Member LoginDividend CushionValue Trap |

Best Idea Vertex Pharma Continues to Impress

publication date: Jun 4, 2021

|

author/source: Callum Turcan

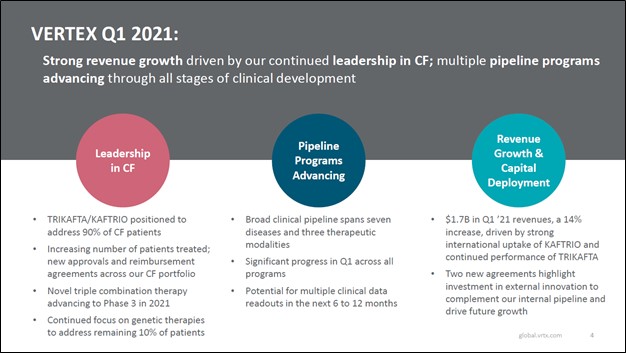

Image Shown: We are big fans of Vertex Pharmaceuticals Inc and include shares of VRTX as an idea in our Best Ideas Newsletter portfolio. The biotech firm posted a solid first quarter 2021 earnings report in late-April. Image Source: Vertex Pharmaceuticals Inc – First Quarter of 2021 Earnings IR Presentation By Callum Turcan On April 29, Vertex Pharmaceuticals Inc (VRTX) reported first quarter 2021 earnings that beat both consensus top- and bottom-line estimates. Its GAAP revenues popped higher by 14% year-over-year as sales of its TRIKAFTA/KAFTRIO therapeutic offerings (TRIKAFTA is the US brand name, KAFTRIO is the European brand name) which treat cystic fibrosis (‘CF’) grew by 33% year-over-year. Economies of scale and revenue growth enabled Vertex Pharma to grow its GAAP operating income by 23% year-over-year in the first quarter. We include shares of VRTX as an idea in the Best Ideas Newsletter portfolio and continue to be huge fans of the biotech firm. Earnings Update In the first quarter, Vertex Pharma generated a bit under $0.9 billion in free cash flow and spent a little over $0.4 billion buying back its stock. The company does not have a common dividend policy at this time. Vertex Pharma’s free cash flow generating abilities are impressive, a product of its CF drug portfolio which represent its only commercialized therapeutics so far. During its first quarter earnings update, Vertex Pharma reiterated most of its full-year forecasts for 2021, though it raised its expected operating expenses due to a recent deal we will cover later in this article. Vertex Pharma still aims to grow its product revenues to $6.7-$6.9 billion in 2021. That represents a nice improvement from 2020 levels when it generated $6.2 billion in product revenues and a huge improvement over 2018 levels when it generated $3.1 billion in product revenues. For reference, product revenues represent virtually all of Vertex Pharma’s sales, with the remainder made up from ‘collaborative and royalty revenues.’

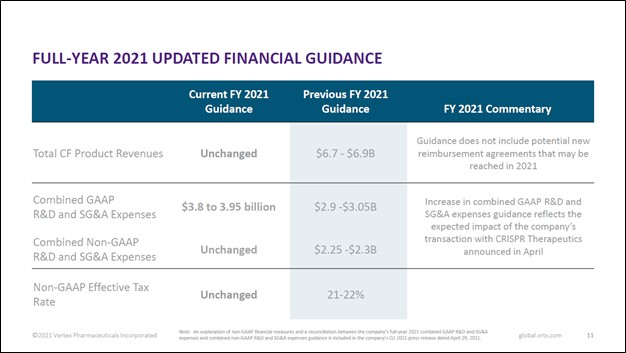

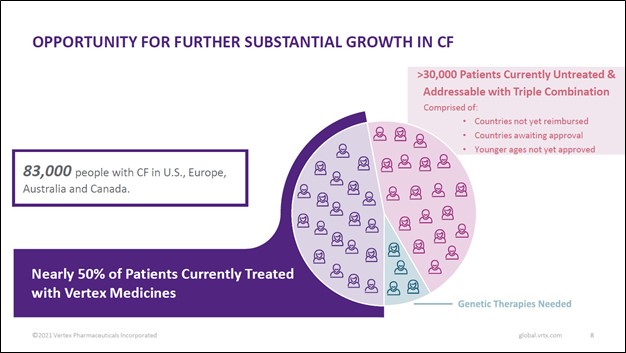

Image Shown: An overview of Vertex Pharma’s full-year guidance for 2021. Image Source: Vertex Pharma – First Quarter of 2021 Earnings IR Presentation Back in January 2021, we provided a detailed overview of Vertex Pharma’s CF drug business in this article here. Looking ahead, Vertex Pharma sees ample room to continue growing sales of its CF therapeutics by expanding into new geographical markets and securing regulatory approval for its drug portfolio to treat younger patients with CF (which among other things involves running clinical trials to test the efficacy and safety of its drugs in younger patients). Please note Vertex Pharma’s CF portfolio has only been approved to treat CF in patients aged 12 or older in certain geographical markets as of this writing. Securing regulatory approvals and reimbursement deals are the two main ways Vertex Pharma aims to grow sales of its CF drug portfolio going forward. According to Vertex Pharma’s first quarter of 2021 earnings call, the firm expects Canadian regulators will approve TRIKAFTA in the second half of this year. Furthermore, the firm’s management team noted that TRIKAFTA is expected to receive approval to treat six to 11 year old patients with CF in the US around mid-2021. Vertex Pharma also aims to secure approval from European regulators to treat patients aged 6 to 11 with CF, and the firm expects to soon file its regulatory submission (covering KAFTRIO) according to management commentary provided during the firm’s first quarter of 2021 earnings call. Additionally, while Vertex Pharma’s management team recently noted that the company had received regulatory approval for its KAFTRIO treatment in Australia, France, and Spain, it had yet to secure reimbursement deals as of late April 2021. Positive changes on these fronts could yield substantial upside for Vertex Pharma and patients with CF who are currently not able to readily access the company’s therapeutic offerings.

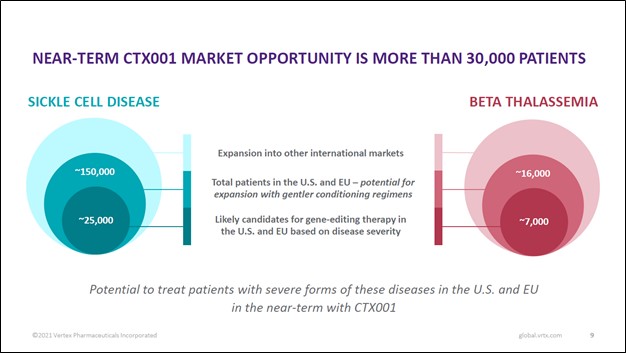

Image Shown: There are tens of thousands of patients across the world that could get treated with Vertex Pharma’s CF drug portfolio that are currently untreated according to the company. Image Source: Vertex Pharma – First Quarter of 2021 Earnings IR Presentation The biotech firm’s pristine financials lend a tremendous amount of support to its growth ambitions. At the end of March 2021, Vertex Pharma had $6.3 billion in cash and cash equivalents on hand along with $0.6 billion in marketable securities versus $0.6 billion in long-term finance lease liabilities, a $0.2 billion ‘long-term contingent consideration’ line item, and $0.4 billion in long-term operating lease liabilities on the books. Inclusive of the aforementioned line items, Vertex Pharma had an adjusted net cash position of ~$5.8 billion at the end of the first quarter of 2021. We are huge fans of Vertex Pharma’s fortress-like balance sheet, and management recently put some of the firm’s cash hoard to good use, in our view. Key Strategic Partnership Vertex Pharma has a strategic partnership with CRISPR Therapeutics AG (CRSP) that is working towards developing an experimental CRISPR/Cas9-based gene editing therapy, CTX001, that could potentially treat and cure sickle cell disease (‘SCD’) and transfusion-dependent beta-thalassemia (‘TDT’). As you can see in the upcoming graphic down below, CTX001 is addressing a sizable patient pool in the US and Europe, and there is substantial room for upside in other markets as well.

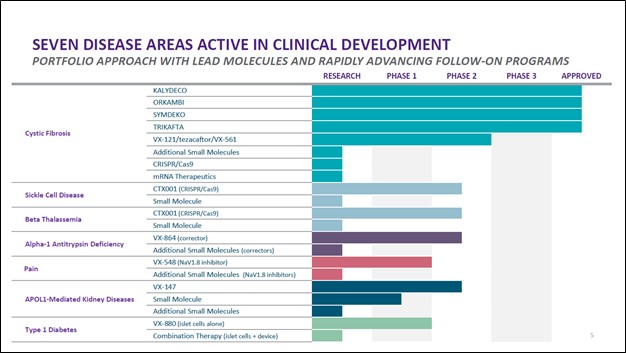

Image Shown: The CTX001 drug candidate, if commercialized, would have a long growth runway. Image Source: Vertex Pharma – First Quarter of 2021 Earnings IR Presentation In April 2021, Vertex Pharma announced it would increase its economic stake in CTX001 through an amended agreement with CRISPR Therapeutics. This amended deal involved Vertex Pharma paying $0.9 billion in cash up front to CRISPR Therapeutics and agreeing to a contingent payout of $0.2 billion should CTX001 receive its first regulatory approval. Additionally, Vertex Pharma agreed to shoulder 60% of the drug candidate’s development costs. In return, Vertex Pharma now is entitled to 60% of the future profits of CTX001, “representing a 10% increase in program economics compared to the previous agreement” according to the press release. We like Vertex Pharma’s decision to grow its exposure to CTX001 as this move could significantly improve its growth runway, in our view (we covered this deal in a previous article here). However, in the biotech space, nothing is for certain until drug candidates pass the finish line and receive the necessary regulatory approvals after running several successful clinical trials, a process that takes years. Please note that CTX001 has been granted various special regulatory designations from both US and European regulators, and the partnership sees their CTX001 gene-editing therapy as the furthest along in clinical trials as it concerns treating and curing SCD and TDT. During Vertex Pharma’s first quarter earnings call, management had this to say on CTX001 (emphasis added, moderately edited): “CTX001 is our most advanced program beyond CF. In the last year, we've generated remarkable clinical data that demonstrates the potential of this therapy to be a one-time functional cure for patients suffering from sickle cell disease and beta-thalassemia… …[T]here are nearly 170,000 patients with sickle cell disease and beta-thalassemia in the U.S. and Europe, of whom 32,000 patients have severe disease and we believe will be eligible for CTX001 therapy with the current conditioning regimen. This number could extend significantly once gentler conditioning regimens are available. To date, more than 30 patients have been dosed with CTX001 and we anticipate sharing updated data from the ongoing sickle cell and transfusion-dependent thalassemia studies with more patients and longer duration of follow-up at upcoming medical meetings this year. We also expect to complete enrollment in both of these studies this year. Lastly, while we’ve initiated, we have not yet completed our discussions with regulators regarding filing expectations. Based on conversations to-date, we believe regulatory submissions for approval of CTX001 may be possible in the next 18 to 24 months. We’ll provide further details as we conclude our discussions.” --- Dr. Reshma Kewalramani, CEO of Vertex Pharma We are keeping a close eye on the development and potential future commercialization of CTX001 given how that could have a profound impact on the future financial performance of both Vertex Pharma and CRISPR Therapeutics. On May 12, Vertex Pharma and CRISPR Therapeutics “announced [that] two abstracts detailing updated data from the ongoing CTX001 clinical trials have been accepted for presentation during the European Hematology Association (EHA) 2021 Virtual Congress” according to the press release. This virtual congress event is expected to take place on June 9 to June 17. Beyond its CF portfolio and CTX001, Vertex Pharma has a robust drug pipeline as you can see in the upcoming graphic down below. Its drug pipeline includes various potential treatments in either the research or early clinical trial phases that seek to treat alpha-1 antitrypsin deficiency, pain management, APOL1-mediated kidney diseases, and Type 1 diabetes. While these candidates are still a way off from reaching the commercial stage, we appreciate that Vertex Pharma has identified and is actively moving forward with developing several potential future growth opportunities.

Image Shown: Vertex Pharma’s drug pipeline is robust. Image Source: Vertex Pharma – First Quarter of 2021 Earnings IR Presentation Concluding Thoughts We view Vertex Pharma’s growth outlook quite favorably, with its fortress-like balance sheet and stellar free cash flow generating abilities providing the biotech firm with the capacity to make major investments in its business. Our fair value estimate for Vertex Pharma sits at $229 per share, though the top end of our fair value estimate sits at $321 per share of VRTX. Should its CTX001 drug candidate receive the necessary regulatory approvals, and/or in the event its CF drug portfolio continues to grow at a brisk pace going forward, shares of Vertex Pharma may test the upper bound of our fair value estimate range over time. We continue to like Vertex Pharma as an idea in the Best Ideas Newsletter portfolio. ----- Health Care Bellwethers Industry - JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH Tickerized for VRTX, CRSP, XBI, IBB Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund ETF (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment