By Brian Nelson, CFA

On April 27, Honeywell International (HON) reported better-than-expected first-quarter 2023 results.

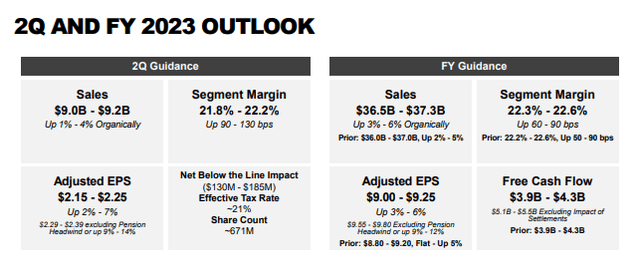

In the period, revenue advanced 5.7%, while non-GAAP earnings per share exceeded the consensus forecast. Honeywell also raised its outlook for 2023 across the board, now expecting organic revenue growth in the range of 3%-6% (was 2%-5%) and adjusted earnings per share in the range of $9.00-$9.25 (was $8.60-$9.20). Though Honeywell didn’t raise its operating cash flow or free cash flow target guidance range for 2023, it’s still relatively early in the year, and we like the company’s top-line and earnings momentum supported by a backlog that advanced 6% on a year-over-year basis.

Image: Honeywell continues to experience strong fundamental momentum across the board. Image Source: Honeywell

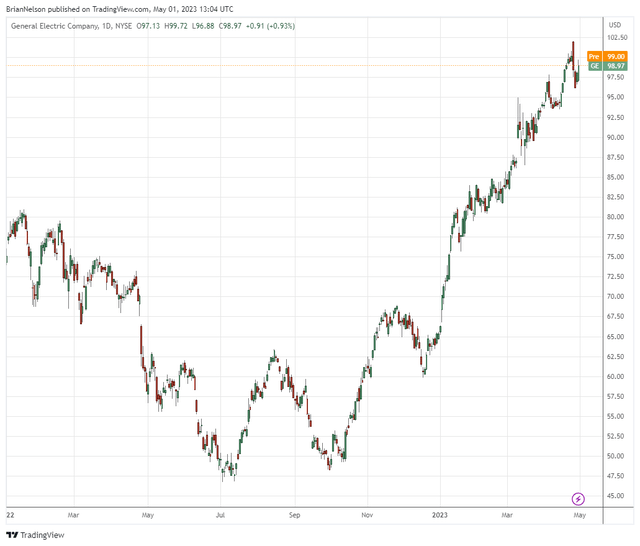

Honeywell continues to benefit from strength in its commercial aerospace business, UOP, building and process solutions, and materials operations. The first quarter of 2023 marked Honeywell’s “eighth consecutive quarter of double-digit organic sales expansion in commercial aviation.” Aerospace bellwether Boeing (BA) continues to work through production hiccups with its 737 MAX, but the outlook for commercial aerospace has improved considerably in recent months, perhaps best illustrated by General Electric’s (GE) massive share price recovery since mid-2022.

Image: General Electric’s shares have recovered nicely since the doldrums of mid-2022.

We liked Honeywell’s first-quarter 2023 report, released April 27, and its raised outlook for 2023. We remain huge fans of Honeywell’s ~2.1% dividend yield, and we support Honeywell’s COO Vimal Kapur who will succeed Darius Adamczyk as CEO on June 1, 2023. Our fair value estimate for Honeywell remains $210 per share. With shares trading at ~$200 at the time of this writing, there’s still valuation upside to the Honeywell story, in our view.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.