Member LoginDividend CushionValue Trap |

Visa Is a Great Company

publication date: Dec 8, 2020

|

author/source: Callum Turcan

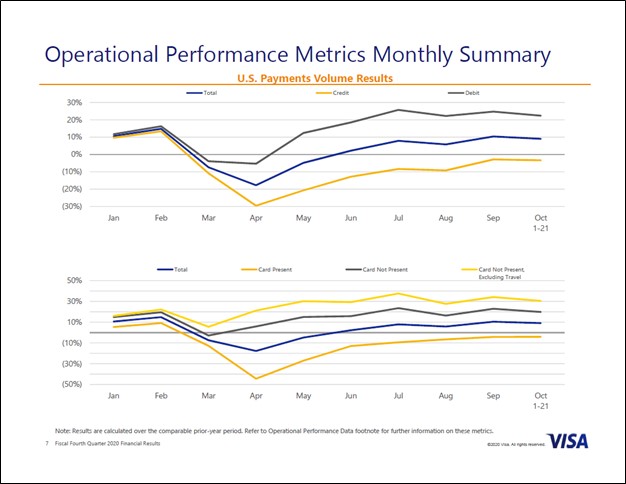

Image Shown: Visa Inc’s operations are on the rebound, though meaningful headwinds remain. Image Source: Visa Inc – Fourth Quarter and Full-Year Earnings for Fiscal 2020 IR Presentation By Callum Turcan We have been big fans of Visa Inc (V) for a long time and continue to include shares of V in our Best Ideas Newsletter portfolio as a top-weighted holding. Visa reported its fourth quarter and full-year earnings for fiscal 2020 (period ended September 30, 2020) in late October, which as expected saw the firm’s financial performance face significant headwinds due to the coronavirus (‘COVID-19’) pandemic. However, Visa’s outlook has improved tremendously during the past month as it appears there is a good chance that a safe and viable COVID-19 vaccine will get distributed sooner than many previously expected, though nothing is for certain as several leading vaccine candidates are still seeking emergency authorization from the relevant regulatory bodies. Outlook Improving In the event global travel begins recovering in earnest due to the widespread distribution of a COVID-19 vaccine (as households resume vacations away from home while busines travel picks back up), that would go a long way to improve Visa’s financial performance given its significant exposure to the level of global travel-related activities (Visa has a large cross-border payment processing and payments solutions business). Equities are valued/priced based on forward-looking assumptions, not their historical performance, and investors are starting to warm back up to Visa as its near-term outlook is improving (shares of V are up more than 7% over the past month as of this writing).Bigger picture, Visa has a stellar cash flow profile, strong balance sheet, and impressive long-term growth runway, which combined underpin our expectations that Visa will be able to significantly grow its free cash flows going forward. At the end of fiscal 2020, Visa had $3.8 billion in net debt (inclusive of short-term debt, and short- and long-term marketable securities). We view that burden as manageable given Visa generated $9.7 billion in free cash flows in fiscal 2020 and had $20.3 billion in cash-like items on the books at the end of this period. The firm spent $2.7 billion covering its dividend obligations and $8.1 billion buying back its Class A common stock in fiscal 2020, which were partially funded by its balance sheet. Visa’s digital payments business has performed well during the pandemic and the secular shift towards e-commerce should help the firm maintain its momentum on this front going forward, especially as households are increasingly turning to e-commerce marketplaces to meet their consumer staples needs. Management also noted that Visa’s “tap to pay” offerings were holding up well as consumers and businesses seek to minimize physical contact. Visa did not provide full-year guidance for fiscal 2021 due to uncertainties created by the ongoing pandemic. However, consensus analyst estimates indicate that many market participants expect Visa’s financials will rebound in fiscal 2021 and fiscal 2022 versus its fiscal 2020 performance. Plaid Acquisition Update Back in January 2020, Visa announced it was acquiring Plaid for ~$5.3 billion in a deal that we covered in this article here. We had this to say in that article (lightly edited): Plaid primarily offers a network that allows consumers to connect financial accounts to apps securely and safely, meaning that when a consumer downloads a mobile financial-oriented app to their phone (for example), Plaid is the company that ensures a smooth connection between app and the relevant financial institution when it comes to transferring information and ultimately money… Plaid’s customers include firms such as Acorns (specializes in micro-investing and robo-investing), Betterment (an online investment company based), Chime (an online bank), TransferWise (a British online money transfer service), and the widely-popular mobile payment service Venmo… Generally speaking, these start-ups and subsidiaries are experiencing high levels of growth given the rising popularity of less traditional banking and investing institutions. As an aside, please note PayPal Holdings Inc (PYPL) owns Venmo, and we continue to be big fans of PayPal for a number of reasons, which is why we include shares of PYPL as a top-weighted holding in our Best Ideas Newsletter. The payment processing, payment solution and financial tech space is quite lucrative and most importantly, supported by secular growth tailwinds (e.g. the global shift towards a “cashless” society and the rise of e-commerce). Pivoting back to the Plaid deal, the US Department of Justice filed a civil antitrust lawsuit this past November to stop Visa’s acquisition of Plaid from going through. In late October, the “Department of Justice filed a petition in the U.S. District Court for the District of Massachusetts to enforce Bain & Company’s compliance with the department’s Civil Investigative Demand” as part of the Department of Justice’s antitrust case that “require[d] the company to answer interrogatories and produce documentary material” concerning Visa’s corporate strategy, among other things. During Visa’s latest earnings call, management did not have much to say other than this: “In terms of Plaid, I want to say two things. First, we continue to engage with the Department of Justice on the review of the acquisition. Second, the Department of Justice's lawsuit yesterday against Visa and Bain & Company is related to a dispute over documents they requested as part of the review of the deal. Beyond that, we're not going to comment further.” --- Al Kelly, CEO and Chairman of Visa Whether or not the Plaid acquisition will be allowed to proceed does not change our view towards Visa, which is a great company with or without the deal. Visa is a serial acquirer, and anti-trust concerns are likely to pop up from time to time. That has not stopped Visa from acquiring other companies, such as YellowPepper (a financial tech firm focused on markets in the Caribbean and Latin America), which Visa acquired in November 2020 (financial terms were not disclosed in the press release). Concluding Thoughts We recently took a fresh look at our valuation of Visa, and we raised the company’s fair value estimate to $219 per share. The high end of Visa’s current fair value estimate range sits at $263 per share, indicating there is room for substantial capital appreciation upside under a more bullish/upside scenario (note that upside and and downside scenarios help inform each company's fair value estimate range). We continue to be big fans of Visa, and the firm is not only one of our top ideas in the financial-technology/payment-processing space that includes innovators in blockchain and cryptocurrency, but it is also one of our top ideas in our entire coverage universe. Visa's 16-page stock report >> ----- Also tickerized for SQ, ACIW, EPAY, FIS, FDC, FISV, FLT, GPN, MELI, VRSK, WU, WEX Related blockchain: GBTC, ETCG, RIOT, MARA, HIVE, OSTK, BITW, GDLC, BTBT, EBON ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment