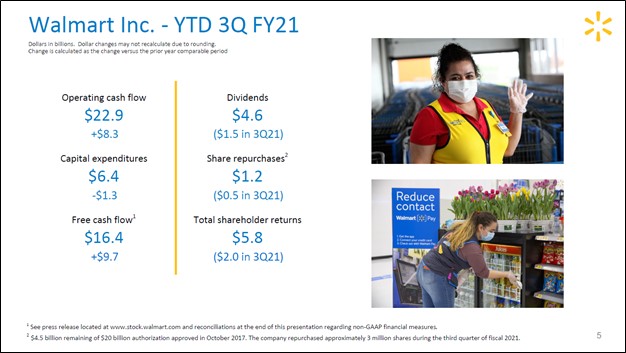

Image Shown: Walmart Inc continues to distribute its free cash flows back to shareholders via dividends and share repurchases. The retailing giant’s management team has a long track record of being shareholders friendly. However, we still view shares of WMT as generously valued as of this writing, given that the top end of our fair value estimate range sits at $133 per share though WMT is currently trading closer to ~$150 per share. Image Source: Walmart Inc – Third Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

On November 17, Walmart Inc (WMT) reported third quarter earnings for fiscal 2021 (period ended October 31, 2020) that beat consensus estimates on both the top- and bottom-lines. As we have noted in the past, the key driver behind Walmart’s financial outperformance of late has been its e-commerce operations. Whether that be to support home delivery services or curbside pick-up options, Walmart’s past digital investments better allowed the retailing giant to meet surging demand for consumer staples and other products in the wake of the ongoing coronavirus (‘COVID-19’) pandemic.

The top end of our fair value estimate range sits at $133 per share of WMT, indicating Walmart is generously valued as of this writing as its shares are currently trading near $150. However, we still view Walmart’s business model as stellar and its cash flow profile as impressive. During the first nine months of fiscal 2021, Walmart generated over $16.4 billion in free cash flow. The firm spent $4.6 billion covering its dividend obligations and another $1.2 billion buying back its stock during this period, and both of these activities were fully covered by Walmart’s free cash flows and then some. Shares of WMT yield ~1.4% as of this writing.

Quarterly Update

Walmart US posted 6.4% year-over-year comparable sales growth last fiscal quarter as this business operating segment’s e-commerce sales surged higher by 79% year-over-year (which was responsible for 540 basis points of the Walmart US division’s comparable sales growth). Its Sam’s Club business operating segment posted 11.1% year-over-year comparable sales growth, even after factoring in headwinds from a change in its tobacco sales policy (raising the minimum buying age to 21 in the US, which went into effect last calendar year). Like at Walmart US, its Sam’s Club’s comparable sales growth was heavily assisted by a 49% year-over-year increase in this segment’s e-commerce sales.

Beyond its strong domestic showing, Walmart’s overseas operations also performed well last fiscal quarter. Walmart International posted modest 1.3% year-over-year sales growth in the fiscal third quarter, though foreign currency headwinds were big here (on a constant-currency basis, Walmart International posted 5.0% year-over-year sales growth). This business operating segment’s operating income rose by 70% year-over-year last fiscal quarter, hitting $1.1 billion (up 79% on a constant-currency basis). Walmart posted $1.80 in GAAP diluted EPS in the fiscal third quarter, up just under 57% year-over-year, aided by a marginal reduction in its weighted-average outstanding diluted share count.

The outperformance at these three segments culminated into Walmart’s (company-wide) GAAP revenues growing by over 5% year-over-year last fiscal quarter. Rising economies of scale, managed operating expense growth, and improvement in the economies of its e-commerce business saw Walmart’s GAAP operating income rise by over 22% year-over-year last fiscal quarter. On the merchandising front (removing ‘membership and other income’ from the picture), Walmart’s GAAP gross margin grew moderately in the fiscal third quarter, up ~50 basis points year-over-year. We appreciate Walmart’s strong top-line growth and expanding margins of late.

Operational Update

Please note that Walmart launched Walmart+ this past September in the US, which offers free home delivery services and fuel discounts through a program that costs $98 per year or $12.95 per month (with the annual subscription offering consumers a modest pricing discount). Here is some key commentary from Walmart’s management team during the firm’s latest earnings call (emphasis added):

“Walmart U.S. had another strong quarter. Comp sales increased 6.4% and we significantly reduced operating losses in eCommerce. Consistent with the second quarter, we saw customers consolidate shopping trips with larger baskets and fewer transactions. Comp sales accelerated from the beginning of the quarter, helped by food, consumables, and health and wellness. eCommerce grew 79%. Growth was strong in pickup and delivery as well as direct-to-home with the highest growth coming from marketplace.

We also launched Walmart+, and we’re excited to have that important piece of the puzzle in place. We launched it with an initial set of benefits that we know are important to our customers. Over time, we’ll evaluate the program against our broader set of assets with the aim of improving the value proposition and deepening our relationship with customers, including earning a greater share of wallet.

Our merchant and replenishment teams are working hard to ensure we have products available for our customers. In-stock levels have improved from Q2, but we’re still below where we want to be. The team is being flexible when it comes to meeting demand. For example, we’ve turned on nearly 2,500 stores to fulfill online orders. We can quickly flex this number as the holiday season progresses, to help relieve pressure on our eCommerce fulfillment centers, if necessary. This holiday season will obviously be unique.” — Doug McMillon, CEO and President of Walmart

As Walmart scales its e-commerce business, its margins will likely continue to move in the right direction. It appears Walmart is contemplating adding new perks/services to its Walmart+ program, just as Amazon Inc (AMZN) has over the years with its Amazon Prime service. We are extremely interested to see how well Walmart+ performs going forward. On a final note here, it appears Walmart is getting a better handle on managing its inventory and supply chain in the face of hurdles created by the COVID-19 pandemic according to recent management commentary. Making sure its stores are well stocked during the holiday shopping season will be crucial.

Downside Considerations

In our view, Walmart’s biggest downside is its large debt load. When including finance lease obligations, Walmart’s total debt-like burden stood at ~$50.8 billion at the end of October 2020 (inclusive of short-term debt and both current and non-current finance lease obligations) versus a cash and cash equivalents balance of $14.3 billion. Given Walmart’s impressive free cash flow generating abilities and ample cash on hand, we view that net debt burden as manageable, though we caution the company also has significant operating lease liabilities as well ($17.7 billion at the end of October 2020 on both a current and non-current basis).

Another important downside consideration is how the simmering US-China trade war will play out, particularly as it relates to US tariffs on Chinese imports. Walmart’s ability to push through price increases will be tested by the hypercompetitive nature of the retailing business in the US and any potential price increases could be hindered by elevated unemployment rates due to the COVID-19 pandemic. That said, Walmart has done a solid job growing its margins of late, and its focus on growing its subscription/membership revenues going forward could help offset any new headwinds that arise here.

Concluding Thoughts

On both an operational and financial basis, Walmart is doing quite well. The company remains a free cash flow generating machine, though we caution that its balance sheet needs to be monitored going forward. With this in mind, shares of Walmart appear to be generously valued as of this writing given that demand for most consumer staples products will likely start to moderate out over the coming quarters, save for cleaning and hygiene products (which will likely continue to experience elevated demand for some time due to structural changes brought on by the pandemic). We are keeping an eye on Walmart, though in our view, we think the capital the firm has deployed to buy back its stock would have been better spent paring down its large debt-like burden.

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM

Health Care Bellwethers Industry – JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Recession Resistant Industry – BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT

Tickerized for BJ, COST, TGT, AMZN, DG, DLTR, KR, GO, SFM, ACI, IMKTA, WMK

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and Health Care Select Sector SPDR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Dollar General Corporation (DG) and The Walt Disney Company (DIS) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Philip Morris International Inc (PM) and Vanguard Consumer Staples ETF (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.