Image Shown: The reach of the Disney+ video streaming service continues to grow as The Walt Disney Company keeps expanding the service into new markets. Image Source: The Walt Disney Company – December 2020 Investor Day Presentation

By Callum Turcan

We continue to be big fans of The Walt Disney Company (DIS) and include shares of DIS in the Best Ideas Newsletter portfolio. Back when Disney’s stock price plummeted this past March, we stuck with our capital appreciation thesis and did not panic. Since then, shares of DIS have staged an impressive comeback and are currently trading near all-time highs. Shares of Disney are up ~22% year-to-date as of this writing, significantly outperforming the S&P 500 (SPY) which is up ~14% during this period (before taking dividend considerations into account, which does not change this picture much). Our optimistic view towards Disney is underpinned by the company’s bright long-term growth outlook.

Disney has effectively suspended its dividend program (for the time being) after forgoing two of its semi-annual dividends in a row (I, II). Given that Disney is included in the Best Ideas Newsletter portfolio (which targets long-term capital appreciation potential and not in the Dividend Growth Newsletter portfolio, which targets long-term dividend growth potential), we are fine with this strategy (for now). Management is redirecting capital that would have gone to the dividend toward investing in original content to support its video streaming growth trajectory, which has been nothing short of fantastic. Here is what Disney’s management team had to say on the matter during the firm’s fourth quarter of fiscal 2020 earnings call (emphasis added):

“As we’ve discussed on prior calls, while our liquidity position remains strong, we are continuing to manage our leverage with a long-term commitment to return to levels consistent with a single A credit rating. As part of that commitment and given limited visibility due to COVID and our decision to prioritize investment in our DTC [direct-to-consumer] initiatives, the Board has decided to forego payment of a semi-annual dividend in January 2021.

Our capital allocation strategy will continue to prioritize investing in the growth of our businesses, particularly in the direct-to-consumer space. However, we anticipate the payment of a dividend will remain a part of our long-term capital allocation strategy following the return to a normalized operating environment.” — Christine McCarthy, Senior Executive Vice President and CFO of Disney

On December 10, Disney held a large Investor Day presentation and significantly increased its subscriber growth outlook for its various video streaming services. Before going into Disney’s recent guidance update, we will provide some background information on the company’s video streaming progress so far.

Background Information

After acquiring 21st Century Fox in March 2019 for approximately $71 billion through a cash-and-stock deal, Disney’s content portfolio became enormous. Since then, Disney has proven that it has the expertise to leverage that vast portfolio to create another juggernaut in the video streaming space, one that could potentially rival Netflix Inc (NFLX) in a couple of years. At the end of the third quarter of 2020, Netflix had 195.15 million paid streaming memberships on a global basis. Netflix remains far ahead of the competition when it comes to original and local language content, though Disney is catching up.

By the end of Disney’s fiscal 2020 (period ended October 3, 2020), the firm had 120.6 million paid subscribers in total across its Disney+, EPSN+, and Hulu services. Management was happy to report that by early December, that had grown to over 137.0 million paid subscriptions. For reference, Disney owns 80% of EPSN and 67% of Hulu as we have covered in the past (link here). Additionally, Disney owns 75% of BAMTech that operates EPSN+ and it also owns the Hotstar service (through Disney’s Star subsidiary).

Disney launched the Disney+ service in November 2019 in the US, Canada, and the Netherlands. Since then, the company has steadily expanded that service into additional markets. In India, Disney launched the Disney+ Hotstar service in April 2020 and so far, subscriber growth has been explosive. For reference, ESPN+ was launched back in April 2018 and Hulu launched to the general public back in March 2008.

Video Streaming Service Subscriber Growth Targets Raised Significantly

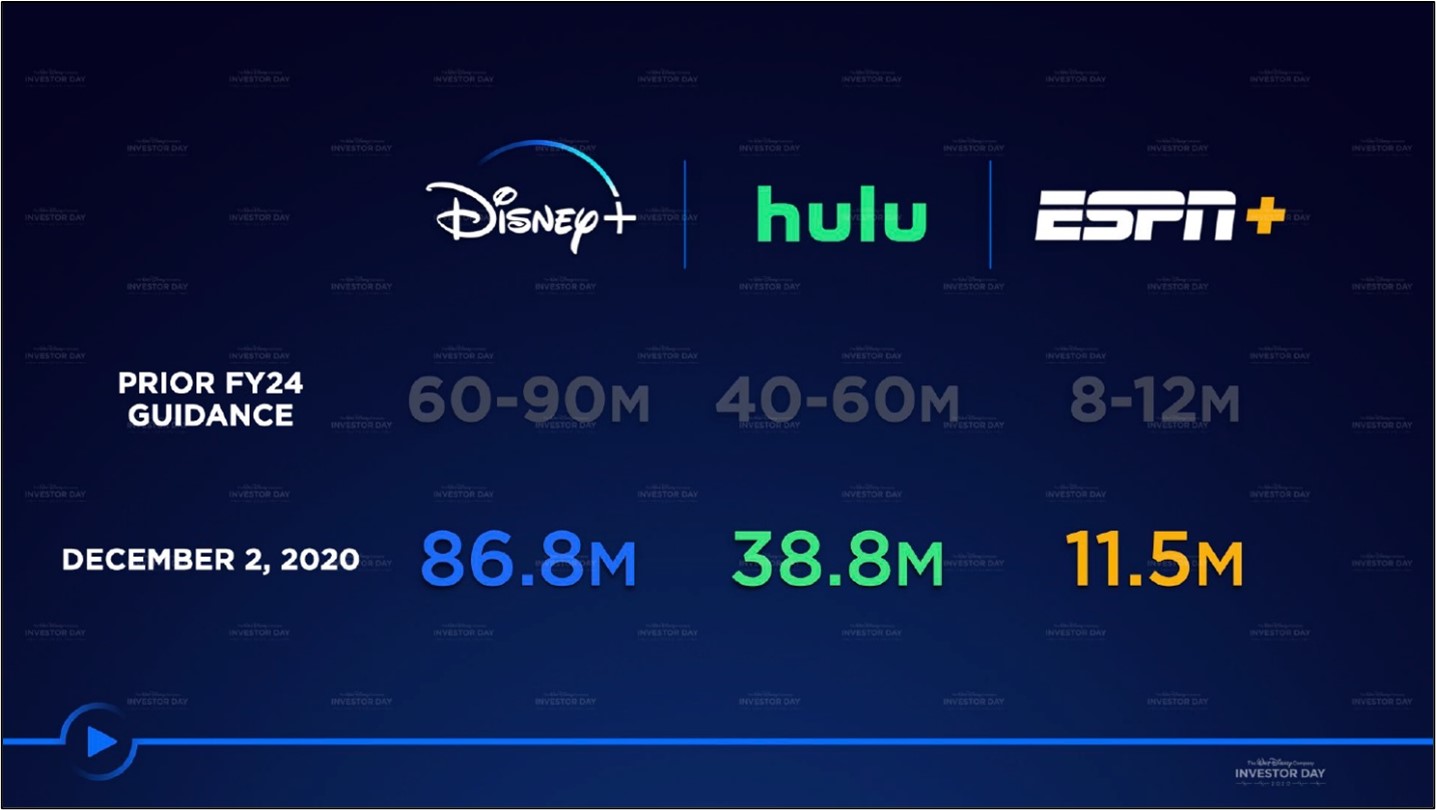

In the upcoming graphic down below, Disney provides an overview of its subscriber base as of December 2 in relation to where the firm’s previous guidance estimated its subscriber base would be in fiscal 2024 (four years from now). As you can see, Disney is running years ahead of schedule, and the market is very pleased. Note that Disney experienced strong subscriber growth across the board from October 3 to December 2 (Disney+ added over 13 million net subscribers, EPSN+ added over 1 million net subscribers, and Hulu added over 2 million net subscribers) as mentioned previously.

Image Shown: A look at Disney’s video streaming subscriber base as of early-December 2020. The company is well on its way to exceeding its prior guidance for fiscal 2024 as it concerns its forecasted subscriber base growth. Image Source: Disney – December 2020 Investor Day Presentation

According to Rebecca Campbell, who oversees the firm’s ‘International Operations and Direct-to-Consumer’ segment which includes its video streaming operations, about 30% of Disney+’s subscriber base comes from the Disney+ Hotstar service. This video streaming service is primarily focused on India, though Disney+ Hotstar recently expanded into Indonesia and in Singapore, Disney recently launched its Hotstar service decoupled from its Disney+ service. Disney’s vast content library appears to be popular in markets worldwide, and the firm intends to aggressively step up investments in this space.

Looking ahead, Disney now expects its Disney+ subscriber base will grow to 230-260 million by the end of fiscal 2024, with 30-40% of those subscribers coming from its Disney+ Hotstar service. This represented a major increase from its prior guidance. Additionally, Disney now expects its EPSN+ subscriber base will grow to 20-30 million and that Hulu’s subscriber base will grow to 50-60 million by the end of fiscal 2024. The EPSN+ subscriber guidance revision was significantly higher than previously expected while the Hulu subscriber guidance update saw the bottom end of its range raised significantly while the top end remained the same. Putting this together, Disney expects its global subscriber base will stand at 300-350 million by the end of fiscal 2024, which is why we view Disney as one of Netflix’s biggest competitive threats.

Image Shown: Disney’s updated video streaming subscriber guidance calls for impressive growth over the next few fiscal years, highlighting one of the reasons why we are big fans of the name. Image Source: Disney – December 2020 Investor Day Presentation

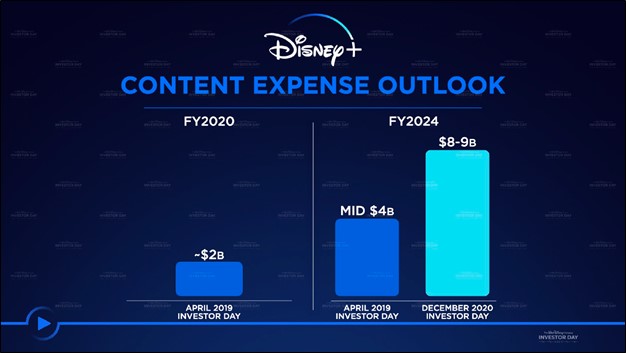

Ramping Up Original Content Investments

Disney expects to steadily ramp its original content spend going forward, and for that reason, it does not expect to turn an operating profit from its video streaming business for at least a few fiscal years. The Disney+ service is expected to experience peak operating losses from fiscal 2020-2022 before reaching profitability in fiscal 2024. Its EPSN+ service and Hulu are both expected to generate positive operating profits by fiscal 2023. By fiscal 2024, Disney expects to spend $14.0-$16.0 billion on its global direct-to-consumer content expense, with half or more of that going towards its Disney+ service.

Image Shown: Disney plans to aggressively ramp up investments in original content for its Disney+ service. Image Source: Disney – December 2020 Investor Day Presentation

Price increases will help offset some of these headwinds. Certain Hulu packages have seen significant price increases recently, and that has not stopped the service from growing its subscriber base. Management also intends to moderately boost the price of Disney+ in March 2021 and the Disney+/ESPN+/Hulu bundle will also see a moderate price increase. Netflix has had success pushing through price increases in the past while maintaining its ability to grow its subscriber base, and we expect Disney will be able to do so, too.

These large original content investments are required for Disney to maintain the interest of its subscriber base. As expected, Disney intends to make the most of its Star Wars property by launching new movies and most importantly, numerous new TV shows over the coming years. The Mandalorian was the flagship TV show for its Disney+ service, and this offering has proven to be a big winner with the firm’s subscriber base. Disney intends to launch two spinoffs of The Mandalorian on its Disney+ service called Rangers of the New Republic and Ahsoka, and in our view, these TV shows will likely prove to be quite popular. Disney also has big plans for its Pixar and Marvel Studios units as well as it concerns bulking up the original content on its various video streaming services. On a final note, Disney has at times opted to send its movies straight to its Disney+ service, sometimes for free and sometimes for an additional fee.

Another key consideration is the upcoming launch of its new Star and Star+ video streaming services that will focus on general content and live sports. In February 2021, the Star service will launch in several markets including those in Europe, Australia, New Zealand, Canada, and Singapore. A few months later in June 2021, the Star+ service will launch in Latin America. These new video streaming services offers additional upside for Disney and highlights how the firm is targeting extensive growth overseas.

Image Shown: Disney plans to launch its new video streaming service, Star, in February 2021 in select markets with plans expand the service into additional markets going forward. Image Source: Disney – December 2020 Investor Day Presentation

Image Shown: Disney plans to launch its upcoming Star+ service in Latin America in June 2021. Image Source: Disney – December 2020 Investor Day Presentation

Concluding Thoughts

Shares of Disney surged higher by almost 14% December 11 during normal trading hours as investors were clearly impressed with the firm’s long-term growth strategy. Disney’s stock price is currently trading near their all-time highs, and we see room for additional upside. Though it will take a few years for Disney’s video streaming business to become a profit generating machine, the market is clearly excited about how this segment could potentially drive Disney’s future free cash flows meaningful higher over the long haul. We continue to be big fans of Disney and in our view, this company is one of the best video streaming companies out there. The high end of our updated fair value estimate range is $184 per share.

Disney’s 16-page Stock Report >>

—–

Also tickerized for CMCSA, CTL, DISH, ROKU, TMUS, VZ, FOX, FOXA, SBGI, OMC, VIAC, VIACA, AMCX, DISCA, IPG, FUN, SIX, SEAS, LUMN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Walt Disney Company (DIS) are is included in Valuentum’s simulated Best Ideas Newsletter portfolio. AT&T Inc (T) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.