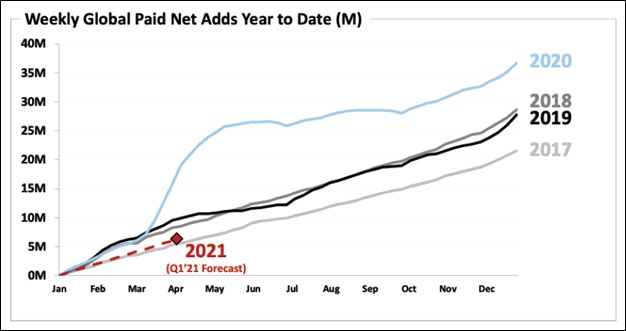

Image Shown: Netflix Inc’s global paid subscriber base is expected to keep growing at a decent clip going forward, though at a slower pace than in the recent past. Image Source: Netflix Inc – Shareholder Letter covering its fourth quarter and full-year earnings in 2020

By Callum Turcan

The proliferation of video streaming services during the past decade accelerated in 2020 due to the coronavirus (‘COVID-19’) pandemic forcing households to stay indoors, which in turn drove up demand for economical forms of at-home entertainment. During the early days of the video streaming services industry, subscriber growth was driven largely by the “cord cutting” trend in which households traded out more expensive cable/satellite TV packages (sometimes referred to as “premium” TV packages) for cheaper options that could be cancelled at any time. Lower monthly bills and greater flexibility were a big selling point, especially in the wake of the Great Financial Crisis (‘GFC’). That trend will likely continue going forward, but ultimately, it is the original content on these video streaming services that underpins the value proposition for consumers.

The Proliferation of Streaming Rests on Original Content

In the early days, companies such as Netflix Inc (NFLX) and Hulu licensed vast amounts of third-party content to build compelling libraries, though as the proliferation of video streaming services continued, licensing costs for third-party content surged. This prompted companies with forward-thinking management teams, such as Netflix, to realize that “content is king” so these entities started allocating enormous sums towards developing their own original content.

Netflix borrowed extensively to fund its growth ambitions as the company steadily built a portfolio of original content for its domestic audience. When Netflix started pushing more aggressively into overseas markets, its original content spending levels continued to move higher as it began to place a greater emphasis on developing local content to be more competitive in international markets.

When Hulu was first created and launched over a decade ago, the firm was then-owned by a consortium of large entertainment and media giants, which arguably limited its operational focus. Ownership consolidation in recent years supports Hulu’s outlook.

Given the explosive growth Netflix experienced, and the highly scalable nature of the video streaming service business model, many other firms now want a piece of the growing pie. Our favorite video streaming play is Walt Disney Company (DIS) and we include DIS in our Best Ideas Newsletter portfolio, “Best Ideas Newsletter Portfolio Holding Disney Surges to All-Time Highs.”

Disney May Be the One to Beat

Disney’s slate of video streaming services, such as Disney+, Hulu, and ESPN+ (additional services are on the way), have performed incredibly well of late in terms of net paid subscriber growth (something we covered in detail here). After Disney acquired 21st Century Fox in 2019, the same year AT&T Inc (T) sold its 10% equity stake in Hulu back to the firm, Disney’s stake in Hulu grew to 67%.

Disney now has complete operational control of Hulu and the option to acquire the remaining stake, owned by Comcast Corporation (CMCSA), as early as calendar year 2024 (we covered this here). Hulu has built up a sizable portfolio of original content and Disney intends to aggressively ramp up spending on this front. As of early-December 2020, Disney had over 137 million subscriptions across those three services, with the goal to grow that to 300 million – 350 million subscriptions by fiscal 2024.

In our view, Disney’s success is largely due to the expansive nature of its vast content portfolio and the popularity of its original content. The company’s flagship TV show for its Disney+ service, The Mandalorian, highlighted Disney’s ability to leverage its Star Wars property to generate excitement and ultimately subscriber growth at its video streaming offerings. Bundling Disney+, Hulu, and ESPN+ further enhanced the value proposition of its various services. The Disney+ service launched in November 2019, and a little more than a year later the service had almost 87 million subscribers (this figure appears to be paying subscribers), an impressive feat.

The video streaming services industry has become incredibly competitive. Comcast, which owns NBCUniversal (along with the Hulu stake), launched its Peacock service last year and AT&T, which owns Time Warner, also launched its HBO Max service last year. Discovery Inc (DISCA) just recently launched its Discovery+ service while ViacomCBS Inc (VIAC) is getting ready to launch its Paramount+ service, which is largely a rebranding of its CBS All Access service. ViacomCBS also owns the Pluto TV video streaming service.

Not to be confused with 21st Century Fox, Fox Corp (FOX) recently acquired video streaming service Tubi for about $440 million in net cash considerations and the deal was largely funded by Fox selling off its position in Roku Inc (ROKU). This deal gives Fox a video streaming platform to build off that it previously did not have. As an aside, Roku recently acquired the global rights to the content portfolio of the now defunct Quibi service. Roku’s TV platform allows consumers to access other video streaming service, and now the firm will also have its own content library. We see room for a number of winners in this space and original content will be the key differentiator, in our view.

Netflix’s Latest Earnings

On January 19, Netflix released fourth quarter and full-year earnings for 2020. The company’s global paid subscriber base stood near 204 million as of the fourth quarter, which was up 22% year-over-year as the firm saw its net paying subscriber base grow by roughly 67 million last year. Netflix generated $2.4 billion in positive net operating cash flow in 2020, a complete reversal from the $2.9 billion in negative net operating cash flow Netflix generated in 2019. In 2020, Netflix generated about $1.9 billion in free cash flows, though we will caution that its original content spending levels slowed last year due to production delays caused by the pandemic.

Netflix is finally at an inflection point. During its latest earnings conference call management had this to say in response to an analyst’s question (emphasis added):

“To the point of our capital allocation approach, the philosophy remains unchanged, which is that we’re going to be disciplined stewards of the capital and try to do things that we believe are value maximizing for our shareholders. But we have turned this corner where now we can, as we talked about, with $8 billion of cash on the balance sheet, projecting to be cash flow about breakeven in 2021 and then positive thereafter, we want to return excess cash to our shareholders.

So we won’t build up a bunch of excess cash. We’ll maintain, as you say about — we said in the letter, as you mentioned, about $10 billion to $15 billion of gross debt on the balance sheet. And that’s really just to maintain familiarity and access to the debt markets should we need it, but there’s really not a whole lot of science beyond that. And then beyond that, as we say, we put a premium on balance sheet flexibility, so we’re going to continue to invest aggressively into the growth opportunities that we see. And that’s always going to come first. But beyond that, if we have excess cash, we’ll return it to shareholders through a share buyback program.” — Spencer Neumann, CFO of Netflix

At the end of 2020, Netflix had $8.2 billion in cash and cash equivalents on hand versus $0.5 billion in short-term debt and $15.9 billion in long-term debt. The company also has significant long-term liabilities related to production commitments, but news regarding positive free-cash-flow targets in the near term is encouraging.

Management appears incredibly confident that Netflix will be able to maintain its strong cash flow generating abilities going forward, aided by price increases and net paid subscriber growth, which in turn are made possible through the attractive nature of Netflix’s offerings (meaning its original content and broader content portfolio is attractive enough that consumers are willing to pay marginally more per month to continue accessing that content). ‘Economies of scale’ is key here.

In the first quarter of 2021, Netflix forecasts it will add roughly 6 million in net paying global subscribers to its operations on a sequential basis while its revenues and operating income are expected to jump sequentially as well. Though its growth rate is expected to slow down from levels seen in 2020, we appreciate that Netflix still expects its net paid subscriber base to keep growing going forward.

Shares of Netflix jumped higher by double-digits during normal trading hours January 20, though there is room for NFLX’s shares to continue to climb as the top end of our fair value estimate range sits at $659 per share (the stock is trading ~$570 at the time of this writing). As it relates to the potential for share buybacks that management alluded to, that may be Netflix’s way of communicating that, within the next few years, growth in its original content spend will moderate.

Controlled original content spend (relatively to its expected net operating cash flow growth) combined with economies of scale should allow Netflix to become incredibly free cash flow positive in the coming years. The upcoming graphic down below highlights our free cash flow growth forecasts for Netflix going forward, derived through our enterprise cash flow model.

Image Shown: The grey line represents our “base” case scenario while the green dots represent our “bear” case scenario, and the blue dots represent our “bull” case scenario used within our enterprise cash flow models covering Netflix. We forecast that Netflix will become a free cash flow cow over the coming years.

Concluding Thoughts

The video streaming services industry will continue to experience strong subscriber growth in 2021, and we see room for a number of winners in the space. Original content and scale are essential to remaining relevant, and competitive headwinds are growing as companies seek to replicate the success of Netflix.

We think Netflix will eventually turn into a free-cash-flow generating machine, but at the moment, we’re big fans of “new” streaming rival Disney and include the latter in the Best Ideas Newsletter portfolio. Disney is the top competitive threat to Netflix, in our view.

—

Now Read: Best Ideas Newsletter Portfolio Holding Disney Surges to All-Time Highs

We continue to be big fans of The Walt Disney Company and include shares of DIS in the Best Ideas Newsletter portfolio. Back when Disney’s stock price plummeted this past March, we stuck with our capital appreciation thesis and did not panic. Since then, shares of DIS have staged an impressive comeback and are currently trading near all-time highs. Shares of Disney are up ~22% year-to-date as of this writing, significantly outperforming the S&P 500 (SPY) which is up ~14% during this period (before taking dividend considerations into account, which does not change this picture much). Our optimistic view towards Disney is underpinned by the company’s bright long-term growth outlook. Though it will take a few years for Disney’s video streaming business to become a profit generating machine, the market is clearly excited about how this segment could potentially drive Disney’s future free cash flows meaningful higher over the long haul. The high end of our updated fair value estimate range is $184 per share.

Downloads

Netflix’s 16-page Stock Report >>

Disney’s 16-page Stock Report >>

—-

Telecom Services Industry – CMCSA, LUMN, DISH, T, TMUS, VZ, SBAC, AMT, CCI, VIAC

Related: NFLX, DIS, DISCA, ROKU, FOX, FOXA, FUBO

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Walt Disney Company (DIS) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. AT&T Inc (T) and Crown Castle International Corp (CCI) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.