Image Shown: Visa Inc, one of our favorite companies, has been growing robustly of late. Image Source: Visa Inc – First Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

On January 27, Visa Inc (V) reported first quarter earnings for fiscal 2022 (period ended December 31, 2021) that beat both consensus top- and bottom-line estimates. Shares of V shot higher after its results were made public. We include Visa as a “top-weighted” idea in the Best Ideas Newsletter portfolio (link here) and remain huge fans of the company. Our fair value estimate sits at $255 per share of V, well above where Visa is trading at as of this writing, indicating the payment processing giant has ample room to run higher from current levels. Shares of V yield a modest ~0.7% as of this writing.

Earnings Update

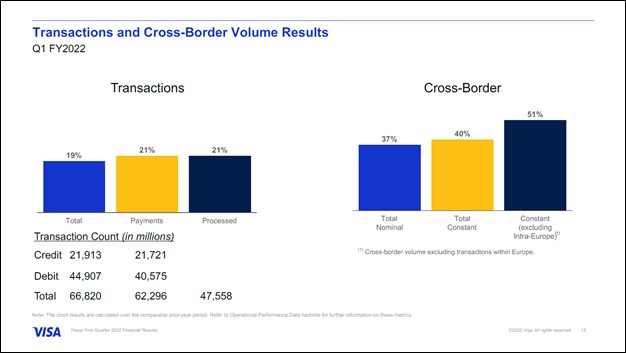

Visa is benefiting from the global economy that is slowly and unevenly opening back up. The company’s business took a hit from the coronavirus (‘COVID-19’) pandemic, though things are now starting to look up again for Visa. Its payments volume rose by 20% year-over-year on both a constant-currency and nominal basis, and its processed transactions were up 21% year-over-year last fiscal quarter, while its cross-border volumes also surged higher last fiscal quarter as you can see in the upcoming graphic down below.

Image Shown: Visa’s business is on the rebound. Image Source: Visa – First Quarter of Fiscal 2022 Earnings Press Release

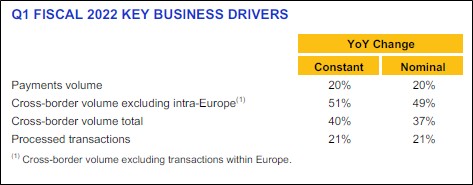

Last fiscal quarter, Visa’s ‘international transaction revenues’ grew by 50% year-over-year while its GAAP revenues climbed higher 24% year-over-year. Its ‘services revenue’ and data processing revenue’ both grew 19% year-over-year last fiscal quarter. The company’s GAAP operating income also climbed higher 24% year-over-year in the fiscal first quarter as Visa’s revenue growth matched its operating expense growth (in percentage terms). Visa continues to invest heavily in its business, personnel, and its marketing efforts to support its longer-term growth runway, which is the right call in our view. We appreciate that Visa’s business is on the rebound. Visa’s GAAP EPS grew by 29% year-over-year in the fiscal first quarter.

Image Shown: Visa’s financials are trending in the right direction. Image Source: Visa – First Quarter of Fiscal 2022 Earnings Press Release

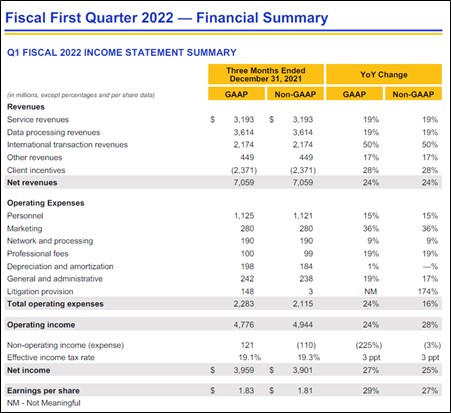

One of the reasons why we are huge fans of Visa is that its asset-light business model requires relatively modest capital expenditures to maintain a given level of revenues, better enabling the firm to generate sizable free cash flows. The company collects a fee every time one of its credit cards is swiped. Visa remained a free cash flow cow in the fiscal first quarter.

The company generated over $4.2 billion in net operating cash flow and spent less than $0.2 billion on its capital expenditures (defined as ‘purchases of property, equipment and technology’), allowing for ~$4.05 billion in free cash flow last fiscal quarter.

Visa allocated $4.1 billion buying back its Class A common stock and another $0.8 billion covering its dividend obligations in the fiscal first quarter, some of which was covered by its balance sheet strength (which we will cover in a moment). Given that shares of V are trading well below our estimate of their intrinsic value as of this writing and have been for some time, we view its share repurchases as a good use of shareholder capital.

Image Shown: Visa is a free cash flow cow due to the asset-light nature of its business model. Image Source: Visa – First Quarter of Fiscal 2022 Earnings Press Release

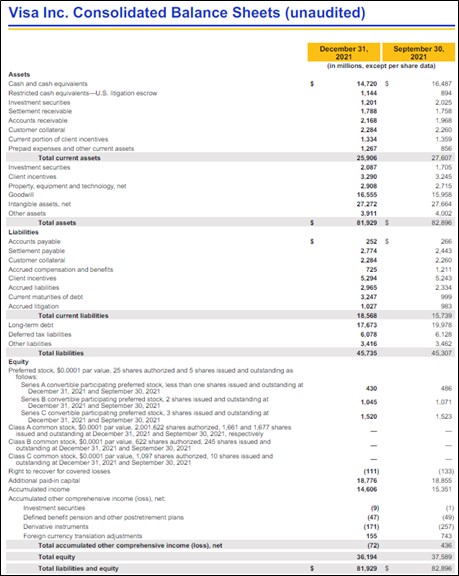

At the end of December 2021, Visa had $15.9 billion in cash, cash equivalents, and current investment securities on hand (excluding restricted cash) versus $3.2 billion in short-term debt and $17.7 billion in long-term debt. Its net debt load of $5.0 billion (inclusive of short-term debt) at the end of December 2021 is manageable given Visa’s stellar free cash flow generating abilities and ample liquidity on hand.

Visa also had $2.1 billion in non-current investment securities on hand at the end of December 2021. Historically, this line-item has been represented by investments in US Treasury holdings, US government-sponsored debt securities, and marketable securities, which are primarily cash-like assets. Visa’s net debt load is arguably smaller than it first appears, and we appreciate its relatively strong balance sheet (though we still prefer net cash positions).

Image Shown: Visa had a modest net debt load at the end of December 2021. We view its net debt load as manageable given its stellar free cash flow generating abilities and sizable cash-like position on the books. Image Source: Visa – First Quarter of Fiscal 2022 Earnings Press Release

Within Visa’s latest earnings press release, management had this to say regarding the firm’s recent performance and outlook (emphasis added):

“Visa delivered very strong results with revenue, net income and EPS all growing at 24% or higher. The strength of our network, the growth in e-commerce, better than expected progress in the return of cross-border travel and a continuation of the recovery all contributed to an excellent quarter.

As we look ahead, we do not believe the current surge in the pandemic will curtail the recovery. We see economies around the world continuing to improve and, as restrictions are lifted, cross-border travel will continue to recover. We remain confident that we are well-positioned, via our multi-pronged growth strategy, to deliver strong results well into the future.” — Alfred F. Kelly Jr., CEO and Chairman of Visa

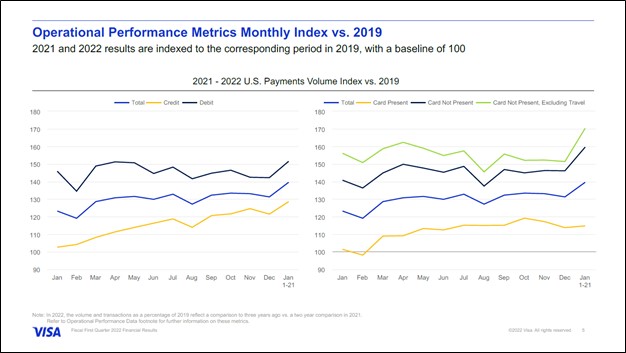

We appreciate Visa’s optimistic take towards its near-term outlook. The company is incredibly well-positioned to ride the global economic recovery higher and should receive a massive boost from the eventual recovery of international travel activities to pre-pandemic levels. Demand for e-commerce activities remains quite strong as Visa’s ‘card not present’ payment volumes in the US have held up well as you can see in the upcoming graphic down below.

Image Shown: Visa’s card not present payments volumes in the US, a barometer for its performance in the realm of e-commerce, has come in quite strong of late indicating that this part of its business should remain in high demand even as the COVID-19 pandemic fades. The proliferation of e-commerce has long legs and supports Visa’s longer term growth outlook. Image Source: Visa – First Quarter of Fiscal 2022 IR Earnings Presentation

Concluding Thoughts

Visa is a tremendous enterprise with an extensive growth runway supported by secular growth tailwinds as the world continues to pivot away from cash and towards card and other payment options. The company’s stellar free cash flow generating abilities and relatively strong balance sheet enables Visa to return ample cash to shareholders. We view Visa’s capital appreciation upside quite favorably and continue to like the firm as a top-weighted idea in the Best Ideas Newsletter portfolio. The company’s dividend program offers incremental upside to its potential capital appreciation upside.

Downloads

Visa’s 16-page Stock Report (pdf) >>>

Visa’s Dividend Report (pdf) >>>

—–

Tickerized for V, MA, DFS, AXP, COF, PYPL, SQ, ADS, SYF, FISV, GPN, GBTC, BITO, BTF, COIN, BKKT, BKNG, TRIP, EXPE

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.