|

|

Recent Articles

-

McDonald’s, Chipotle, Domino’s Second-Quarter 2023 Results Solid

McDonald’s, Chipotle, Domino’s Second-Quarter 2023 Results Solid

Jul 27, 2023

-

Image: Shares of McDonald’s, Chipotle and Domino’s have done well since the beginning of 2020, with Chipotle leading the pack.

McDonald’s and Chipotle aren’t going away anytime soon, and we’re not at all discouraged by their respective second-quarter 2023 same-store-sales performance; CMG’s performance gave the market pause, but the sell-off in the burrito maker’s shares was mostly profit-taking (after a huge run up so far in 2023). McDonald’s is a perfect stock for the current inflationary environment, in our view, while Chipotle remains one of the best unit growth stories in the restaurant arena. Another one of our favorites, Domino’s has recently broken through its downtrend. We don’t expect to make any major changes to our fair value estimates of MCD, CMG, or DPZ, and we continue to like shares of all three in the Best Ideas Newsletter portfolio.

-

“Bought” Low and “Sold” Low with Meta

“Bought” Low and “Sold” Low with Meta

Jul 27, 2023

-

Image: Shares of Meta Platforms have been on a wild ride the past few years. We didn’t do well with the stock, unfortunately.

Let the good times roll in big cap tech and large cap growth! What a fantastic year 2023 is turning out to be and thank you for sticking with us. If Meta serves as any example for you, it should be that you shouldn’t expect us to get everything "right," but it should be very, very clear that we’ve gotten far more things “right” than we’ve gotten “wrong” over the years. Cheers!

-

4 REITs For Consideration

4 REITs For Consideration

Jul 26, 2023

-

Image Source: Mike Mozart.

We like these four REITs for the long haul.

-

First Read: Microsoft, Alphabet Cash Components Wonderful in Calendar Q2 2023

First Read: Microsoft, Alphabet Cash Components Wonderful in Calendar Q2 2023

Jul 25, 2023

-

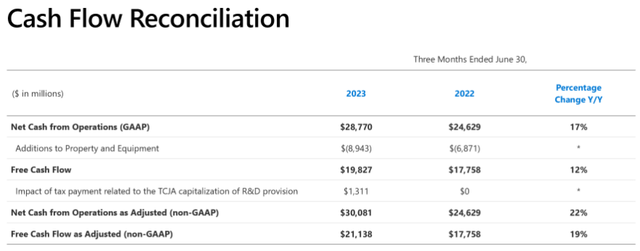

Image: Microsoft’s free cash flow continues to be phenomenal.

There are two primary cash-based sources of intrinsic value, and Microsoft and Alphabet have gobs of them: net cash on the balance sheet and free cash flow. Both Microsoft and Alphabet reported calendar second-quarter results after the market close July 25, and while much will be said about their respective earnings reports, the reality is that the fundamental backdrop for both remains incredibly strong. We think both deserve a hearty weighting in the portfolio of the Best Ideas Newsletter, and we don’t plan to make any changes to our long-term fair value estimates as a result of the quarterly prints.

|