Image Shown: A snapshot of Vertex Pharmaceuticals Inc’s approved therapeutic offerings and its drug pipeline. Image Source: Vertex Pharmaceuticals Inc – January 2021 IR Presentation

By Callum Turcan

On January 12, we tweaked the Best Ideas Newsletter portfolio (link here) and added Vertex Pharmaceuticals Inc (VRTX) to the portfolio to gain exposure to a top tier biopharmaceutical company with powerful growth catalysts, a pristine balance sheet, a stellar cash flow profile, and exposure to next-generation treatments (gene therapies) through a strategic partnership that we will cover later on. The top end of our fair value estimate range for Vertex sits at $321 per share.

Commercial Portfolio Overview

Vertex’s commercialized therapeutics portfolio is heavily weighted towards treating cystic fibrosis (‘CF’) across various age groups including: TRIKAFTA/KAFTRIO (age 12 and older), SYMDEKO/SYMKEVI (age six and older), ORKAMBI (age two and older), and KALYDECO (age four months and older). Back in October 2019, Vertex’s TRIKAFTA offering was approved by the US Food and Drug Administration (‘FDA’). The FDA noted:

Trikafta is approved for patients 12 years and older with cystic fibrosis who have at least one F508del mutation in the cystic fibrosis transmembrane conductance regulator (CFTR) gene, which is estimated to represent 90% of the cystic fibrosis population…

Cystic fibrosis, a rare, progressive, life-threatening disease, results in the formation of thick mucus that builds up in the lungs, digestive tract, and other parts of the body. It leads to severe respiratory and digestive problems as well as other complications such as infections and diabetes. Cystic fibrosis is caused by a defective protein that results from mutations in the CFTR gene. While there are approximately 2,000 known mutations of the CFTR gene, the most common mutation is the F508del mutation…

Trikafta is a combination of three drugs that target the defective CFTR protein. It helps the protein made by the CFTR gene mutation function more effectively. Currently available therapies that target the defective protein are treatment options for some patients with cystic fibrosis, but many patients have mutations that are ineligible for treatment. Trikafta is the first approved treatment that is effective for cystic fibrosis patients 12 years and older with at least one F508del mutation, which affects 90% of the population with cystic fibrosis or roughly 27,000 people in the United States.

The efficacy of Trikafta in patients with cystic fibrosis aged 12 years and older was demonstrated in two trials.

CF is a profoundly serious disease. Recent pharmaceutical breakthroughs have significantly advanced the ability for healthcare providers to treat and manage patients with CF, with Vertex leading the way on this front. The approval in the US and Europe covered slightly different applications of Vertex’s TRIKAFTA/KAFTRIO treatments. In August 2020, the European Commission (‘EC’) approved KAFTRIO (the European-branded name of the TRIKAFTA therapeutic) to treat certain forms of CF in patients ages 12 years and older in combination with KALYDECO, and Vertex put out a press release noting that (lightly edited):

…European Commission (EC) has granted marketing authorization for KAFTRIO® (ivacaftor/tezacaftor/elexacaftor) in a combination regimen with ivacaftor [trade name KALYDECO] to treat people with cystic fibrosis (CF) ages 12 years and older with one F508del mutation and one minimal function mutation (F/MF), or two F508del mutations (F/F) in the cystic fibrosis transmembrane conductance regulator (CFTR) gene.

For the first time, up to 10,000 people in Europe ages 12 years and older with CF who have one F508del mutation and one minimal function mutation will be eligible for a CFTR modulator that treats the underlying cause of the disease. Approval of the triple combination regimen also expands the number of treatment options available to people ages 12 years and older with CF who have two copies of the F508del mutation, the most common CF-causing mutation worldwide…

Marketing authorization was based on the results of two global Phase 3 studies, which showed statistically significant and clinically meaningful improvements in lung function (primary endpoint) and all key secondary endpoints, in people with CF ages 12 years and older with one F508del mutation and one minimal function mutation or two F508del mutations in the CFTR gene. The triple combination regimen was generally well tolerated in both studies.

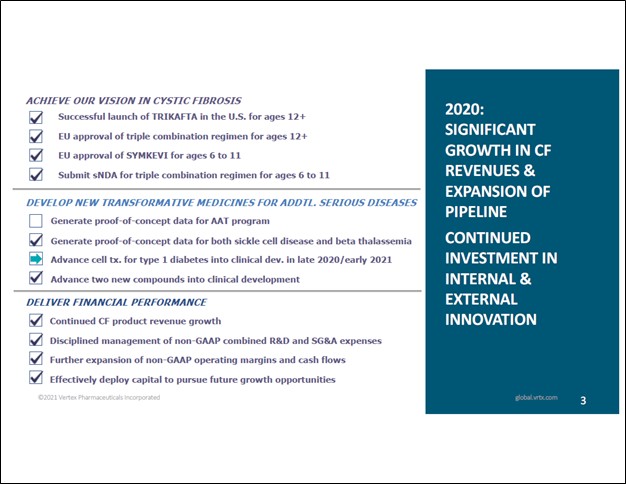

Vertex highlights its recent operational accomplishments and some of the near-term goals management is currently focused on in the upcoming graphic down below.

Image Shown: An overview of Vertex’s recent accomplishments and some of its near-term goals. Image Source: Vertex – January 2021 IR Presentation

Promising CF Therapeutic Sales Growth Trajectory

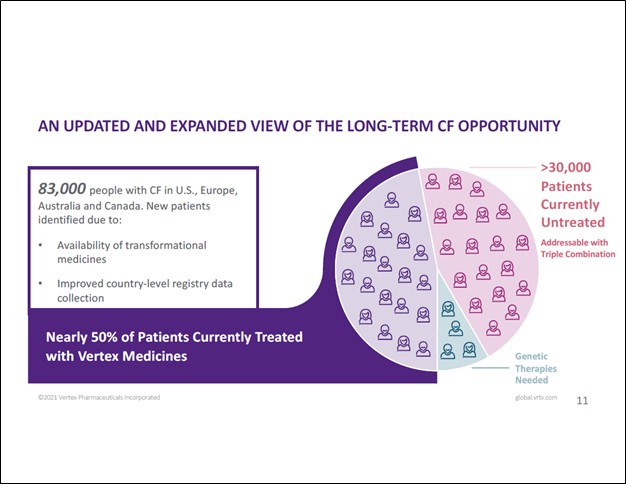

In the view of Vertex, there are 83,000 people with CF in Australia, Canada, Europe, and the US combined, up from 75,000 previously as management noted at a January 2021 investor relations event (due in part to better data collection). There are over 30,000 patients in these geographical markets currently not taking treatment for CF that Vertex’s therapeutic offerings could treat according to the company. Vertex’s management noted that the firm was currently “treating about 40% to 50% of the CF population” and that Vertex was “working hard to bring the triple combination to all of these patients” who were currently not getting treated during the recent investor presentation.

Image Shown: There are still many patients with untreated CF across various Western countries that Vertex’s therapeutics could treat. Image Source: Vertex – January 2021 IR Presentation

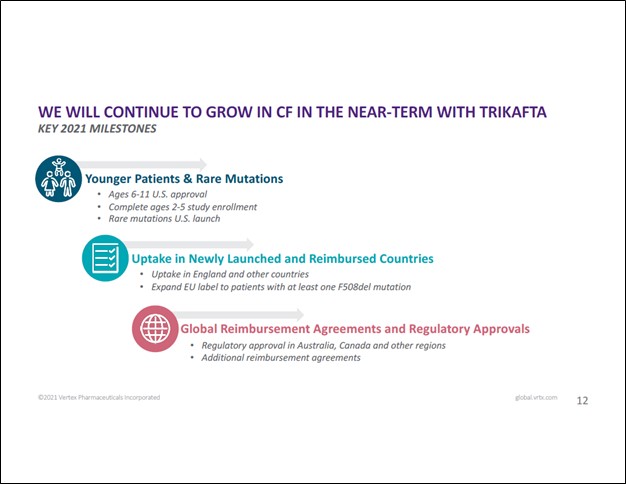

Looking ahead, Vertex intends to continue to expand the application of its CF portfolio. In Europe, that includes efforts to expand the ability for KAFTRIO to treat European patients with at least one F508del mutation. In the US, that includes conducting clinical trials to gauge how effective its CF portfolio is at treating rare mutations, while also seeking to secure approval for TRIKAFTA to treat patients that are younger than 12. Regulatory approval for its TRIKAFTA/KAFTRIO treatments in Australia and Canada is pending, and Vertex has its eyes on other markets as well. Securing reimbursement agreements for KAFTRIO in various European countries is another key initiative at Vertex (according to recent management commentary, Vertex appears to be working on securing reimbursement deals in France, Spain, and Italy).

Image Shown: Vertex intends to continue to expand the reach and application of its CF therapeutic portfolio. Image Source: Vertex – January 2021 IR Presentation

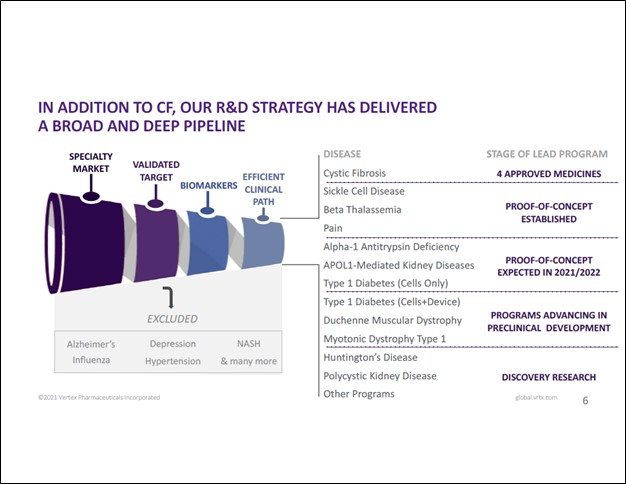

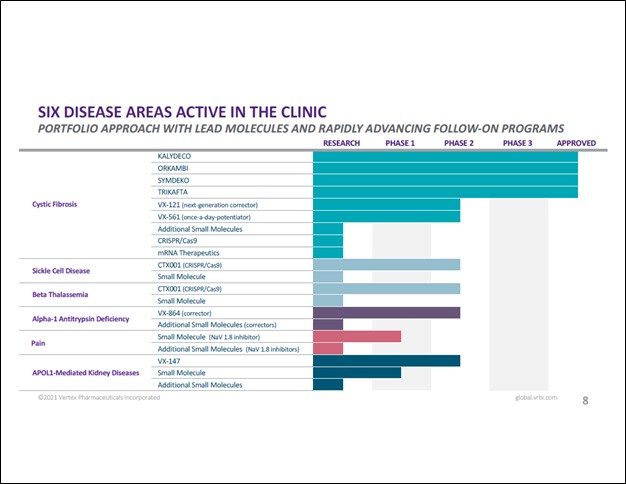

Drug Pipeline Overview

Vertex’s portfolio covers more than just CF and its drug pipeline is quite large (which does include a meaningful CF drug pipeline, too). That includes potential therapeutics which could treat sickle cell disease (abbreviated as ‘SCD’ — this is a group of red blood cell disorders), beta thalassemia (blood disorder), alpha-1 antitrypsin deficiency (can cause lung disease and liver disease), APOL1-mediated kidney diseases, and offerings for pain management, along with new potential CF therapeutics. Some of these conditions, such as SCD and APOL-1-mediated kidney diseases, are inherited and gene therapies (a new space in the biotech world) might offer a may to treat such conditions which historically have been incredibly difficult/impossible to cure (though there are ways to treat and manage such conditions).

Back in October 2015, Vertex and CRISPR Therapeutics AG (CRSP) announced a strategic partnership that aimed to use “CRISPR’s gene editing technology, known as CRISPR-Cas9, to discover and develop potential new treatments aimed at the underlying genetic causes of human disease.” CRISPR focuses on gene therapies. The partnership is currently working on treating transfusion-dependent beta thalassemia (‘TDT’), CF and SCD. We are intrigued by the potential therapeutic breakthroughs that the Vertex-CRISPR partnership could uncover. The upcoming graphic down below provides a snapshot of Vertex’s drug pipeline and commercial portfolio.

Image Shown: While Vertex’s commercial portfolio is built on its CF therapeutic offerings, its drug pipeline covers an array of health conditions and offers Vertex a way to diversify its commercial drug portfolio over time. Image Source: Vertex – January 2021 IR Presentation

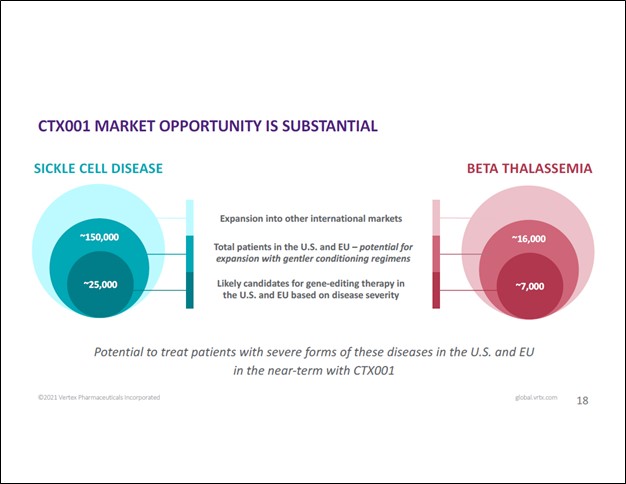

One of the potential drugs Vertex and CRISPR are working together one is CTX001, “an investigational ex vivo CRISPR gene-edited therapy” that could treat TDT and severe cases of SCD. In November 2019, the duo announced positive interim safety and efficacy data from a CTX001 clinical trial which involved “two patients with severe hemoglobinopathies” though that is a very small sample. Following up on that, the duo announced favorable proof-of-concept clinical trial data in June 2020 from the CLIMB-111 and CLIMB-121 Phase 1/2 trials. This past December, the duo noted this in a press release (lightly edited):

[Today CRISPR and Vertex] announced new data on a total of 10 patients treated with the investigational CRISPR/Cas9-based gene-editing therapy, CTX001, that show a consistent and sustained response to treatment. All seven patients with transfusion-dependent beta thalassemia (TDT), including three who have either a severe or b0/b0 genotype, were transfusion independent at last follow-up and all three patients with sickle cell disease (SCD) were free of vaso-occlusive crises (VOCs) from CTX001 infusion through last follow-up.

While these are still early days, things are moving in the right direction for CTX001. In the upcoming graphic down below, Vertex highlights the substantial market opportunity for CTX001 when including the potential for international expansion and the possibility that the venture will be able to offer gentler conditioning regimes in the future. However, the therapeutic candidate still has a long way to go before getting approved by the appropriate regulators.

Image Shown: Vertex and CRISPR are targeting a substantial market opportunity with their experimental CTX001 therapeutic candidate. For the foreseeable future, the partnership is focused on treating severe forms of SCD and TDT. Longer term, future medical breakthroughs could see application of the therapeutic candidate expanded to a significantly larger patient pool by offering gentler conditioning regimes. Image Source: Vertex – January 2021 IR Presentation

Financial Overview

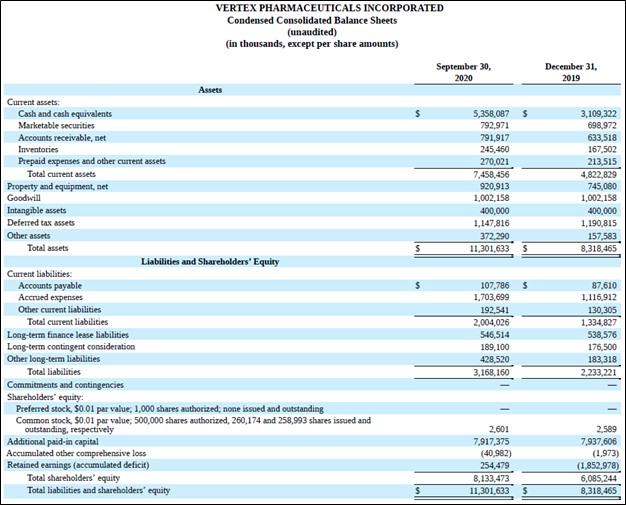

During the first nine months of 2020, Vertex’s GAAP revenues grew by roughly two-thirds while its GAAP operating income more than tripled on a year-over-year basis. When Vertex reported its third quarter earnings, management increased Vertex’s ‘total product’ revenue guidance for 2020 to $6.0-$6.2 billion from $5.7-$5.9 billion previously. In our view, Vertex’s sales and operating income growth trajectory will continue to impress going forward.

Vertex had a net cash position of ~$5.6 billion at the end of September 2020 (inclusive of long-term finance lease liabilities) with no short-term debt on the books. We are big fans of Vertex’s pristine balance sheet and please note the firm can utilize this financial firepower to bulk up its drug pipeline as needed.

Image Shown: An overview of Vertex’s pristine balance sheet. We are big fans of its net cash position. Image Source: Vertex – 10-Q SEC filing covering the third quarter of 2020

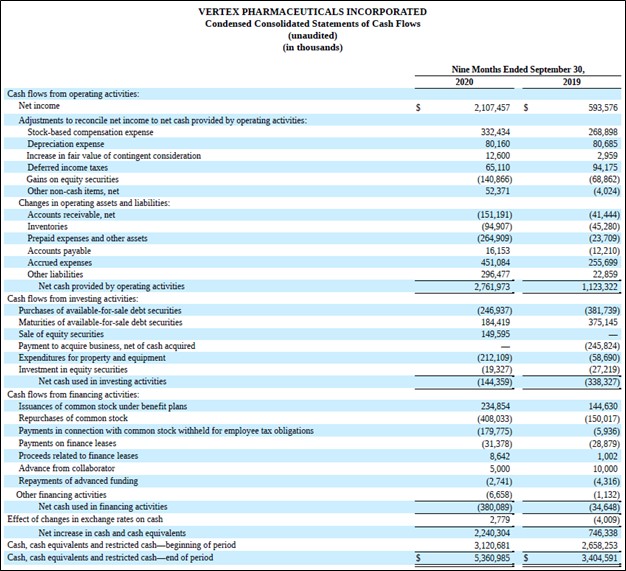

Another reason why we are big fans of Vertex is due to its stellar cash flow profile. The firm’s asset-light operations require minimal capital expenditures (relatively speaking) to maintain a certain level of revenues, which in turn supports Vertex’s ability to generate meaningful free cash flows. During the first nine months of 2020, Vertex generated over $2.5 billion in free cash flow (up from $1.1 billion in the same period in 2019) and spent $0.4 billion repurchasing its stock via its share buyback program. The company does not pay out a common dividend at this time.

Image Shown: Vertex more than doubled its free cash flows year-over-year during the first nine months of 2020. Image Source: Vertex – 10-Q SEC filing covering the third quarter of 2020

Concluding Thoughts

Vertex’s market leading position in the cystic fibrosis (‘CF’) therapeutics space underpins our expectations that its free cash flow will grow at a brisk pace going forward (supported by the potential for the company to expand into new markets and the potential to grow the application of its CF portfolio). We also like Vertex’s exposure to gene therapies via its partnership with CRISPR Therapeutics. Vertex’s existing drug pipeline is decent, and the biotech has the ability to use its net cash position to bulk up its drug pipeline even further if needed (through a strategic partnership, acquisition, purchase of drug development rights, etc.). Though we generally don’t get too excited about biotech plays given their speculative nature, difficulty in predicting the success of drugs in their pipeline, and the potential for shareholder dilution via new equity issuance, Vertex’s financial position is rock-solid, its outlook is bright, and we like having exposure to the company in the Best Ideas Newsletter portfolio.

—–

Health Care Bellwethers Industry – JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Tickerized for VRTX, CRSP, XBI, IBB, PJP, IHE, IMRA, BLUE, GBT, EDIT, REGN, ALXN, MRNA, UTHR, GILD, CATB, LIFE, CLLS, NBSE, SRPT, KYMR, DYN, CAPR, SLDB, PTCT, RNA, FULC, BMRN, SGEN, BSGM, KPTI, TEVA, INFI, TAUG, IQV, MTEM, NTLA, ARWR, PTI, AZRX, ELOX, TAK, NKTR, INCY, SAGE, CRBP, XON

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today