|

|

Recent Articles

-

Tesla Faces Earnings and Margin Pressure But Free Cash Flow Soars

Tesla Faces Earnings and Margin Pressure But Free Cash Flow Soars

Oct 23, 2025

-

Image Source: Tesla.

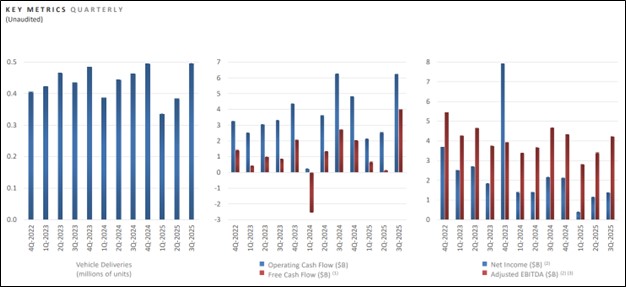

Tesla’s cash flow from operations was roughly flat year-over-year at $6.24 billion and the company slowed capital spending to $2.25 billion, resulting in free cash flow of nearly $4 billion in the quarter. Cash and cash equivalents totaled $41.65 billion at the end of the quarter versus $7.7 billion in debt and finance leases, resulting in a net cash position of nearly $34 billion. Tesla delivered 497,099 vehicles in the quarter, up 7%, buoyed by a pull-forward in demand from the expiration of the $7,500 government tax credit. Though fourth quarter results may be pressured, the company remains a net cash rich, free cash flow generating powerhouse. The high end of our fair value estimate range stands at $345 per share, however, well below where shares are currently trading.

-

AT&T Expects Strong Free Cash Flow in Coming Years

AT&T Expects Strong Free Cash Flow in Coming Years

Oct 22, 2025

-

Image Source: TradingView.

AT&T reiterated its full year 2025 financial guidance. Consolidated service revenue is targeted to grow in the low-single-digit range, while adjusted EBITDA is expected to grow 3% or better. Free cash flow is expected in the low-to-mid $16 billion range, while adjusted earnings per share is targeted in the higher end of the $1.97-$2.07 range. The company also reiterated its 2026-2027 financial outlook. Consolidated service revenue growth is expected in the low-single-digit range annually from 2026-2027, with adjusted EBITDA growth of 3% or better annually from 2026-2027. Adjusted earnings per share is expected to accelerate to double-digit percentage growth in 2027. Free cash flow is targeted at $18+ billion and $19+ billion for 2026 and 2027, respectively. We like the free cash flow growth expectations at AT&T, but its huge net debt position keeps us on the sidelines. Shares yield 4.3% at the time of this writing.

-

Netflix Reports Mixed Third Quarter Results

Netflix Reports Mixed Third Quarter Results

Oct 22, 2025

-

Image Source: Netflix.

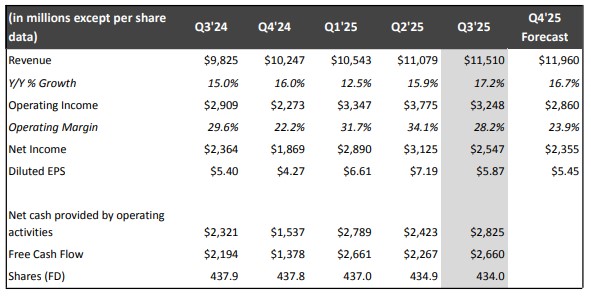

Looking to the fourth quarter, Netflix expects revenue growth of 17% (16% on a currency-neutral basis) thanks in part to growth in members, pricing, and ad revenue. The company projects an operating margin of 23.9%, representing a two percentage-point improvement year-over-year. For 2025, it expects to record $45.1 billion in revenue (16% growth, 17% on a currency-neutral basis), a level that is in line with the company’s prior expectations calling for 15%-16% revenue growth (16%-17% on a currency neutral basis). Though revenue growth remains robust, Netflix now forecasts a 2025 operating margin of 29%, which is below prior expectations calling for a 30% reported operating margin due to the impact of the Brazilian tax matter. Management expects 2025 free cash flow of roughly $9 billion (+/- a few hundred million dollars), up from its prior forecast of $8-$8.5 billion. It ended the quarter with gross debt of $14.5 billion and cash of $9.3 billion.

-

Philip Morris’ Smoke-Free Portfolio Continues to Outperform

Philip Morris’ Smoke-Free Portfolio Continues to Outperform

Oct 21, 2025

-

Image Source: Philip Morris.

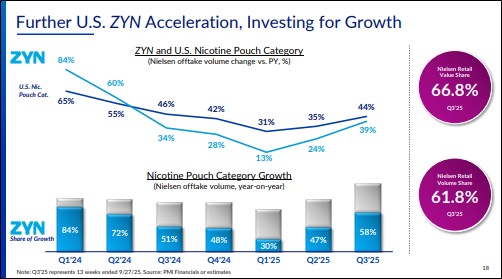

Philip Morris’ work to continue to grow its smoke-free business (SFB) is bearing fruit. Its SFB now accounts for 41% of total net revenues, up 2.9 percentage points from last year’s quarter. In the quarter, the company’s SFB experienced net revenue growth of 17.7% (13.9% organically) with gross profit increasing 19.5% (14.8% organically). We continue to like Philip Morris’ oral SFB, which increased 16.9% in pouch or pouch equivalents (20.2% in cans), fueled by nicotine pouches. In the U.S., for example, its nicotine pouch product line-up ZYN accelerated growth to 39% in the third quarter. Philip Morris recently increased its regular quarterly dividend by 8.9%, to $1.47 per share, or annualized $5.88 per share. Looking to 2025, net revenue is expected to grow 6%-8% on an organic basis and adjusted diluted earnings per share, excluding currency, is targeted in the range of $7.36-$7.46, up from $6.57 in 2024, up 12.8% year-over-year at the midpoint. Shares yield 3.7% at the time of this writing.

|