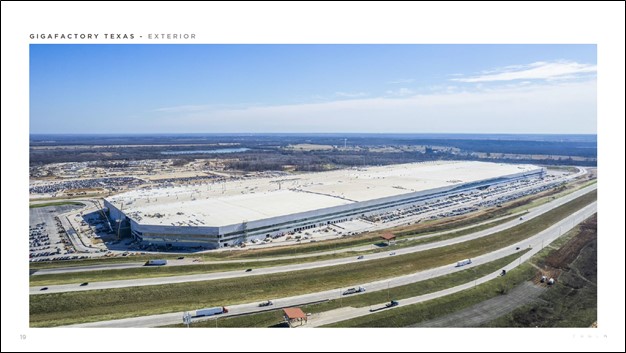

Image Shown: A look at Tesla Inc’s new ‘Gigafactory’ manufacturing facility in Austin, Texas, that is currently under development. Image Source: Tesla Inc – Fourth Quarter of 2021 IR Shareholder Deck

By Callum Turcan

On January 26, Tesla Inc (TSLA) reported that it had produced ~306,000 vehicles and delivered ~309,000 vehicles during the final quarter of 2021. The electric vehicle (‘EV’) and battery maker beat both consensus top- and bottom-line estimates in the fourth quarter as it continued to successfully ramp its production capabilities. We plan to fine-tune our cash flow valuation model covering Tesla to take its latest earnings report into account, but we still expect the point fair value estimate to be below where shares are trading at the time of this writing (~$937 per share).

Earnings Update

In 2021, Tesla produced and delivered over 930,000 vehicles, which represented year-over-year growth of 83% and 87%, respectively. The growth came from its Model 3 and Model Y vehicles, as production and deliveries of its Model S and Model X vehicles on a combined basis fell year-over-year in 2021.

Tesla is aggressively rolling out its ‘Supercharger’ EV charging stations across North America. At the end of 2021, Tesla had ~3,500 Supercharger stations with ~31,500 Supercharger connectors, both up double-digits on a percentage basis versus year-ago levels. ‘Charging anxiety’ is often cited as a key reason households are not interested in EVs, even as the price of new and used EVs has come down considerably during the past decade. Tesla is seeking to put those concerns at ease.

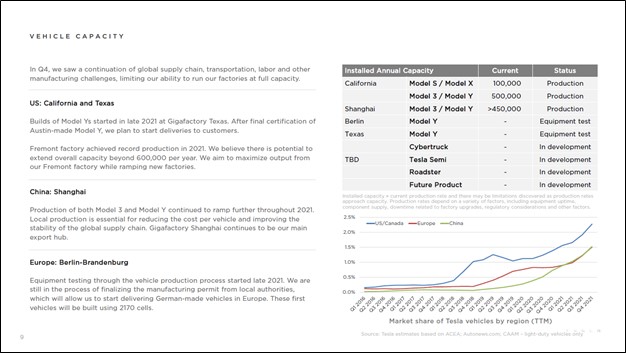

Image Shown: Tesla aggressively boosted its EV production and delivery rates in 2021 over 2020 levels as the company continued to successfully scale up its manufacturing capabilities. Strong operational performance of late, all things considered, has played an outsized role in improving Tesla’s financial performance. Image Source: Tesla – Fourth Quarter of 2021 IR Shareholder Deck

Looking ahead, Tesla is actively developing new manufacturing facilities in Germany and Texas while scaling up production at its existing facilities. Regarding the company’s facilities currently under development in Berlin-Brandenburg in Germany, Tesla is testing equipment at these locations and requires a manufacturing permit from local authorities before it can begin progressing towards commercial-level output. Its ‘Gigafactory’ in Austin, Texas, recently started building Model Y vehicles though output from this facility still needs to be certified.

Tesla has operational manufacturing facilities in California, Nevada, and China. At its Freemont facility in California, Tesla sees room to crank up its annual production to ~600,000 vehicles by 2026 (the facility hit record output in 2021). In Nevada, its ‘Gigafactory’ represents a joint-venture between Tesla and Panasonic Corporation (PCRFY), and the facility produces batteries for Tesla’s EVs. As it concerns its manufacturing facility in Shanghai, China, Tesla continues to steadily increase vehicle output and views its production ramp in the country as crucial to reducing its per vehicle costs. Tesla views its Shanghai factory as its “main export hub” and is using its manufacturing presence there to meet brisk demand in Chinese and European markets.

Image Shown: Tesla has a solid strategy in place to boost its production capabilities going forward, which underpins the company’s bright long-term growth outlook. Image Source: Tesla – Fourth Quarter of 2021 IR Shareholder Deck

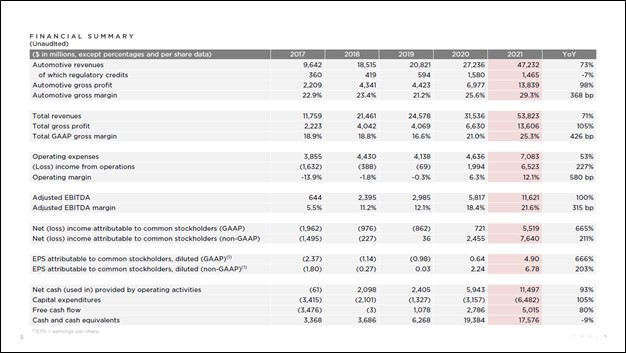

Tesla’s growth ambitions aren’t cheap. Its capital expenditures more than doubled in 2021 versus 2020 levels, hitting roughly $6.5 billion (read more about the broader trend toward rising capex at the largest companies here). However, increasing vehicle deliveries and economies of scale saw Tesla’s ‘automotive revenues’ surge higher by 73% year-over-year in 2021, while its GAAP gross and GAAP operating margins advanced ~425 and ~580 basis points year-over-year, respectively. Tesla grew its net operating cash flows 93% year-over-year in 2021, which hit approximately $11.5 billion. Tesla generated ~$5.0 billion in free cash flow in 2021, up 80% year-over-year.

Image Shown: Tesla’s free cash flows have grown materially in recent years, including in 2021. Image Source: Tesla – Fourth Quarter of 2021 IR Shareholder Deck

Inflationary headwinds, supply chain hurdles (with an eye towards the ongoing shortage of semiconductor components), rising wage/labor expenses, and growing competitive threats are all major concerns for Tesla. US federal safety regulators are investigating Tesla and its self-driving feature ‘Autopilot’ after a series of crashes involving Tesla vehicles and emergency vehicles were reported. Tesla has its work cut out for it.

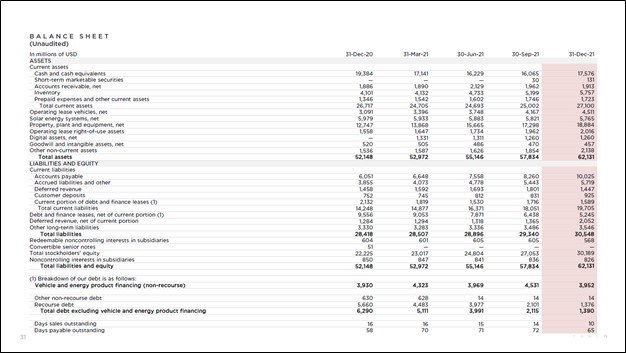

At the end of December 2021, Tesla had a nice net cash position of $10.9 billion (inclusive of short-term debt and finance lease liabilities), though please note that it has a lot of non-cancellable financial liabilities on the books to be aware of as well. Its balance sheet is depicted in the upcoming graphic down below. We appreciate Tesla’s fortress-like balance sheet.

Image Shown: Tesla had a pristine balance sheet at the end of December 2021. Image Source: Tesla – Fourth Quarter of 2021 IR Shareholder Deck

Concluding Thoughts

A lot has changed over the past decade. Tesla has become a free cash flow generating powerhouse, and its balance sheet is rock-solid. We view Tesla’s outlook quite favorably (there is ample room for strong revenue growth and meaningful margin expansion over the long haul). As noted previously, we are in the process of updating our valuation model covering Tesla, but we don’t expect so large of a fair value estimate revision to declare shares of Tesla as cheap.

Looking ahead, Tesla has a lot on its plate as it scales its business and expands its manufacturing capabilities into new geographical markets, all while rolling out new products, such as its Cybertruck (an EV pickup truck). According to Reuters, Tesla has reportedly delayed production of the Cybertruck until 2023. Such growth pains should be expected, especially as the coronavirus (‘COVID-19’) pandemic threw a wrench into the development timetables of most companies. Tesla’s EVs remain in high demand, and it is likely its customers will be able to wait until then for their futuristic looking Cybertruck.

Tesla has proven the critics wrong.

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Tickerized for various companies tied to the automotive and EV industry.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc Class B shares (BRK.B), Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.