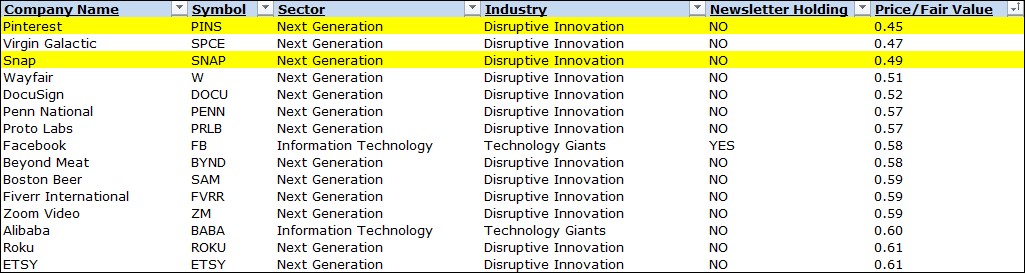

Image: Valuentum’s Periodic Screener, February 4.

—

By Valuentum Analysts

—

Two of the most undervalued stocks in our coverage Pinterest, Inc. (PINS) and Snap Inc. (SNAP) are indicated to rally hard February 4 after issuing positive earnings reports, providing further evidence of the importance of the discounted cash flow process and the magnet that intrinsic value estimates are to stock prices. Pinterest is indicated up ~14%, while Snap is indicated up ~47% based on the latest information we have.

—

The refreshed Valuentum periodic data screener is now available for download on our website (it can be found in the ‘Stock Screens’ section in the left column of our website). The periodic data screener, which also includes updated fair value estimates on the Consumer Discretionary industry, as well as Meta Platforms (FB) and PayPal Holdings (PYPL), can be downloaded at the end of this article.

—

The periodic data screener is updated, generally every Sunday, but in light of a large Consumer Discretionary industry model refresh that we had in the pipeline and the materially changed forward guidance from both Meta and PayPal, we think a Friday update (today, rather than this weekend) is most appropriate. In all, about 50 reports have been refreshed the past couple weeks. Updated FB and PYPL reports are now available on the site, too.

—

Let’s talk about Facebook, now Meta Platforms.

—

For starters, we think the market is getting Meta wrong, as the company’s cash-based sources of intrinsic value continue to be phenomenal. Let’s put what we’re saying into context. Meta’s market capitalization now stands at ~$680 billion. Last fiscal year, it generated nearly $40 billion in free cash flow as it held about $50 billion in net cash on the balance sheet.

—

Hypothetically, for valuation context, assuming no growth, on average, in free cash flow the next three years, and that Meta allocates the sum of those next three year’s future free cash flow generation plus its current net cash to share repurchases, Meta could buy back ~25% of itself (in 3 years!), if it does nothing operationally but hold the line, on average (while still spending vigorously on capex and buybacks).

—

We think Meta’s stock sell off may have more to do with people disliking Facebook, the company, than the stock, itself. With what we believe to be a very, very conservative updated valuation, we still value FB shares north of $400 per share, and we reiterate that we’re using very modest future expected revenue growth rates, hardly any operating leverage improvements, and incorporating massive capital spending for the investments in the metaverse, data centers, and the like.

—

Though Meta is facing headwinds from the likes of TikTok and regulatory/anti-trust fronts, the company still guided first-quarter 2022 revenue to double-digit growth at the high end of the range, lapping difficult comps. At $237 per share, FB is trading at ~17.2x trailing earnings per share, and that doesn’t even consider its huge net cash position (the trailing P/E for S&P 500 companies is 22.9x, according to FactSet). FB is a debt-free, moaty, net cash rich, free cash flow generating powerhouse trading at a 25% discount to the market multiple as it buys back billions in its undervalued stock.

—

Frankly, we didn’t like the trading activity in Meta Platforms at all February 3 (down 26%) as the stock should not have sold off as much as it did. If it can drop that much, in light of what we noted above, investors might expect more selling until more weak hands are shaken out. Our thesis regarding increased volatility in the markets due to price-agnostic trading continues to clearly reveal itself, too. If you recall, Tesla (TSLA) traded like a penny stock last year at times, Netflix’s (NFLX) shares collapsed recently, Meta’s unusual activity yesterday, and then we have companies like Snap that were down ~25% during the trading session February 3 only to be indicated up nearly 50% the following morning (today).

—

We continue to reiterate that market structure is not healthy and that investors should remain laser-focused on the cash-based sources of intrinsic value — net cash and future expected free cash flow — and not let the often machine-driven, algorithmic pricing activity play too much of a role in the long term theses of your names (save for important technical evaluations). Though the pricing moves this day and age are uncomfortable, they are still digestible, but the financial system is going down a path where in the longer run the markets could very much become far too volatile for savers, a condition brought about by the proliferation of price-agnostic quant/index trading.

—

Let’s talk PayPal.

—

PayPal is not nearly as cheap as Meta Platforms, and PayPal has now disappointingly become a “show-me” story, in our view. We had been far too aggressive in our operating leverage assumptions within our valuation model months ago (meaning that we thought its mid-cycle operating margin had a lot more potential), and PayPal is no longer as attractive as we once thought. Our updated fair value estimate of PayPal now stands at $160 per share, but we reiterate that PayPal still has to deliver on what we would consider to be optimistic free cash flow projections. In hindsight, we should have removed PayPal from the simulated newsletter portfolio some time ago.

—

That said, we’re not making any changes to the simulated newsletter portfolios with respect to Meta or PayPal at this time. From our perspective, the market is confusing a distaste for Facebook, the company, with Meta Platforms, the stock. One’s feelings about a company, good or bad, shouldn’t factor into an investor’s cash-based analysis of the company’s intrinsic value, and while we should have probably exited PayPal some time ago, we’re going to evaluate its next few quarters and make a decision at that time. We don’t want to overreact in any respect.

—

Other reports this calendar earnings season from Qualcomm (QCOM) [I] and Alphabet (GOOG) [I] have been excellent, and the overweighting of the energy sector has been a nice tailwind for the simulated Best Ideas Newsletter portfolio, simulated Dividend Growth Newsletter portfolio and simulated High Yield Dividend Newsletter portfolio, the latter off to a wonderful start in 2022! If you are a high yield investor, and looking for diversified exposure to higher-yielding securities, please consider subscribing to the High Yield Dividend Newsletter.

—

After the close February 3, investors seemed to like Amazon’s (AMZN) fourth-quarter report, and we’ll see just how choppy the coming trading sessions will be as investors digest reports from big cap tech and other areas. The awesome calendar fourth-quarter reports from Alphabet, Apple (AAPL) [I], Visa (V) [I], Tesla [I], Microsoft (MSFT) [I], and UnitedHealth (UNH) [I] coupled with Meta Platform’s massive undervaluation suggest that the areas of large cap growth and big cap tech remain the strongest places to be, especially given the group’s strong balance sheets and solid existing and expected free cash flow in an environment where rate hikes might only be expected this year.

—

We won’t be chasing companies like Pinterest or Snap higher, but it’s good to see the confirmation in our valuation process and how outliers with respect to our fair value estimates are a good place to start looking for ideas, especially if you’re a deep value investor, which many of you are. We think 2022 is off to a rather peculiar start, and we believe that we’re seeing more noise in prices than anything else, brought about by price-agnostic rotations and robo-rebalancing, conditions that will just have to work themselves through the system. The Fed really hasn’t done much, the 10-year Treasury rate hasn’t moved much, and fourth-quarter earnings reports thus far, while mixed, for the most part have been solid.

—

We remain bullish on stocks for the long haul and big cap tech and large cap growth, in particular. We think Meta Platforms is the best risk-adjusted bargain on the market these days, we like being tactical overweight the energy sector, and we’re growing more and more cautious on the consumer staples arena (VDC). Many of the consumer staples earnings reports/outlooks have shown the stocks are having trouble pricing products ahead of cost inflation, and their huge net debt positions and lofty dividend obligations may pose headwinds to share-price expansion, with the consumer staples sector trading at a forward P/E of 21.1x, above the sector’s 10-year average of 17.8x (numbers according to FactSet).

—

We have a note on big pharma in the works, and we’ll expand upon our concerns in the consumer staples space in a note in the not-too-distant future. The consumer staples sector has some of the strongest brand name companies on the market, but if the economy does get a bout of hefty inflation in the coming years, consumers might very well look to trade down to private label offerings at their detriment, all the while many consumer staples will have to service their large net debt positions while satisfying dividend investors that are counting on above-inflation annual dividend increases. Things may be okay for the consumer staples sector this year and maybe the next five years, but their fundamentals will eventually start to matter more than their brand awareness.

—

Just a few things as we gear up for the weekend. We continue to be excited about the ideas in the simulated newsletter portfolios, and we again want to make sure that everyone understands that our process is one that is very much focused on the cash-based sources of intrinsic value of companies — net cash on the balance sheet and future expected free cash flow generation, the key drivers within a discounted cash flow model. We are not either value or growth investors at Valuentum, but instead we share Buffett’s opinion that there are not really value and growth stocks as growth is but a component of value. While others were overly optimistic about frothy ‘growth stocks’ — as this commercial shows — we very much kept a level head focused on core intrinsic-value-estimate parameters.

—

As it is sometimes easy to do, please don’t confuse our excitement about moaty, net cash rich companies, expected to grow their top lines in the double-digits at the high end of their guidance ranges that have huge free cash flow generating prospects that are tied to secular growth trends and are trading at a 25% discount to the average market P/E multiple — with — stocks that are trading at nosebleed price-to-sales multiples, that generate little to no GAAP earnings, that are burning through cash, and are built on stories of castles in the air while being in constant need of external capital. The discounted cash flow process helps keep us grounded in reality, and if only for this, it remains one of the most relevant tools to help you as an investor in any market environment.

—

Download the periodic screener (xls) >> — login required

—

Kind regards,

—

The Valuentum Team

info@valuentum.com

—

———-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.