Image Shown: A snapshot of Microsoft Corporation’s first quarter fiscal 2021 performance. We continue to be huge fans of the cash-rich tech giant. Image Source: Microsoft Corporation – First Quarter Fiscal 2021 IR PowerPoint Presentation

By Callum Turcan

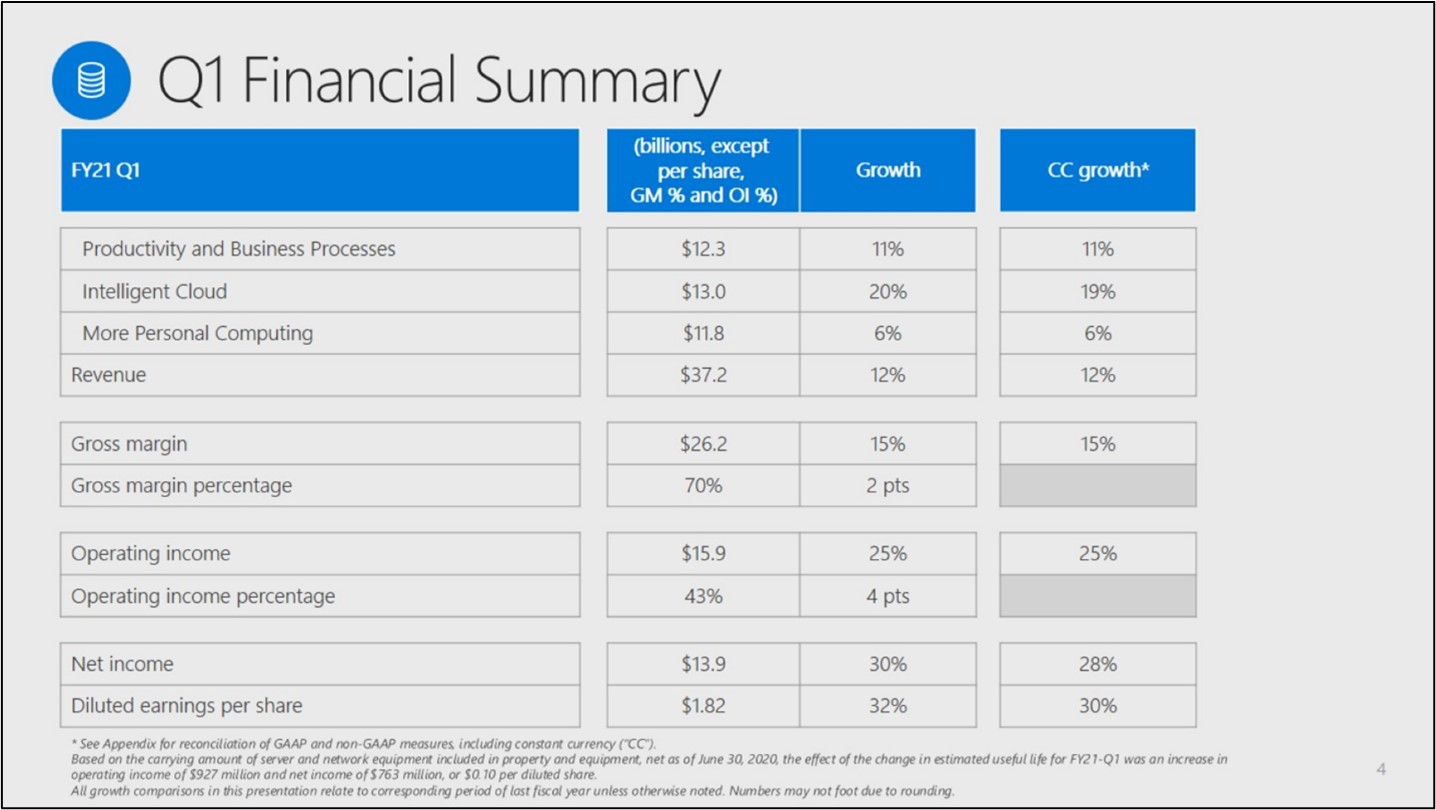

On October 27, Microsoft Corporation (MSFT) reported first quarter fiscal 2021 earnings (period ended September 30, 2020) that blew past both consensus top- and bottom-line estimates. Its GAAP revenues were up 12% year-over-year, hitting $37.2 billion, while its GAAP diluted EPS jumped 32% higher on a year-over-year basis, hitting $1.82 last fiscal quarter. Leading the charge was Microsoft’s cloud-computing Azure segment, which reported 48% year-over-year sales growth, and its Dynamics 365 segment (includes offerings that meet enterprise resource planning and customer relationship management applications needs), which reported 38% year-over-year sales growth last fiscal quarter.

Almost all of Microsoft’s various business segments reported impressive performance last fiscal quarter. Microsoft is firing on all cylinders and we continue to be huge fans of the name. We include shares of Microsoft as a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios.

Quarterly Update

The ongoing coronavirus (‘COVID-19’) pandemic has accelerated several trends in the IT industry, including the shift towards cloud-computing, productivity, cybersecurity, and big data analytics offerings. During Microsoft’s latest earnings call, management had this to say (emphasis added):

“When it comes to data, Azure brings together cloud native, limitless data and unmatched analytics. Nearly 1 million SQL databases are migrated to Azure to date, and we process more than 1.4 trillion customer queries each day. The number of petabyte scale workloads running on Azure has more than doubled year-over-year.

Azure Synapse redefines cloud analytics by bringing together enterprise data warehousing and big data analytics.With Synapse Link, customers can run real-time analytics over their operational data. They can build advanced AI models using Azure Machine Learning to identify trends and predict outcomes. And with Power BI, anyone in an organization can access these insights and build custom dashboards.” — Satya Nadella, CEO of Microsoft

Microsoft’s digital advertising business continued to face meaningful headwinds last fiscal quarter due primarily to the COVID-19 pandemic prompting businesses to scale back their advertising spend across the board, though this operation’s outlook is starting to improve according to management. The company’s ‘search advertising excluding traffic acquisition costs’ segment reported a 10% year-over-year drop in sales in the fiscal first quarter, an improvement from the 18% year-over-year drop recorded in the fourth quarter of fiscal 2020 (period ended June 30, 2020). We noted the resilience of the US digital advertising market in this article here.

Going forward, management sees this segment posting a “revenue… decline in the mid to high-single-digit range” this fiscal quarter. LinkedIn’s performance was strong last fiscal quarter, with the segment’s revenues up 16% year-over-year. Microsoft’s management team cited a recovery in its digital advertising business as part of the reason why. The ongoing recovery on this front speaks favorably as it concerns the outlook for digital advertising giants Facebook Inc (FB) and Alphabet Inc (GOOG) (GOOGL), especially given both players have significantly stronger digital advertising businesses.

The acceleration of various IT trends due to COVID-19 has also driven up demand for cybersecurity services to keep data safe as more workers than ever before started working from home. Some of Microsoft’s security-oriented offerings include Azure Active Directory, an enterprise identity service, and Microsoft Defender, an antivirus offering. Management noted “Azure AD (Active Defender) has nearly 400 million monthly active users, and we’ve seen usage of third party apps increase 2X since last year” during the firm’s latest earnings call.

Demand for Microsoft’s productivity offerings has been strong of late, with the company reporting that its ‘Office Commercial products and cloud services,’ ‘Office 365 Commercial,’ and ‘Office Consumer products and cloud services’ segments posted 9%, 21%, and 13% year-over-year sales growth last fiscal quarter, respectively. Here is what Microsoft’s management team had to say on the issue during the firm’s latest earnings call (emphasis added):

“Paid Office 365 commercial seats increased 15% year-over-year, with early momentum in free trial conversions. And we saw continued seat growth in small and medium business and first-line worker offerings, with improvement through the quarter, though again at more moderated levels. Office 365 commercial now accounts for over 70% of our existing Office Commercial paid installed base. Office Consumer revenue grew 13%, with better than expected sales of Office 2019 and accelerating growth in Microsoft 365 subscriptions, up 27% year-over-year to 45.3 million.” — Amy Hood, CFO of Microsoft

According to management, Microsoft’s telecommunications-focused Teams offering now has “more than 115 million daily active users.” We are impressed with Microsoft’s ability to integrate its various offerings to improve the experience for its customers while extending the firm’s growth runway and building upon its competitive advantages. Microsoft Teams is part of the Microsoft 365 division within the Office Commercial segment. Here is what management had to say regarding Teams from an operational viewpoint during Microsoft’s latest earnings call (emphasis added):

“Teams is the only solution with meetings, calls, chat, content collaboration, as well as business process workflows in a secure, integrated user experience. And, as companies move online, they also want one unified platform from meetings to phone systems, which Teams delivers. The key to productivity is to move beyond transactional meetings and stay in the flow of work and maintain business process context. That’s where Microsoft 365 and Teams stand out.

You collaborate on a PowerPoint presentation before a meeting and share it with participants in SharePoint. If you miss a meeting, you can access a recording via Stream and catch up via persistent chat. Action items can automatically be assigned in Lists. With Power Platform in Teams, you can build custom productivity apps using lists as the data source. And you can even connect Dynamics 365 to Teams so you can see customer information and take action.” — CEO of Microsoft

Additionally, Microsoft’s consumer-focused ‘Xbox content and services’ segment posted strong 30% year-over-year sales growth last fiscal quarter as its Xbox Game Pass subscription service now has over 15 million subscribers (according to recent management commentary). We are excited for the upcoming launch of Microsoft’s next-generation Xbox console, the Xbox Series X and the cheaper Xbox Series S, which we covered alongside Microsoft’s pending acquisition of a major video game publisher and developer in this article here. Microsoft’s ~$7.5 billion cash acquisition of ZeniMax Media, which owns Bethesda Softworks, is still expected to close during the second half of fiscal 2021.

Financial Update

Contained operating expense growth helped enable Microsoft to grow its GAAP operating income by 25% year-over-year, allowing for meaningful margin expansion (Microsoft’s GAAP operating margin grew by over 430 basis points in the fiscal first quarter versus year-ago levels). Microsoft’s ‘sales and marketing’ expenses shifted lower year-over-year while its R&D and G&A expenses moved only moderately higher year-over-year last fiscal quarter. The company also benefited from its strong cloud-computing performance, which provided a tailwind for its margin performance (assisted by an accounting change highlighted in the upcoming quote) as noted by management during Microsoft’s latest earnings call (emphasis added):

“Commercial cloud revenue grew 31% to $15.2 billion. And commercial cloud gross margin percentage expanded 5 points year-over-year to 71%, driven by the change in accounting estimate for the useful life of server and network equipment assets discussed in our July earnings call. Excluding this impact, commercial cloud gross margin percentage was up slightly, despite revenue mix shift to Azure and increased usage to support our customers’ remote work scenarios.” — CFO of Microsoft

As of September 30, Microsoft had $138.0 billion in cash, cash equivalents, and short-term investments on hand. Please note this does not include Microsoft’s $3.1 billion long-term equity investment position at the end of the fiscal first quarter. The firm had $6.5 billion in short-term debt and $57.1 billion in long-term debt as of September 30, which provided for a $74.4 billion net cash position.

Microsoft continued to be a free cash flow cow, generating $19.3 billion in net operating cash flow while spending $4.9 billion on capital expenditures in the fiscal first quarter, allowing for $14.4 billion in free cash flow. The company spent $3.9 billion covering its dividend obligations and $6.7 billion repurchasing its stock last fiscal quarter, activities that were fully covered by its free cash flows.

Considering our fair value estimate for MSFT sits at $216 per share (under our “base case” scenario) and the top end of our fair value estimate range sits at $259 per share of Microsoft (under our “bull case” scenario), we view share repurchases as a good use of Microsoft’s capital. The company’s enormous net cash position provides Microsoft with an immense amount of strength during these turbulent times. Microsoft’s dividend growth trajectory remains quite promising and the company recently boosted its quarterly payout as we covered in this article here. Shares of MSFT now yield ~1.1% on a forward-looking basis, as of this writing, after that payout increase.

Concluding Thoughts

We continue to be huge fans of Microsoft and its latest earnings report reinforces our thesis. Though Microsoft’s fiscal second quarter guidance was not as strong as some expected, management communicated that all three of the firm’s core businesses (‘Productivity and Business Processes,’ ‘Intelligent Cloud,’ and ‘More Personal Computing’) were expected to post sequential revenue growth this fiscal quarter. Microsoft remains a net cash-rich free cash flow cow with a very promising growth outlook, which is why we like shares of Microsoft as a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios.

—–

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: FB, GOOG, GOOGL, SPY, QQQ, SCHG, IVV, VOO, XLK, IYW, VGT, FTEC, IXN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Microsoft Corporation (MSFT) is included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.