Image Source: Paramount Global

By Brian Nelson, CFA

The Dividend Cushion ratio is not a perfect predictor of dividend health and the risks of a dividend cut, but it’s a pretty darn good one. On May 4, Paramount Global (PARA) missed expectations for its first-quarter 2023 results on both the top and bottom line and cut its quarterly dividend to $0.05 per quarter (was $0.24). The company’s Dividend Cushion ratio, which considers its balance sheet as well as future expectations of free cash flow relative to future expected cash dividends paid, was -2.5 (negative 2.5). Any ratio below 1 indicates growing risk to the health of the dividend, while any materially negative (below 0) ratio indicates severe risk of a dividend cut in the longer run.

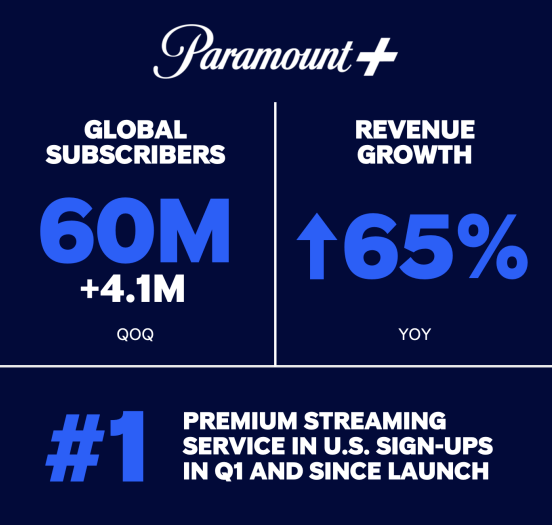

During the first quarter of the year, Paramount Global’s revenue dropped 1%, while operating performance swung to a loss of $1.23 billion from an operating profit of $775 million in the prior-year period. In the quarter, the company lost $1.81 per share, which is a far cry from the $0.58 per share it earned during the same period a year ago. Higher expenses to support growth at Paramount+ was the main culprit as its Direct-to-Consumer business faced income pressure, while a slowing advertising market hurt performance across its TV Media operations. Paramount Global’s Filmed Entertainment division also experienced income declines due to lower licensing and other revenue. We plan to update our reports on Paramount Global soon, and we expect a downward fair value estimate revision.

NOW READ: The Dividend Cushion Ratio: Unadjusted Is Less Subjective, Adjusted Is More Subjective

———-

Tickerized for PARA, PARAA, DIS, NFLX, AMZN, WBD, FOX, FOXA, CMCSA, WMG, SIRI, LGF.A, LGF.B, NXST, SBGI, SONY, AMC, CNK, IMAX, MCS, RDI, NCMI, NTDOY, CSSE, CHTR, DISH, VZ, ATUS, CABO, GTN, TGNA, SSP, MGNI, PUBM, CRTO

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.