Today! You’ll gain immediate access to our premium product and service offering (including articles, commentary, stock reports, dividend reports, and more). You’ll also receive the Best Ideas Newsletter and Dividend Growth Newsletter in your inbox every month. You can also order our ultra-premium publications, the High Yield Dividend Newsletter and the Exclusive publication, too!

-

Valuentum’s Dividend Growth Newsletter Portfolio

*Portfolio Information as of published date in top, left corner of table. The Dividend Growth Newsletter portfolio is not a real money portfolio. Past results are not a guarantee of future performance, and actual results may differ from simulated information provided. There is substantial risk associated with investing in financial instruments. The Dividend Growth Newsletter portfolio puts into…

-

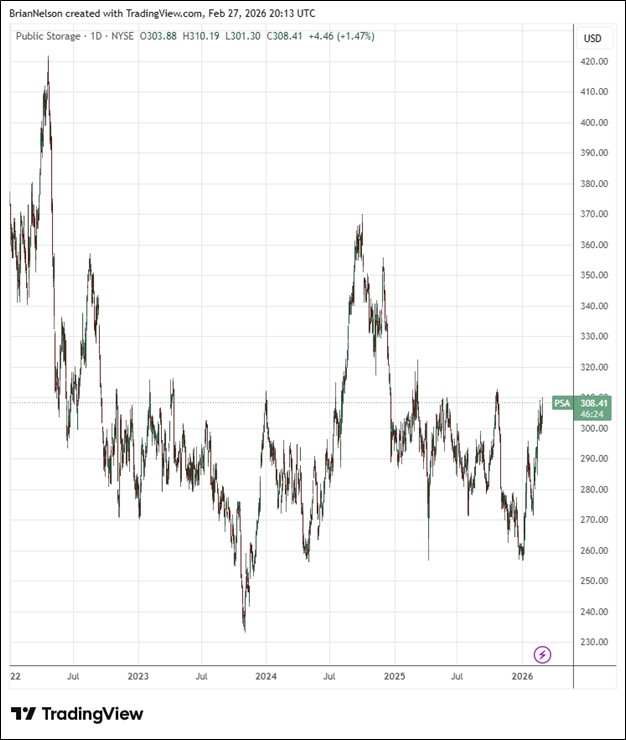

Public Storage Boasts Investment Grade Marks

Image Source: TradingView By Brian Nelson, CFA Public Storage (PSA) recently reported better than expected fourth quarter results with revenue and funds from operations (FFO) exceeding the consensus forecast. Net income fell compared to the same period a year ago, but core FFO increased to $4.26 versus $4.21 in the year-ago period. Among the highlights…

-

Home Depot Navigating Housing Pressures

Image Source: TradingView By Brian Nelson, CFA Home Depot (HD) recently reported better than expected fourth quarter results with both the top and bottom lines exceeding the consensus forecast. Sales for the fourth quarter fell 3.8% from the fourth quarter of last year due to one less week of selling compared to last year, while…

-

Booking Holdings Hit By AI “Scare Trade”

Image Source: TradingView By Brian Nelson, CFA On February 18, Booking Holdings (BKNG) reported better than expected fourth quarter results with both revenue and non-GAAP earnings per share exceeding the consensus marks. Room nights grew 9% in the quarter compared to 2024, while gross bookings advanced 16% on a year-over-year basis (11% on a constant…

-

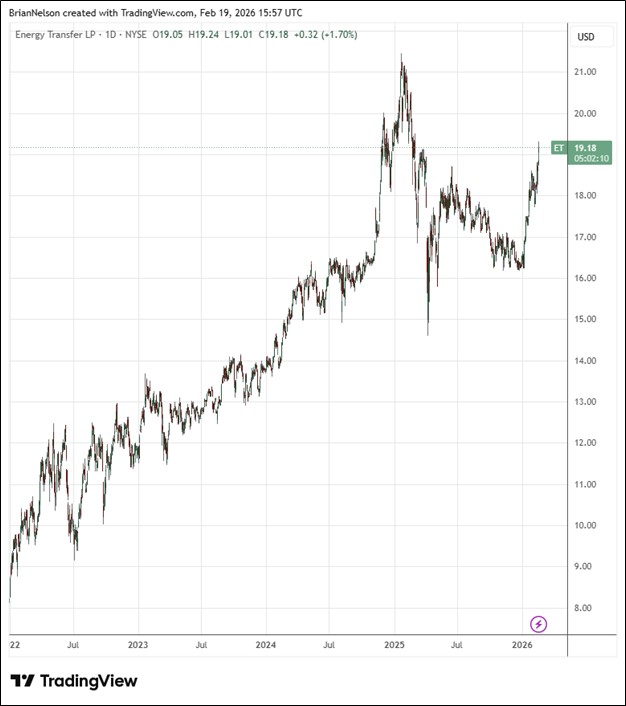

Energy Transfer Raises 2026 Adjusted EBITDA Guidance

Image Source: TradingView By Brian Nelson, CFA On February 17, Energy Transfer (ET) reported mixed fourth quarter results with revenue beating expectations, but GAAP earnings missing the consensus forecast. Net income for the three months ended December 31, 2025, was $928 million, down from $1.08 billion for the same period last year. Adjusted EBITDA for…