Image: Albemarle’s shares have rocketed higher the past few years and are soaring during 2022.

By Brian Nelson, CFA

On November 2, Albemarle Corp. (ALB) reported mixed third-quarter results that showed a modest miss on the top line versus consensus estimates, but a strong showing on the bottom line that beat what most analysts were looking for. Through the close of November 4, Albemarle’s shares have advanced more than 20% so far this year, and we think there may be more room to run based on the high end of our fair value estimate range ($300 per share).

For those just getting familiar with key ideas in the simulated ESG Newsletter portfolio, here is some background on Albemarle’s operations from its most recent Form 10-K:

(Albemarle is) a leading global developer, manufacturer and marketer of highly engineered specialty chemicals that are designed to meet our customers’ needs across a diverse range of end markets…Our Lithium business [~72% of revenue] develops lithium-based materials for a wide range of industries and end markets. We are a low-cost producer of one of the most diverse product portfolios of lithium derivatives in the industry…

Lithium is a key component in products and processes used in a variety of applications and industries, which include lithium batteries used in consumer electronics and electric vehicles, high performance greases, thermoplastic elastomers for car tires, rubber soles and plastic bottles, catalysts for chemical reactions, organic synthesis processes in the areas of steroid chemistry and vitamins, various life science applications, as well as intermediates in the pharmaceutical industry, among other applications…

…Our bromine and bromine-based business [~17% of revenue] includes products used in fire safety solutions and other specialty chemicals applications. Our fire safety technology enables the use of plastics in high performance, high heat applications by enhancing the flame resistant properties of these materials. End market products that benefit from our fire safety technology include plastic enclosures for consumer electronics, printed circuit boards, wire and cable products, electrical connectors, textiles and foam insulation.

…[In its Catalysts segment (~11% of revenue)], we offer a wide range of [hydroprocessing catalysts] HPC products, which are applied throughout the oil refining industry. Their application enables the upgrading of oil fractions to clean fuels and other usable oil feedstocks and products by removing sulfur, nitrogen and other impurities from the feedstock. In addition, they improve product properties by adding hydrogen and in some cases improve the performance of downstream catalysts and processes. We continuously seek to add more value to refinery operations by offering HPC products that meet our customers’ requirements for profitability and performance in the very demanding refining market.

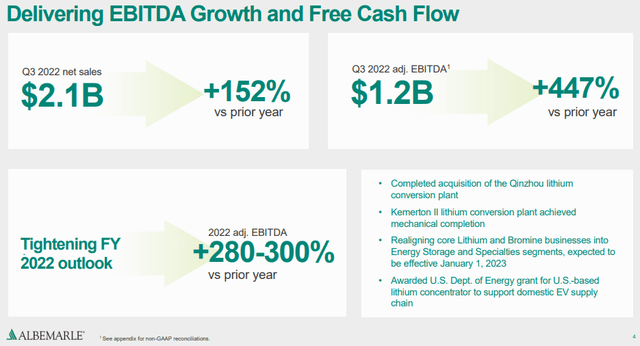

During the third quarter, Albemarle showcased revenue growth of ~152% on a year-over-year basis, while adjusted diluted earnings per share came in at $7.50, a jump of ~614% from last year. Adjusted EBITDA advanced ~447%, to $1.2 billion, and the company’s outlook remains solid. Albemarle is putting up some impressive growth rates.

Image Source: Albemarle

Albemarle tightened the guidance ranges for 2022 for net sales, adjusted EBITDA, its adjusted EBITDA margin, as well as for its adjusted diluted EPS, net cash from operations, and capital expenditures. Though Albemarle only expects to be modestly free cash flow positive in 2022, strength in its lithium end market continues to impress. Here’s what CEO Kent Masters had to say about the quarter:

We had an outstanding quarter driven by strong demand for lithium-ion batteries. As one of the world’s largest producers of lithium, we are well positioned to enable the global energy transition.With our acquisition of the Qinzhou lithium conversion plant in China and mechanical completion of our Kemerton II expansion in Australia, we are on track to more than double our lithium conversion capacity compared to last year. Our new segment structure is designed to support our ability to deliver volumetric growth in the energy storage arena as well as enable long-term growth in the lithium and bromine specialties markets.

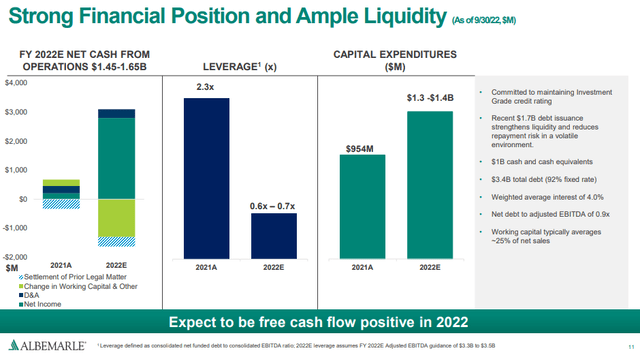

During the nine months ended September 2022, Albemarle’s cash flow from operations increased $465 million, to $955.6 million, while capital spending came in at $815.9 million, showcasing ongoing free cash flow generation throughout the year. Liquidity stood at an estimated ~$3.1 billion at the end of the third quarter of 2022 thanks to a $1.4 billion cash position and capacity on its revolver and other financing instruments. Total debt is a little bit higher than we would like, coming in at $3.4 billion, but its net debt to adjusted EBITDA is only ~0.9x, which isn’t too bad at all. Investing in growing its business and paying dividends (its dividend yield is ~0.55% at the time of this writing) remain key priorities.

Image Source: Albemarle

Albemarle Fits Well as an ESG Consideration

The growing concerns about climate change and the related increasingly stringent regulations may provide (Albemarle) with new or expanded business opportunities. We provide solutions to companies pursuing alternative fuel products and technologies (such as renewable fuels), emission control technologies (including mercury emissions), alternative transportation vehicles and energy storage technologies and other similar solutions. As demand for, and legislation mandating or incentivizing the use of, alternative fuel technologies that limit or eliminate greenhouse gas emissions increase, we continue to monitor the market and offer solutions where we have appropriate technology and believe we are well positioned to take advantage of opportunities that may arise from such demand or legislation.” – Albemarle Corp, Form 10-K

Though Albemarle faces considerable competition in the global specialty chemicals industry and lithium pricing can be volatile at times, the firm has a long runway of growth, in our view, and its recent pace of expansion is quite impressive. However, investors should be aware that, as a fast-growing entity with exciting opportunities across an undersupplied lithium space, even a slight miss relative to Street expectations could send shares of Albemarle tumbling.

Concluding Thoughts

We think Albemarle remains a great fit for ESG-related investment considerations, and we’re sticking with shares in the ESG Newsletter portfolio following the company’s third-quarter results, released November 2. The lithium producer remains well-positioned, and its growth rates remain fabulous in an undersupplied market.

Prices for lithium can be volatile at times, but Albemarle’s financial leverage remains manageable, and the firm expects to churn out free cash flow during 2022 as it continues to invest aggressively in its business and pay out dividends to shareholders. Albemarle’s fundamental and relative share-pricing strength have been a sight to see thus far in 2022.

We still like shares of Albemarle based on the high end of our fair value estimate range.

Tickerized for ALB, BHP, FCX, ANFGF, AAUKF, NGLOY, GLCNF, GLNCY, SQM, CPER, COPX, JJC, JJCTF, LIT, LAC, PLL, LTHM, TLOFF, CHPT, BLNK, WBX, ALLG, ADSE, QS, MVST, FREY, EVGO

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.