Image Source: Philip Morris

By Brian Nelson, CFA

On October 21, Philip Morris (PM) reported better than expected third quarter results with both revenue and non-GAAP earnings per share exceeding the consensus forecasts. Third quarter net revenues increased 5.9% on an organic basis, reflecting higher combustible tobacco pricing and favorable volume/mix driven by higher smoke-free products volume, offset in part by lower volumes and unfavorable mix for cigarettes. Philip Morris’ shipment volume increased 0.7% with smoke-free product (SFP) volumes up 16.6%, with all SFP categories growing strongly. Cigarette volumes declined 3.2%, with weakness in all regions. Adjusted operating income increased 7.5% on an organic basis. Adjusted diluted earnings per share grew 17.3%, to $2.24, and by 13.1% excluding currency.

Management had the following to say about the quarter:

In the third quarter, we continued to invest in the growth of our increasingly profitable smoke-free business, while achieving record quarterly smoke-free gross profit and adjusted diluted EPS.

Our global smoke-free portfolio is outgrowing the industry by a clear margin, driving positive total volumes, strong top-line growth and impressive margin expansion.

We are on track to exceed our industry-leading 2024-26 growth targets and upgrade our 2025 full-year adjusted diluted EPS forecast.

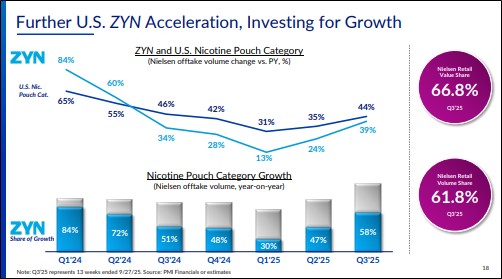

Philip Morris’ work to continue to grow its smoke-free business (SFB) is bearing fruit. Its SFB now accounts for 41% of total net revenues, up 2.9 percentage points from last year’s quarter. In the quarter, the company’s SFB experienced net revenue growth of 17.7% (13.9% organically) with gross profit increasing 19.5% (14.8% organically). We continue to like Philip Morris’ oral SFB, which increased 16.9% in pouch or pouch equivalents (20.2% in cans), fueled by nicotine pouches. In the U.S., for example, its nicotine pouch product line-up ZYN accelerated growth to 39% in the third quarter. Philip Morris recently increased its regular quarterly dividend by 8.9%, to $1.47 per share, or annualized $5.88 per share. Looking to 2025, net revenue is expected to grow 6%-8% on an organic basis and adjusted diluted earnings per share, excluding currency, is targeted in the range of $7.36-$7.46, up from $6.57 in 2024, up 12.8% year-over-year at the midpoint. Shares yield 3.7% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.