Image Shown: Vertex Pharmaceuticals Inc is one of our favorite biotech ideas. Image Source: Vertex Pharmaceuticals Inc – Third Quarter of 2021 IR Earnings Presentation

By Callum Turcan

One of our favorite biotech plays out there is Vertex Pharmaceuticals Inc (VRTX), which is included as an idea in the Best Ideas Newsletter portfolio. The company’s commercial portfolio, meaning therapeutics that have already been approved by key health regulators, is centered on drugs that treat cystic fibrosis (‘CF’), including patients as young as four months old as well as older patients. Its branded commercialized CF treatments include TRIKAFTA/KAFTRIO, SYMDEKO/SYMKEVI, ORKAMBI, and KALYDECO. Vertex Pharma is currently generating substantial revenue and cash flows from these offerings.

Guidance Update

Sales of its CF treatments are performing quite well, with Vertex Pharma beating both consensus top- and bottom-line estimates when it reported third-quarter 2021 earnings in early November. In its latest third-quarter 2021 earnings release, the company guided to generate $7.4-$7.5 billion in product revenues (a proxy for total sales, as the firm will occasionally generate some sales via activities such as collaboration and royalty revenues). For reference, it generated $6.2 billion in GAAP revenue in 2020 (the lion’s share of which was generated by product revenues).

Vertex Pharma has now raised its full-year guidance during both its second and third quarter earnings reports in 2021. At the midpoint of guidance, Vertex Pharma is forecasting that it will post 20% annual sales growth in 2021. During the first three quarters of 2021, Vertex Pharma generated $5.5 billion in GAAP revenues, representing 20% year-over-year growth. The firm is clearly on track to match its current guidance.

The company’s GAAP operating income came in at $1.9 billion during this period, down 10% year-over-year, though it’s important to note that this decline was entirely due to the firm recording a $0.9 billion increase in its R&D expenses relating to a deal with CRISPR Therapeutics AG (CRSP). When removing that item, Vertex Pharma’s adjusted non-GAAP operating income would have grown to $2.8 billion (up ~33% year-over-year).

Major Potential Growth Catalyst

In April 2021, Vertex Pharma agreed to pay CRISPR Therapeutics $0.9 billion with the potential for up to $0.2 billion in additional milestone payments to increase its economic interest in the potential CTX001 therapeutic. Please note that CTX001, which is “an investigational CRISPR/Cas9-based gene editing therapy that is being developed as a potentially curative therapy for sickle cell disease (‘SCD’) and transfusion-dependent beta-thalassemia (‘TDT’),” has not been approved by health regulators yet, as key clinical trials are ongoing.

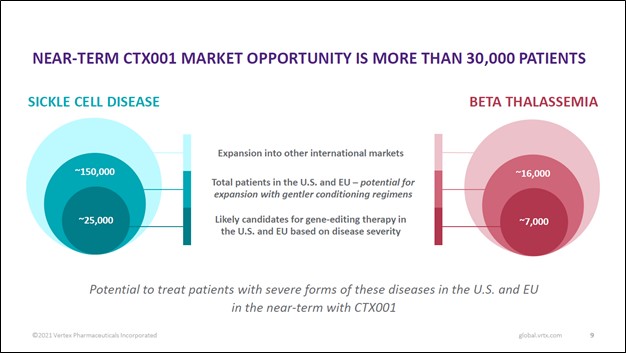

There is a large commercial opportunity here as CTX001, if it receives regulatory approval, would represent a major leap forward in the realm of therapeutics. According to Vertex Pharma, there are over 30,000 potential patients in the US and EU alone that would immediately benefit from CTX001 getting approved (those with severe cases of SCD and TDT). Under “gentler conditioning regimens,” the potential treatment’s addressable market grows to over 165,000 prospective patients in the US and EU, with room for upside via international market expansion.

Image Shown: CTX001 is targeting a large opportunity with ample room for upside as its prospective patient pool could grow in the event Vertex Pharma and CRSIPR Therapeutics offer “gentler conditioning regimens” and by expanding CTX001 into international markets, assuming the potential treatment receives regulatory approval. Image Source: Vertex Pharma – First Quarter of 2021 IR Earnings Presentation

Within its third quarter 2021 earnings press release, Vertex Pharma noted that “target enrollment has been achieved in the ongoing clinical trials in TDT and SCD to support the planned regulatory submissions in late 2022” as it concerns its CTX001 drug candidate. During Vertex Pharma’s third quarter of 2021 earnings call, management had this to say on the status of the potential CTX001 therapeutic (emphasis added):

“CTX001 is our non-viral ex vivo gene editing therapy that is designed as a one-time curative approach for sickle-cell disease and beta thalassemia. It also stands out as a clear example of how we have accelerated our pipeline in 2021. CTX001 is our most advanced programs outside of CF and continues to have strong momentum. We’ve now fully enrolled the target number of patients in both the sickle-cell disease and beta thalassemia clinical studies.

Based on the clinical data we’ve presented to-date, physician and patient interest in these trials has been high. And we have additional patients beyond the target 45 in each trial who are now completing eligibility assessments and will be enrolled this month. We anticipate closing out our regulatory discussions in the near term and submitting regulatory filings for approval of CTX001 by year-end 2022, based on these clinical results. We have high confidence that CTX001 will be our next launched medicine.” — Reshma Kewalramani, President and CEO of Vertex Pharma

Additionally, Vertex Pharma’s management team noted (emphasis added):

“We are focused on three key areas of launched preparation for CTX001. First, people. We’ve hired many of the key people who will support the launch. Second, manufacturing. This is an area we have focused on from the earliest days of our work on CTX001.

To ensure we can supply our consistent and high-quality product to the large number of patients we believe will benefit from the medicine on day 1 of the launch. Importantly, we are using the same manufacturing sites and processes for commercialization that we are using for our clinical trials.

And third, patients, making sure we really listen, understand them and their experience. So, we can provide them at launch with the information, resources and support they need as they consider treatment with CTX001.” — Stuart Arbuckle, EVP and COO of Vertex Pharma

Vertex Pharma is confident that it will be able to leverage its expertise commercializing its CF drug portfolio as it concerns bringing to market CTX001, according to recent management commentary. The company has already identified its prospective patient pool, is bulking up its sales and support staff, and is getting its manufacturing operations ready should CTX001 get the green light. We appreciate that Vertex Pharma is laying the groundwork for its, potentially, next big treatment.

Other Drug Candidates

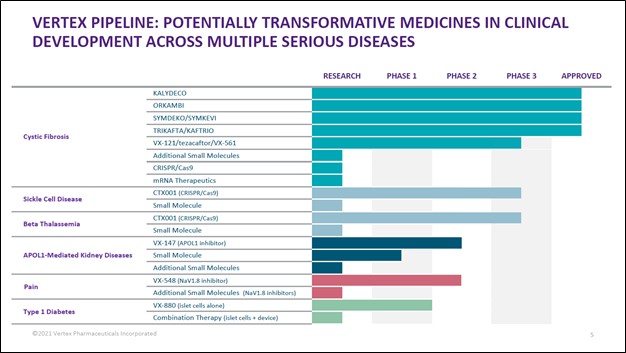

Beyond CTX001, Vertex Pharma has other drug candidates in the works. For instance, its VX-147 (treats certain kinds of kidney diseases) and VX-548 (pain management) drug candidates are undergoing Phase 2 clinical trials. In early-December 2021, Vertex Pharma reported favorable Phase 2 clinical trial data from its VX-147 drug candidate which is treating APOL1-mediated kidney disease. The company noted in a recent press release that “VX-147 was well tolerated” and that, should VX-147 prove successful, there are “more than 100,000 patients in the U.S. and Europe living with APOL1-mediated kidney disease” who could potentially benefit from this drug candidate. Additionally, the press release noted:

…[I]n a Phase 2 proof-of-concept (‘POC’) study in patients with APOL1-mediated focal segmental glomerulosclerosis (‘FSGS’), VX-147 on top of standard of care achieved a statistically significant, substantial and clinically meaningful mean reduction of 47.6% in the urine protein to creatinine ratio (‘UPCR’) at Week 13 compared to baseline. VX-147 was well tolerated. These results provide the first clinical evidence and POC that an oral small molecule APOL1 inhibitor can decrease proteinuria in patients with APOL1-mediated kidney disease. Based on these results, Vertex plans to advance VX-147 into pivotal development in APOL1-mediated kidney disease, including FSGS, in Q1 2022…

About the VX-147 Phase 2 Study

The Phase 2 open-label, single-arm study evaluated the efficacy, safety and pharmacokinetics of VX-147 in patients with APOL1-mediated FSGS. Patients with biopsy-confirmed FSGS, two APOL1 genetic variants, proteinuria defined by at least 0.7 g/g in the UPCR and an estimated glomerular filtration rate (eGFR) of at least 27 mL/min/1.73 m2 were eligible for enrollment in the study.

Patients were on a stable standard-of-care regimen, which could include an angiotensin-converting enzyme (ACE) inhibitor, an angiotensin II receptor blocker (ARB), immunosuppressants and/or low doses of corticosteroids. Patients were treated with VX-147 for a total of 13 weeks. The primary endpoint was percent change from baseline in UPCR at Week 13. The secondary endpoints were safety and pharmacokinetics. In addition, there is a 28-day safety follow-up period after the last dose of treatment and an optional off-treatment follow-up period of up to 12 weeks after the last dose of treatment. The study is ongoing for these follow-up periods.

We are monitoring events closely and appreciate Vertex Pharma’s success on this front. Pivoting here, Vertex Pharma expects to receive Phase 2 clinical trial data for its VX-548 drug candidate by the first quarter of 2022. Vertex Pharma also has additional CF treatments in the works as well, with its potential VX-121/tezacaftor/VX-561 drug combination undergoing Phase 3 clinical trials.

Image Shown: In our view, Vertex Pharma has a robust drug pipeline complemented by its existing commercialized CF drug portfolio. Image Source: Vertex Pharma – Third Quarter of 2021 IR Earnings Presentation

CRISPR Upside

Utilizing CRISPR gene editing technologies to develop innovative new therapeutics represents Vertex Pharma’s longer term goal. CTX001 and its strategic partnership with CRSIPR Therapeutics represents one such example of Vertex Pharma’s efforts on this front. Here is what this technology aims to do, from our August 2021 article Best Idea Vertex Pharma Marching Forward with Innovative CRISPR Technology (link here):

What Is CRISPR?

In short, CRISPR gene editing technology can identify a specified portion of DNA in a cell and when done properly (this is no easy task), CRISPR technology can alter that DNA, potentially replace faulty genes, and turn certain genes on and off without altering their sequence. However, this nascent technology comes with its risks.

CRISPR stands for ‘Clustered Regularly Interspaced Short Palindromic Repeats’ and is built around the Cas9 protein, with the “Cas” proteins (meaning CRISPR-associated proteins) found in bacteria. Researchers have found that by adding a guide RNA and the Cas9 protein to a cell, the guided Cas9 protein is able to identify the desired DNA sequence that the researcher aims to edit.

The gene editing process involves the Cas9 protein cutting the DNA, which introduces mutations that usually disable the gene after the cut is repaired, though this process is not necessarily as precise as researchers, patients, and the pharmaceutical industry would like. CRISPR technology can also be used to replace faulty genes, though this is much more complicated.

Other forms of the technology include CRISPRa and CRISPRi, which aim to turn certain genes on or off depending on the desired outcome. There are also currently academic efforts out there that aim to edit just one DNA letter in the DNA sequence (which a team at Harvard University are testing out). We are intrigued by this technology, though a lot of work still needs to be down before commercial opportunities arise. Vertex Pharma, though various strategic partnerships, is a leader on this front.

In October 2021, Vertex Pharma announced a new partnership with Mammoth Biosciences “to develop in vivo gene-editing therapies for two genetic diseases using Mammoth’s next-generation CRISPR systems” according to the press release. Additionally, the press release noted that:

Driven by its unique protein discovery engine, Mammoth’s CRISPR platform consists of a proprietary toolbox of novel, ultracompact Cas enzymes, including Cas14 and Casɸ. The small size of these Mammoth systems, together with further optimized parameters, have the potential to facilitate advanced delivery, which may increase the scope of in vivo gene-editing for genetic diseases…

Under the terms of the agreement, Mammoth Biosciences will receive upfront payments of $41 million, including an investment in the form of a convertible note, and is eligible to receive up to $650 million in potential future payments based upon the successful achievement of prespecified research, development and commercial milestones across two potential programs. In addition, Vertex will pay tiered royalties on future net sales on any products that may result from this collaboration.

While light on details, these are the types of deals that we like to see. This is just one of many similar types of partnerships involving CRISPR gene editing technology that Vertex Pharma is pursuing. Back in August 2021, Vertex Pharma announced a “new collaboration” with Arbor Biotechnologies that builds on their existing partnership first established back in 2018. According to the August 2021 press release:

Under this new partnership, Vertex will receive rights to use Arbor’s technology to research and develop ex vivo engineered cell therapies towards Vertex’s goal of generating fully differentiated, insulin-producing hypoimmune islet cells for the treatment of type 1 diabetes, for next-generation approaches in sickle cell disease and beta thalassemia, and for the treatment of other diseases…

Under the terms of the agreement, Arbor will receive an upfront cash payment and is eligible to receive up to $1.2 billion in potential payments based upon the successful achievement of specified research, development, regulatory and commercial milestones across up to seven potential programs. In addition, Vertex will pay tiered royalties on future net sales on any products that may result from this collaboration. Vertex will also make an investment in Arbor in the form of a convertible note.

Please note that most of these deals do not involve relatively large upfront cash payments. The largest financial component is usually the milestone payments and potential royalty payments should early stage drug candidates eventually get commercialized, which would represent a major win for both Vertex Pharma and its strategic partners. We are keeping a close eye on Vertex Pharma’s efforts in the CRISPR gene editing realm.

Financial Update

At the end of September 2021, Vertex Pharma had $7.0 billion in cash, cash equivalents, and current marketable securities on hand versus $0.6 billion in finance lease obligations on the books. The company’s $6.4 billion net cash position provides Vertex Pharma with ample financial firepower and represents a sizable chunk of the intrinsic value of the company’s equity.

During the first nine months of 2021, Vertex Pharma generated $1.5 billion in free cash flow and spent $1.1 billion buying back its common stock. Please note Vertex Pharma does not pay out a common dividend at this time.

In response to disappointing clinical trial data from VX-864 (which aimed to treat Alpha-1 Antitrypsin Deficiency, abbreviated as AATD) announced back in June 2021, a drug candidate which “will not advance into late-stage development” according to the press release, Vertex Pharma announced it had approved a $1.5 billion share buyback program later that same month (via an 8-K SEC filing) which is set to run through December 2022. Vertex Pharma has ample