Image Source: Netflix

By Brian Nelson, CFA

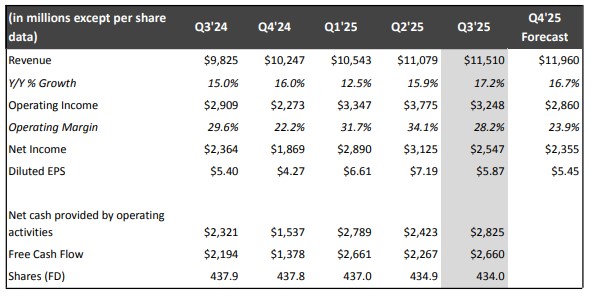

On October 21, Netflix (NFLX) reported mixed third quarter results with revenue coming in line with expectations, but GAAP earnings per share missing the consensus forecast. In the third quarter, revenue grew 17% due to membership growth, pricing adjustments and increased ad revenue, but its operating margin of 28.2% came in below guidance calling for 31.5% due to a $619 million expense related to an ongoing dispute with Brazilian tax authorities. Excluding this expense, Netflix would have exceeded its third-quarter operating margin forecast, and management noted that it doesn’t expect the matter to have a material impact on future results. Diluted earnings per share of $5.87 was better than the $5.40 mark it achieved in last year’s quarter. Cash flow from operating activities in the third quarter was $2.8 billion versus $2.3 billion in the prior-year period, while free cash flow totaled $2.7 billion, up from $2.2 billion in last year’s quarter.

Netflix emphasized that engagement remains healthy, with the firm hitting its highest quarterly view share ever in the US and UK, up 15% and 22%, respectively since the fourth quarter of 2022. In the third quarter, Netflix also recorded its best ad sales quarter ever. The company says that it is finishing the year with good momentum, with an exciting Q4 slate “including the final season of Stranger Things, new seasons of The Diplomat and Nobody Wants This, Guillermo del Toro’s Frankenstein, Kathryn Bigelow’s A HOUSE OF DYNAMITE, Rian Johnson’s Wake Up Dead Man: A Knives Out Mystery as well as more live events including NFL Christmas Day games and the Jake Paul vs. Tank Davis boxing match.”

Looking to the fourth quarter, Netflix expects revenue growth of 17% (16% on a currency-neutral basis) thanks in part to growth in members, pricing, and ad revenue. The company projects an operating margin of 23.9%, representing a two percentage-point improvement year-over-year. For 2025, it expects to record $45.1 billion in revenue (16% growth, 17% on a currency-neutral basis), a level that is in line with the company’s prior expectations calling for 15%-16% revenue growth (16%-17% on a currency neutral basis). Though revenue growth remains robust, Netflix now forecasts a 2025 operating margin of 29%, which is below prior expectations calling for a 30% reported operating margin due to the impact of the Brazilian tax matter. Management expects 2025 free cash flow of roughly $9 billion (+/- a few hundred million dollars), up from its prior forecast of $8-$8.5 billion. It ended the quarter with gross debt of $14.5 billion and cash of $9.3 billion.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.