Member LoginDividend CushionValue Trap |

Op-Ed: Bail Out Boeing, No Other Publicly Traded Companies

publication date: Mar 20, 2020

|

author/source: Brian Nelson, CFA

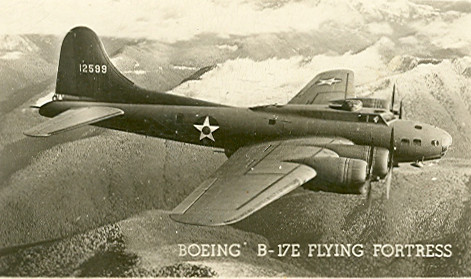

Image: Boeing B-17E Fortress 41-2599 "Tugboat Annie"; took part in the Battle of Midway in Jun '42; later ditched at sea on 16 Jan 43. Source. Dear Uncle Sam: Please stop bailing out the competition of small business. We need a changing of the guard. Let capitalism work. By Brian Nelson, CFA Let’s get this out of the way first: The U.S. government is going to bail out everybody, and that’s just how it’s going to be. It’s what we’ve become, a Bailout Nation. However, let me give you a perspective from a business owner in the financial industry. Valuentum is an investment research publisher, and while we’re not a financial advisor or broker, our team competes indirectly with many of the investment banks and research publishers out there, many of which were bailed out during the Great Financial Crisis. Scholars have written extensively about the causes of the Great Financial Crisis, and most of the work out there is fantastic, but there hasn’t been enough written about the real cause of the crisis. Here is the formula that killed Wall Street during the 2007-2009 crisis: …it was hardly unthinkable that a math wizard like David X. Li might someday earn a Nobel Prize. After all, financial economists—even Wall Street quants—have received the Nobel in economics before, and Li's work on measuring risk has had more impact, more quickly, than previous Nobel Prize-winning contributions to the field. …though, as dazed bankers, politicians, regulators, and investors survey the wreckage of the biggest financial meltdown since the Great Depression, Li is probably thankful he still has a job in finance at all. Not that his achievement should be dismissed. He took a notoriously tough nut—determining correlation, or how seemingly disparate events are related—and cracked it wide open with a simple and elegant mathematical formula, one that would become ubiquitous in finance worldwide. For five years, Li's formula, known as a Gaussian copula function, looked like an unambiguously positive breakthrough, a piece of financial technology that allowed hugely complex risks to be modeled with more ease and accuracy than ever before. With his brilliant spark of mathematical legerdemain, Li made it possible for traders to sell vast quantities of new securities, expanding financial markets to unimaginable levels. His method was adopted by everybody from bond investors and Wall Street banks to ratings agencies and regulators. And it became so deeply entrenched—and was making people so much money—that warnings about its limitations were largely ignored. Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li's formula hadn't expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system's foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril. David X. Li, it's safe to say, won't be getting that Nobel anytime soon. One result of the collapse has been the end of financial economics as something to be celebrated rather than feared. And Li's Gaussian copula formula will go down in history as instrumental in causing the unfathomable losses that brought the world financial system to its knees. On the surface, it is widely viewed that the U.S. government bailed out the banks and insurers and auto companies during the Great Financial Crisis as a result of loose lending, too much leverage, etc. But the U.S. government bailed out something more pointed, a more direct cause: The U.S. government bailed out all the “quantitative thinking” that enabled the crisis to happen. Read more here. One of the biggest tells behind our getting ahead of the Crash of 2020 was just how poor the quantitative/indexing research we had been reading on Finance Twitter (“FinTwit”) had become during 2016-2018 (e.g. value versus growth, buybacks, interest rates, backward-looking analysis, etc), and even some of the quant work in the more prestigious publications. It was all wrong. Most of quant research out there had morphed into nonsense, and like lemmings off a cliff or pigs to the slaughter pen, the followers just kept eating it up. They’re still eating it up. The U.S. government bailed out all of the investment banks (research providers) during the Great Financial Crisis (with the exception of Lehman), and instead of having a cleansing that catapulted new leaders to the top, the U.S. government preserved and supported our competition. But they even made it worse. After the U.S. government backed all the terrible quant thinking and bad policies that led to the Great Financial Crisis, when President Donald Trump took office, the administration cut their taxes pretty much in half. That hurt. With any bailout, there are unintended consequences. In our case, the U.S. government stacked the deck against small research providers and supported quantitative thinking (what we’ve been warning about the past couple years), something that continued to proliferate into prominence as indexing and quant products proliferated. We knew this wasn’t going to end well. The coronavirus was merely the catalyst to expose the fragility of this marketplace. Volatility has been greater than during the Crash of 1929, and all of this was preventable. We needed a change of guard during the Financial Crisis, much like we need a change of the guard today. The U.S. government shouldn’t have bailed out the “Gaussian copula function,” (“quant thinking”), but rather it should have supported more responsible thinking and expert analysis. Now, fast forward to today. We’re in another Financial Crisis, in part made worse by the enormous volatility that is scaring mom and pop from the markets, volatility that is being created by quant algorithms chasing volatility and momentum. Most of the world is scared, and the U.S. government is now posed with the same decision. Should it bail out everybody again? Well, based on Fed and Treasury actions, it seems like if it ever comes down to it, they will bail out the banks (they already have backstopped pretty much everything). More pointedly, however, it seems like they’re going to bail out everybody, and stick it to small businesses, and the prudent tax-payers again! Here’s Valuentum’s perspective: Is it not enough that the U.S. government bailed out our competition during the Financial Crisis, cut their taxes, and then supported the failed quant thinking during the past decade by not putting a stop to quant and indexing proliferation that is responsible for today’s gut-wrenching volatility? Now, the U.S. government is going to do the same types of things again. Should it bail out the airlines? No way! Everybody knows that the airlines are terrible businesses. They’ve spent tens of billions on buybacks during the past decade, and now they want more money from small-business funded tax coffers. They should have been prepared for the next big disruption in their businesses, which could only have been expected. Let them fail. Amazon (AMZN), Google (GOOG), and Apple (AAPL), all of which are huge free cash flow generators, and/or other companies with strong financial profiles can replace these failing entities with their own airlines. Let capitalism work! What about the energy complex and theater, hotel and restaurant industries? They are not systemically important. The world is going to clean energy, streaming and Airbnb, and while theaters and hotels may fail without government assistance, let others who have been prudent and responsible during this past decade, with fresh and deep pockets take their place. Let big publicly-traded corporations that did not plan for the next recession and financial crisis eat cake! My point is this: Please stop bailing out the competition of small business. For example, the restaurant chains absolutely destroyed the mom and pop restaurants during the past 20 years with reckless unit growth, and the government is now going to stick it to mom and pop again by bailing the big chains out? Let capitalism work. Let small business come roaring back, and let the big publicly-traded corporations fail. If you’re a public company with a deep executive bench, and you’re not ready for the next recession or financial crisis, you may have only yourself to blame. Interestingly, while many are saying Boeing (BA) should be punished (not bailed out), it is the only public company that should be bailed out with consideration of equity holders and on friendly terms, in my opinion. Obviously, the United States needs Boeing and its defense expertise, but the company has also paid it forward. To me, we can’t afford a disruption at one of the largest aircraft makers, and it may be the only troubled equity today that has actually earned our support: During World War II, Boeing and its partners worked together to produce staggering 98,965 aircraft, including the famed B-17 Flying Fortress. Representing nearly 28 percent of America’s total aircraft production, Boeing proved a principal contributor to industrial production during the war. These planes helped guarantee victory for Allied forces and served as a symbol of American might and innovation. Thank you for your service Boeing. We’re here for you. Concluding Thoughts Let’s now bring it down a few notches. The U.S. government is going to bail out everybody, and nobody is going to be the wiser. The quants will keep winning accolades, and most all nonsensical quant research will continue as misaligned incentives proliferate. Many small businesses that are prudent and manage their finances as they should (businesses like Valuentum) are ready for this. We’d do anything to support our employees, contractors and customers because we’ve been prepared. It’s because we’ve made sacrifices. On the other hand, the U.S. government will continue to support the reckless competition against small business all over the country and bail them out. I say no. Bail out Boeing and small business, and please send Americans thousands of dollars, but don’t bail out any other publicly-traded corporation. Large corporations just received huge tax breaks, and small business suffered. It’s time to make this right. What do you think? Comment below. |

11 Comments Posted Leave a comment