Image Shown: A look at Tesla Inc’s new Gigafactory factory (Model Y body shop) in Shanghai, China. Image Source: Tesla Inc – Third Quarter of 2020 IR Earnings Presentation

By Callum Turcan

The electric vehicle (‘EV’) market is hot and getting hotter. Aided by a combination of supportive government policies such as subsides for EVs (purchase tax credits, manufacturing tax credits), plans to ban the sale of automobiles powered by internal combustion engines (‘ICE’) in the coming years, and shifting consumer preferences (households preferring to appear “green”), the long-term outlook for EV sales is quite bright. Tesla Inc (TSLA) is the posterchild of the EV boom given its first-mover advantage, though competitive headwinds are rising.

Legacy auto manufacturers are looking to bulk up their EV offerings while new market entrants such as Lordstown Motors (RIDE) and privately-held Rivian, are set to further disrupt the industry. Ford Motor (F) invested in Rivian back in 2019 to bulk up its presence in the EV market. By the middle of 2021, Rivian aims to begin deliveries of its EV pickup truck in the US, the R1T. Lordstown Motors also aims to bring an EV pickup truck to market, named the Endurance, with deliveries set to begin in early-2021.

However, as global EV sales appear set to grow immensely, there is room for a number of winners in this space. Back in July 2020, privately-held Deloitte estimated that global EV sales will grow from an estimated 2.5 million in 2020 to 11.2 million in 2025 and then to 31.1 million by 2030, good for annual compound growth of about 29% in the coming decade, according to the research firm. EV sales in China are expected to represent about half of global EV sales in 2030, according to Deloitte, followed by the European market representing just over one quarter of global EV sales in 2030.

Recent Update Indicates Tesla’s Outlook Is Bright

In 2020, Tesla produced nearly 510,000 vehicles (~54,800 Model S/X units, ~454,900 Model 3/Y units) and delivered almost 500,000 vehicles (~57,000 Model S/X units, ~442,500 Model 3/Y units). That more or less was on target with Tesla’s guidance, made all the more impressive given the colossal headwinds the global auto industry faced last year. For reference, Tesla produced just over 365,000 vehicles and delivered just under 368,000 vehicles across all models in 2019. We appreciate that even in the face of the coronavirus (‘COVID-19’) pandemic, Tesla was able to continue boosting its vehicle production and deliveries last year. This was made possible in part by the firm ramping up operations at its new factory in Shanghai, China, which came online back in late 2019.

The company’s production performance in the fourth quarter of 2020, which came in just below 180,000 units across all models, indicates Tesla is entering 2021 with momentum as it seeks to produce 20 million vehicles annually by 2030. Management’s plan to make that guidance a reality is built around further expanding the production capacity at Tesla’s new production plant in China, while also boosting the production capabilities at its auto plant in Freemont, California, and its ‘Gigafactory’ near Reno, Nevada, which focuses on battery production.

Looking ahead, Tesla is also working toward building new production facilities in Austin, Texas, and Brandenburg, Germany. The Austin facility will enable Tesla to launch its first-ever pickup truck, the futuristic looking Cybertruck, which will primarily cater to the US market. Pivoting to the Brandenburg facility, this future auto plant will help Tesla meet European demand, keeping in mind European EV sales are projected to grow meaningfully in the coming years and decades (aided by government policies/intervention). EV sales in Europe are expected to grow to 15% of total sales in 2021, according to the industry lobby group European Federation for Transport and Environment, up from an estimated 10% at the end of 2020.

Here is what Tesla’s founder and CEO, Elon Musk, had to say on these issues during the firm’s third quarter of 2020 earnings call (emphasis added):

“Then in terms of capacity build out. We’re making progress on three major factories. We’re continuing to expand Shanghai significantly, which is going incredibly well at Tesla China team. It is just, I mean, incredibly good. Super smart, work hard. It’s like I’m always amazed by how much progress the Tesla China team makes. It’s beyond all reasonable expectations.

And then we’re under construction in Berlin and Austin. So we’re also making good progress there. Yes. It’s good. So it’s overall going well. I should make a point that for Berlin and Austin, we do expect to start delivering cars from those factories next year. But because of the exponential nature of the spool up of manufacturing plant, especially one with new technology, it will start off very slow at first and then become very — afterward will become very large.

Just in general, manufacturing follows the S-curve and I think, some of those people kind of spend a lot of time manufacturing kind of things that once you have a factory, you can just sort of turn it on and it’s at capacity. But it will typically take about 12 to 18 months to reach capacity. And that is a very fast period of time, especially for new technology. So yes, I’d say, 12 to 24 months even. So generally, what I see is the manufacturing capacity is underestimated in the beginning for quite some time. Then it is sometimes overestimated because this is an S-curve. It goes exponential to linear to logarithmic. And it’s actually incredibly hard thing, just bringing a production plant up to volume technology.”

When Tesla reports its fourth quarter earnings for 2020, management will likely update investors on how those developments are progressing. Please note that Tesla has in the past leaned on exports out of its facility in Shanghai to meet European demand. Reducing logistics and delivery costs while expanding its global manufacturing footprint should help Tesla improve its margin performance going forward while better positioning the firm to become a global auto and battery-making giant.

However, we caution that Tesla’s development in Germany has run into some hurdles recently regarding snake and lizard habits (legal issues with environmentalists such as Nature and Biodiversity Conservation Union and Green League), which may delay the company’s timetable. There have also been seven bombs dating from the WWII era discovered on the site, which have also been a source of delays. Still, we still expect Tesla’s new production facility will come online in the medium-term, so as to not disrupt company-wide initiatives.

Chinese Upside

China’s EV market has been growing at a brisk pace of late and that momentum is expected to continue going forward. According to the chief deputy engineer of the China Association of Automobile Manufacturers, Xu Haidong, China’s EV sales may have grown by 8% year-over-year in 2020 on a unit basis, reaching over 1.3 million units. Looking ahead, the chief deputy engineer forecasts that EV sales in China could rise to 1.8 million units in 2021, up almost 40% versus estimated 2020 levels. By 2025, China’s EV market could reach 30 million units according to the vice general secretary of the China Association of Automobile Manufacturers, Fu Bingfeng.

Battery production, particularly lithium-ion batteries used to power most EVs, is also forecasted to grow at a brisk pace going forward. Tesla is focused on growing both its auto manufacturing and battery production capabilities to enable the firm to better control its supply chain and to offer Tesla the chance to one day become a major player in the global battery market (meeting third-party demand).

Several Chinese EV players including BYD Group (BYDDF), Nio (NIO), Li Auto (LI), and Xpeng (XPEV) have been major beneficiaries of recent trends. Nio, Li Auto and Xpeng all reported strong EV delivery growth in 2020. BYD Group, which is backed by Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B), has experienced strong initial demand for its luxury sedan offering in China which launched in mid-2020. Additionally, BYD Group manufactures electric busses and has been expanding its production capabilities to meet rising demand in Europe while maintaining its ability to meet strong demand in China.

Toyota Motor (TM) has a joint-venture with BYD Group to develop electric vehicles and the related batteries. Honda Motor (HMC) recently previewed an EV SUV concept in China. Both firms aim to significantly grow their EV production capabilities and offerings going forward. General Motors’ (GM) GM China unit has a joint-venture with China’s state-owned SAIC Motor and Liuzhou Wuling Motors, which appears to be partially owned by Wuling Motors Holdings (WLMTF). That JV is known as SAIC-GM-Wuling Automobile or SGMW. The JV’s EV offerings, usually lower priced vehicles, have been selling well of late.

Considering Tesla’s facility in Shanghai is now operational, its ability to capitalize on China’s long-term EV upside has improved immensely. Having a manufacturing presence in China should support Tesla’s public image in the country and potentially could help the company better navigate future trade tensions between the US and China. Tesla’s growing operations in the US and Europe will assist its public relations and brand building efforts in those two regions.

Tesla’s Financial Outlook

We forecast Tesla will experience meaningful free cash flow growth in the coming years, defining free cash flows as net operating cash flows less capital expenditures. Please note we model expectations that Tesla’s capital expenditures will grow materially going forward as the firm expands its global production capabilities. Our optimistic view on Tesla is underpinned by our expectations that the company will report stellar revenue growth on the back of rising sales/production volumes and margin expansion due to its ever-improving economies of scale.

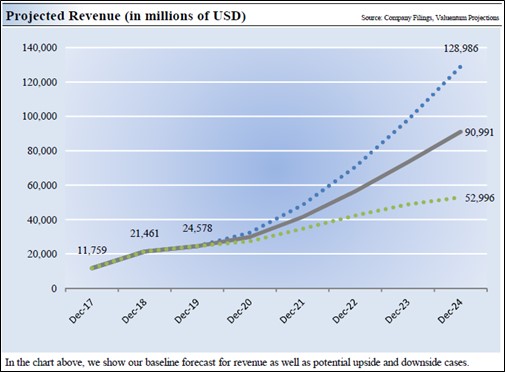

In the first upcoming graphic down below, we highlight our expectations of Tesla’s revenue growth trajectory in the coming years, and in the second upcoming graphic down below, we highlight our expectations of Tesla’s free cash flow growth trajectory in the coming years. Both graphics are from the enterprise cash flow model (i.e. discounted cash-flow model) covering Tesla. These valuation models are made available to members of the Gold and Platinum plans at Valuentum.

Image Shown: By aggressively expanding its global production capabilities, Tesla should be able to significantly boost its annual vehicle deliveries which in turn supports our expectations that the company will experience tremendous revenue growth over the coming years.

Image Shown: Stellar forecasted revenue growth combined with room for meaningful operating margin expansion, made possible through economies of scale and reduced logistics costs relatively speaking, supports our view that Tesla’s free cash flows will grow meaningfully going forward.

Competition Grows

Competitive threats to Tesla’s dominant position in the higher end EV market are rising from auto makers across the globe, however. Daimler’s (DMLRY) Mercedes-Benz unit plans to start producing six different EV models by the end of 2022, two of which are expected to be assembled at a plant in Tuscaloosa, Alabama. By 2023, General Motors aims to launch around 20 new EV models across its Buick, Chevy, Cadillac, and GMC brands. Looking farther ahead, General Motors is