Member LoginDividend CushionValue Trap |

Apple, Facebook, and Tesla Report Earnings

publication date: Jan 27, 2021

|

author/source: Callum Turcan

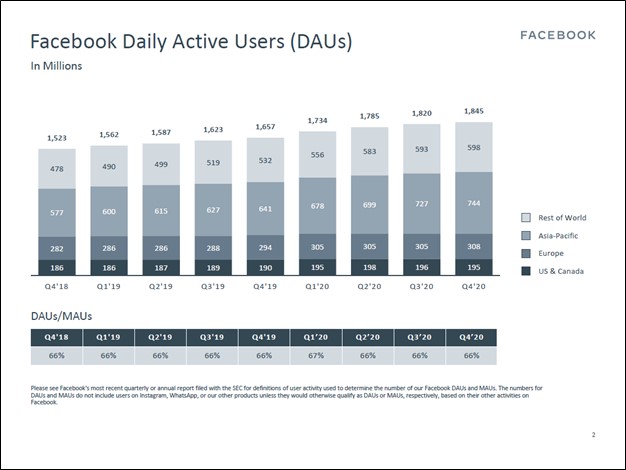

Image Shown: Facebook Inc continues to steadily grow its active user base, primarily by leveraging and expanding its international presence. Image Source: Facebook Inc – Fourth Quarter of 2020 Earnings IR Presentation By Callum Turcan In alphabetical order by ticker: AAPL, FB, TSLA We continue to witness unusual trading activity in the markets driven in large part by investors that are apparently communicating with each other over online forums such as Reddit. This trading activity is then being exacerbated by quantitative trend and momentum funds, generating levels of volatility in some names never before seen. On January 27 (link here), we sent out an alert to members noting that we shifted our newsletter portfolios to a 10%-20% cash weighting. Should numerous hedge funds start to fail due to short squeezes, that would put a tremendous amount of pressure on financial markets, at large, as investor confidence would start to erode. This, in turn, may beget more selling, creating an avalanche effect much like that of Long-Term Capital Management in the 1990s. Keeping this in mind, we continue to be big fans of top tier-tech giants, several of which have recently reported earnings that we will cover in this note. Companies with large (net) cash piles, resilient business models, promising long-term growth outlooks underpinned by secular tailwinds and strong cash flow profiles continue to be the best way to ride out the storm caused by the coronavirus (‘COVID-19’)--and more recently, very strange (if not downright manic) trading activity. Though the levels of volatility witnessed in dozens of companies may be unexpected by many, we had outlined the hazards of the volatility driven by price-agnostic trading (implicitly inclusive of Reddit and Robinhood trading) in the conclusion ("A Call to Action") of our book, Value Trap. Apple (AAPL) On January 27, Apple Inc (AAPL) reported first quarter earnings for fiscal 2021 (period ended December 26, 2020) that saw the company post record quarterly revenue of $111.4 billion (on a GAAP basis). The launch of its first 5G-capable smartphone, the iPhone 12 series, combined with elevated demand for Macs and iPads due to the rise of the work-from-home and school-from-home dynamics played a key role here. Apple’s ‘Products’ revenue climbed higher by 21% year-over-year while its ‘Services’ revenue grew by 24% year-over-year last fiscal quarter. The firm’s GAAP gross margin came in at ~39.8% in the fiscal first quarter, up over 140 basis points year-over-year, in part due to ongoing strength at its higher-margin Services segment though strong sales of higher end iPhones were the big story here. On both a top- and bottom-line basis, Apple beat consensus estimates when it reported its latest earnings. Apple generated $35.3 billion in free cash flow during the fiscal first quarter, up from $28.4 billion in the same period the prior fiscal year, which fully covered $3.6 billion in dividend obligations and $24.8 billion in share repurchases. On a diluted basis, Apple’s outstanding share count was down 4% year-over-year last fiscal quarter. The firm’s operating expenses climbed higher by only 12% year-over-year in the fiscal first quarter, which when combined with meaningful revenue growth and gross margin expansion allowed Apple’s GAAP operating margin to expand by almost 225 basis points year-over-year last fiscal quarter. Apple’s GAAP operating income shot up by 31% year-over-year in the fiscal first quarter, an impressive feat given the sheer size of the company. In every geographical region Apple breaks down its sales performance, the firm posted year-over-year revenue growth last fiscal quarter. Additionally, every single one of its product categories reported year-over-year sales growth last fiscal quarter (alongside growth at its Services segment). We appreciate the widespread strength seen in Apple’s latest earnings report. The company had $195.6 billion in cash-like items on hand (cash, cash equivalents, current marketable securities, and non-current marketable securities) versus $12.8 billion in short-term debt and $99.3 billion in long-term debt as of December 26. Apple’s ~$83.5 billion net cash position is an enormous source of strength during these turbulent times. We include Apple in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios and continue to like exposure to the name. Shares of AAPL yield a modest ~0.6% as of this writing, and there is ample room for the firm to push through large dividend increases in the coming fiscal years. Facebook (FB) As with Apple, Facebook Inc (FB) also beat consensus top- and bottom-line earnings when it reported its fourth quarter earnings for 2020 on January 27. Facebook’s digital advertising revenue surged higher by 31% in the fourth quarter while its ‘other’ revenue rose by 156%, enabling its company-wide GAAP revenues to jump 33% year-over-year. Economies of scale allowed Facebook’s GAAP operating income to grow by 44% year-over-year last quarter. Though Facebook’s headcount was 30% larger at the end of 2020 than it was at the end of the prior year, which saw its operating expenses move higher, the strength of its digital advertising business more than absorbed the incremental costs. Facebook’s daily active users (‘DAUs’) advanced 11% in the fourth quarter of 2020. Though its DAUs in US & Canada moved lower sequentially in both the third and fourth quarters of last year, Facebook’s DAUs in this region were still up 3% year-over-year in the final quarter of 2020. The company’s monthly active users (‘MAUs’) in the US & Canada were up both on a year-over-year and sequential basis in the final quarter of 2020, and in our view, these markets are mature and unlikely to generate the kind of user growth seen at Facebook’s operations elsewhere. In the Asia-Pacific region, Facebook’s DAUs were up 16% year-over-year last quarter, and there is room for an enormous amount of upside. We covered Facebook’s impressive international growth outlook in this article here. At the end of 2020, Facebook had $62.0 billion in cash, cash equivalents, and current marketable securities on hand along with $6.2 billion in equity investments (though this is primarily represented by strategic assets which we covered here). The company did not have any debt on the books at the end of last year, and we're huge fans of Facebook’s pristine balance sheet. Facebook generated $23.6 billion in free cash flow in 2020, up from $21.2 billion in 2019, while spending $6.3 billion buying back its Class A common stock. While Facebook does not have a common dividend policy at this time, should management want to, Facebook could easily initiate such a policy given its stellar financial strength. We include Facebook in the Best Ideas Newsletter portfolio as a top-weighted idea and continue to like exposure to the social media giant. The company authorized an additional $25.0 billion in share buyback authority (as it concerns its Class A common stock) in January 2021, which we view as a great use of capital as our fair value estimate stands at $413 per share of FB. In our view, Facebook’s stock is incredibly undervalued as of this writing. Tesla (TSLA) On January 27, Tesla Inc (TSLA) reported fourth quarter earnings for 2020 that beat consensus top-line estimates though the electric vehicle (‘EV’) maker missed consensus bottom-line estimates. We covered Tesla’s operational performance and strategic goals in the recent past (link here) as the company aims to produce 20 million vehicles a year by 2030, up sharply from about half a million produced in 2020, with the opening of new factories and the expansion of existing facilities expected to make this goal possible. Tesla reported GAAP revenues of $10.7 billion in the fourth quarter of 2020, up 46% year-over-year, while its GAAP gross profit hit $2.1 billion, up 49% year-over-year. We appreciate that Tesla’s pricing power is enabling the firm to maintain and grow its gross margins, supported by its growing economies of scale as it continues to expand its manufacturing footprint. At the end of 2020, Tesla had a net cash position of $7.6 billion (inclusive of short-term debt and long-term convertible notes) due primarily to a cash infusion from recent equity raises. Tesla generated $2.8 billion in free cash flow in 2020, and furthermore, Tesla reported its first annual profit on a GAAP basis last year. We're impressed with Tesla’s growth story, though shares of TSLA are trading well above the top end of our fair value estimate range as of this writing. We do not intend to include Tesla in the newsletter portfolios at this time. Concluding Thoughts We continue to be big fans of Apple and Facebook and view both firms as incredibly well-positioned to ride out the storm. Here, we would like to stress that our team at Valuentum plans to continue keeping a very close eye on the markets as manic trading activity in various heavily-shorted names could have very serious consequences for financial markets at large. The ability for retail investors to coordinate their efforts on online forums, such as Reddit, to “attack” short sellers by buying way out of the money call options and the underlying security is unprecedented. Should certain hedge funds start to fail as they attempt to unwind their short positions, things could get ugly fast. Members that have not yet done so are encouraged to check out our January 25 article ALERT: Bull Raids, Short Squeezes and Highly Unusual Market Activity by clicking this link here. ----- Related: AAPL, FB, TSLA ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL) is included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Facebook Inc (FB) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

1 Comments Posted Leave a comment