By Valuentum Editorial Staff

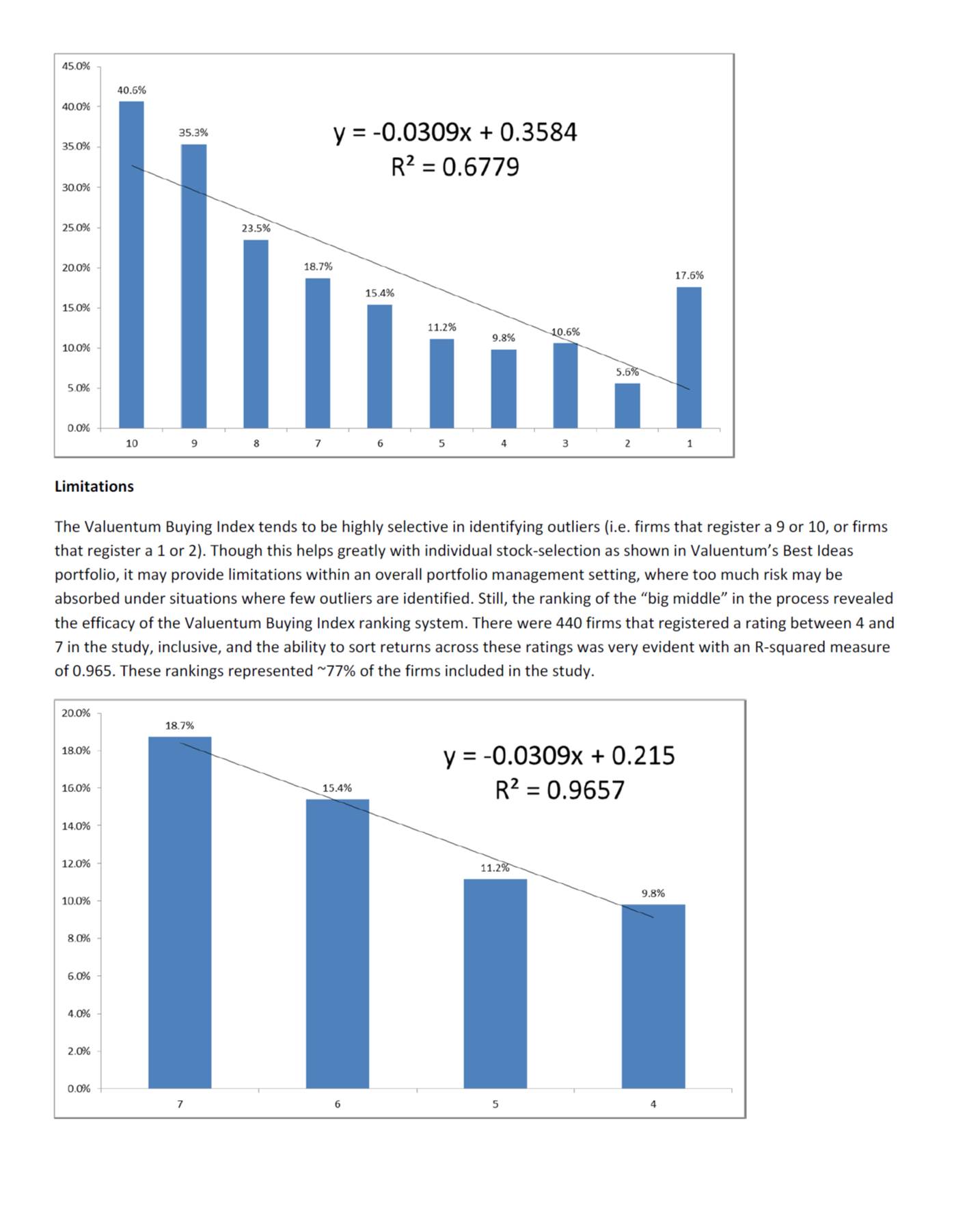

Let’s take a look at the results of a case study of an institutional money manager’s application of the Valuentum Buying Index rating system.

Please be sure to consult your personal financial advisor if any idea or strategy is right for you.

The Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio are not real money portfolios. Results are hypothetical and do not represent actual trading. Valuentum is an investment research publishing company. Past results are not a guarantee of future performance.

Note: We’ve released a new, updated report since the publication of the following case study. To download a study on the evaluation of 20,000+ individual time series of Valuentum Buying Index ratings, please see here.

Please be sure to consult your personal financial advisor if any idea or strategy is right for you.

The Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio are not real money portfolios. Results are hypothetical and do not represent actual trading. Valuentum is an investment research publishing company. Past results are not a guarantee of future performance.

Originally published October 3, 2014.