|

|

Recent Articles

-

We’ve Updated Our Fair Value Estimate of Boeing; Has Aerospace Bottomed?

We’ve Updated Our Fair Value Estimate of Boeing; Has Aerospace Bottomed?

Nov 7, 2022

-

Image: Boeing is expecting to turn the corner with respect to positive free cash flow in 2022 and grow it to ~$10 billion annually by 2025/2026. We think this is achievable. Image Source: Boeing.

The breakout of COVID-19 wreaked havoc on the airline business and the commercial aircraft-making business alike. But has the commercial aerospace industry finally bottomed?

-

Shares of Lithium Producer Albemarle Are Soaring So Far In 2022

Shares of Lithium Producer Albemarle Are Soaring So Far In 2022

Nov 6, 2022

-

Image: Albemarle's shares have rocketed higher the past few years and are soaring during 2022.

We think Albemarle remains a great fit for ESG-related investment considerations, and we’re sticking with shares in the ESG Newsletter portfolio following the company’s third-quarter results, released November 2. The lithium producer remains well-positioned, and its growth rates remain fabulous in an undersupplied market. Prices for lithium can be volatile at times, but Albemarle’s financial leverage remains manageable, and the firm expects to churn out free cash flow during 2022 as it continues to invest aggressively in its business and pay out dividends to shareholders. Albemarle’s fundamental and relative share-pricing strength have been a sight to see thus far in 2022. We still like shares of Albemarle based on the high end of our fair value estimate range.

-

Life Storage Operates Within An Attractive Slice of the REIT Sector

Life Storage Operates Within An Attractive Slice of the REIT Sector

Nov 4, 2022

-

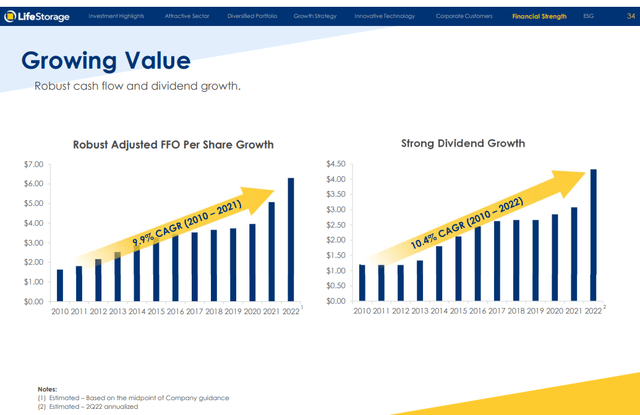

Image Source: Life Storage.

Life Storage operates in one of the most attractive areas of the REIT sector, the self-storage arena. The company has raised its dividend considerably during the past five years, and its 35-year history in the self-storage business coupled with its investment-grade credit ratings speak to sustainability. We like its diversified, coast-to-coast presence in the U.S. with roughly 60% of its owned stores positioned in the fast-growing Sun Belt states. Since 2010, Life Storage has raised its dividend at a 10.4% compound annual growth rate, and we expect further hikes to come. Shares yield ~4.2% at this time.

-

Dividend Increases/Decreases for the Week of November 4

Dividend Increases/Decreases for the Week of November 4

Nov 4, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

|