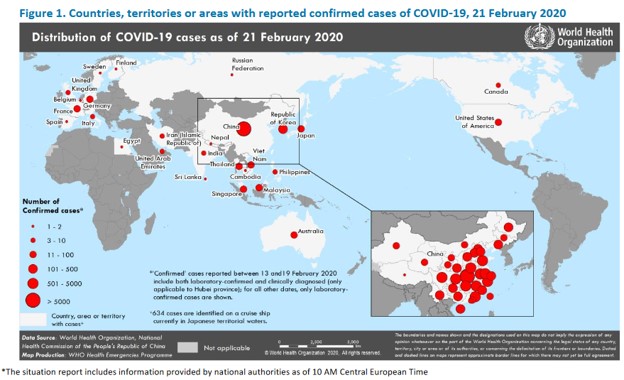

Image Source: World Health Organization, Coronavirus disease 2019 (COVID-19), Situation Report — 32

We don’t think this is the environment to put new capital to work, and we remain highly cautious of what COVID-19 means for global economic growth not just in the first quarter of 2020 but for the rest of this year (maybe longer). Right now, the US markets are not really factoring in anything related to COVID-19, and perhaps may be adjusting to China’s stimulus in artificially propping up the markets as if the outbreak is somehow a “positive thing.” With the S&P 500 trading at 19.0 forward earnings estimates–estimates that are likely too high given the evidence we are seeing with respect to a slowdown due to COVID-19–and corporate debt levels more elevated than ever before (note, a high net debt level should depress the P/E in enterprise valuation–US corporate debt has advanced 50% over the past decade, to $10 trillion), it is our contention that the current market reflects a “situation-equivalent” forward P/E (i.e. rightsizing for new net debt relative to the dot-com peak and adjusting for lower forward earnings expectations compared with current forecasts) perhaps greater than 24.4, which was recorded at the peak of the dot-com bubble. Though interest rates are lower than they were at the time of the dot-com crash, suggesting a modest reasonable bump to normalized forward P/E ratios of ~15 times to reflect “fair valuations,” we could seriously be in for fundamental-driven crash soon, as both the earnings multiple and earnings estimates may contract aggressively. Hypothetically, a contraction to a 16x forward multiple on earnings estimates just 10% lower than currently forecast implies an S&P 500 of 2,566, or a swoon of about 20%-30% from current levels–and that would just get us down to 16x still-respectable forward numbers. How quantitative-driven price-agnostic trading may impact this scenario is not known either, and all of this could be setting up for a wild ride in the coming weeks and months. Fasten your seatbelts. We’ll have a few newsletter portfolio alerts coming Monday.

By Brian Nelson, CFA

This is our third update on the Wuhan 2019 Novel Coronavirus, now named COVID-19. You can read our first two updates here (Feb 7) and here (Jan 31). Let’s first start with some high-level thoughts and then we’ll go into further developments related to COVID-19.

For starters, thanks to a massive liquidity injection by China (FXI, MCHI, KWEB), in many ways, the markets are reacting counter-intuitively to the outbreak of COVID-19. For one, we might have expected a massive 1,000-2,000 point swoon in the Dow Jones Industrial Average (DIA) on outbreak news (and China’s partial economic shutdown) as the market tends to “wrongly” overreact to the near term and underweight the long term, the latter, however, actually more important to normalized prices/values. Our base-case scenario is that COVID-19 will impact global economic growth for the next few quarters, so we had been expecting a massive market sell off (“overreaction”).

However, instead of the market selling off aggressively on what looks to have all the makings of a global economic pause, Chinese stimulus is making the markets look a bit “smarter” than they should. In some ways, if the markets had acted the way we thought they would in selling the Dow Jones Industrial Average down a couple thousand points on COVID-19 outbreak news, we might have been of the opinion that a “buying opportunity” could be present on select undervalued names with strong momentum. However, the market has never really sold off on the COVID-19 outbreak.

In fact, the Dow Jones Industrial Average is still hovering around all-time highs near the 29,000 mark, closing at 28.992.41 Friday, February 21. Having rallied considerably during the past decade or so, US equity markets are not only largely ignoring the biggest threat to global economic health since the Great Financial Crisis, but they are doing so near all-time highs. We don’t think this is the environment to put new capital to work, and we remain highly cautious of what COVID-19 means for global economic growth not just in the first quarter of 2020 but for the rest of this year (maybe longer).

COVID-19 Is A Global Event

Let’s first start with China.

According to the latest reports, there are now a total of 76,288 confirmed cases of COVID-19 in mainland China and 2,345 deaths. The country is throwing everything it has towards containing the spread of the virus, but COVID-19 continues to proliferate…and now on a global scale.

Next, with 430+ confirmed cases in South Korea (EWY), the country looks like it will become the next epicenter of the deadly disease, and the pace of increases seems to be growing exponentially–mirroring in some ways the pace in China when the virus first broke.

According to reports, there are over 5,000 people being tested for coronavirus in South Korea, so new cases are expected to continue to advance rapidly. It seems a large majority of the cases in South Korea “appear to be centered around the Shincheonji Church of Jesus in the city of Daegu, where a member of the congregation spread the virus.” There are over 9,000 people that attend the church.

South Korea, however, may be just the next epicenter in a long line of others, as Italy (EWI)–the largest hotspot in Europe–and Singapore (EWS) may face similar new-case trajectories in the coming weeks and months. According to the International Business Times:

Authorities in northern Italy on Friday ordered the closure of schools, bars and other public spaces in 10 towns following a flurry of new coronavirus cases. Five doctors and 10 other people tested positive for the virus in Lombardy, after apparently frequenting the same bar and group of friends, with two other cases in Veneto, authorities said at a press conference. Over 50,000 people have been asked to stay at home in the areas concerned, while all public activities such as carnival celebrations, church masses and sporting events have been banned for up to a week.

According to the latest update, there are now a total of 89 coronavirus cases in Singapore, too, and the country may have acted as the nexus for the latest surge in reported cases in other countries. According to reports, just “one meeting held in a luxury hotel in mid-January spawned several coronavirus cases around the world. More than 100 people attended the sales conference, including some from China. About a week after that meeting, stories of confirmed coronavirus cases began popping up all over the world – from South Korea to Malaysia, the UK and even Spain.”

COVID-19 has even spread to Iran, which recently reported its fifth death as a result of virus, and both Israel (EIS) and Lebanon have confirmed their first documented cases. The UK (EWU) continues to prepare for more coronavirus cases following the first London diagnosis February 12, and according to the latest tally, the number of cases in Japan (EWJ) rose to 121, excluding those on the Diamond Princess cruise ship. The World Health Organization (WHO) remains “concerned about coronavirus cases with no clear (epidemiological) link…cases with no clear link include those with no travel history to China or contact with a confirmed case.”

Egypt (EGPT) confirmed that it has the first case in Africa (EZA), and in the event COVID-19 spreads to countries with weak and underfunded healthcare systems, the death toll could be catastrophic. According to the WHO’s situation report, dated February 21, there are COVID-19 cases in 26 countries outside of China, and while health officials around the world are learning more and more about the virus and how it spreads, anecdotes are frightening. For one, the incubation period is likely longer than 14 days, meaning that not only are people spreading the virus asymptomatically, but those that have been quarantined for two weeks could still be contagious after release. Some researchers believe the “incubation period could be 24 days,” while others are saying “incubation could be as long as 27 days.”

Right now, despite the 35 confirmed cases of coronavirus in the US, the US has largely avoided the fallout. Most of the cases in the US are repatriated individuals from the Diamond Princess cruise ship, and the 14 US cases include eight in California (the latest in Sacramento), “one in Massachusetts, one in Washington state, one in Arizona, two in Illinois and one in Wisconsin.” The Trump administration thus far, it seems, has done an admirable job keeping COVID-19 from American shores, but it still is early. In the event that even a minor outbreak of a half dozen or fewer uncontained cases hits a major city or two in the US, we could see economic activity grind to a halt.

Getting Back to Valuations

This could be the catalyst that gets investors back to paying attention to valuations. According to Factset, based on the S&P 500 (SPY) closing price of 3386.15 February 19, “the forward 12-month P/E ratio for the S&P…was 19.0… above the four most recent historical averages for the S&P 500: five-year (16.7), 10-year (14.9), 15-year (14.6), and 20-year (15.5). In fact, this marked the first time the forward 12-month P/E had been equal to (or above) 19.0 since May 23, 2002 (19.1). However, it is important to note that even at 19.0, the forward 12-month P/E ratio was still well below the peak P/E ratio (of the past 20 years) of 24.4 recorded on March 24, 2000.”

The impact on hundreds of companies around the world is already being felt. We are witnessing huge drops in same-store sales at Yum China (YUMC), and some believe “Apple’s (AAPL) iPhone sales in China may fall by at least 40 percent to 50 percent in February and March compared with the same period last year.” In some cases, where the COVID-19 outbreak may create pent-up demand, as in the iPhone replacement cycle, we don’t think it applies across the board for every company, namely in key consumables, a large portion of the global economy. Factset noted last week that of the “364 companies (that conducted fourth quarter earnings conference calls from January 1 through February 13), 138 (38%) cited the term “coronavirus” during the call.”

Everyone is on high alert, and nobody can handicap the lasting impact from the outbreak, not even key health officials and the best of the best economists. This is what we call a “known unknown.” That said, we maintain our view that COVID-19 may be the catalyst that triggers the long-anticipated global recession, and our base-case expectations are that we could see a swoon in the Dow Jones Industrial Average by 1,000-2,000 points in the event the market factors in a multi-quarter recession (a scenario that we believe is base case), and perhaps a greater drop (“crash”) should major cities in the US record new documented, uncontained cases. Even a target of 2,566 on the S&P 500, implying a swoon of 20%-30% is not unreasonable.

Concluding Thoughts

Right now, the US markets are not really factoring in anything related to COVID-19, and perhaps may be adjusting to China’s stimulus in artificially propping up the markets as if the outbreak is somehow a “positive thing.” With the S&P 500 trading at 19.0 forward earnings estimates–estimates that are likely too high given the evidence we are seeing with respect to a slowdown due to COVID-19–and corporate debt levels more elevated than ever before (note, a high net debt level should depress the P/E in enterprise valuation–US corporate debt has advanced 50% over the past decade, to $10 trillion), it is our contention that the current market reflects a “situation-equivalent” forward P/E (i.e. rightsizing for new net debt relative to the dot-com peak and adjusting for lower forward earnings expectations compared with current forecasts) perhaps greater than 24.4, a number that was recorded at the peak of the dot-com bubble.

Though interest rates are lower than they were at the time of the dot-com crash, suggesting a modest reasonable bump to normalized forward P/E ratios of ~15 times to reflect “fair valuations,” we could seriously be in for fundamental-driven crash soon, as both the earnings multiple and earnings estimates may contract aggressively. Hypothetically, a contraction to a 16x forward multiple on earnings estimates just 10% lower than currently forecast implies an S&P 500 of 2,566, or a swoon of about 20%-30% from current levels–and that would just get us down to 16x still-respectable forward numbers. How quantitative-driven price-agnostic trading may impact this scenario is not known either, and all of this could be setting up for a wild ride in the coming weeks and months.

Fasten your seatbelts. We’ll have a few newsletter portfolio alerts coming Monday.

Tickerized for our stock and ETF coverage universe.