Member LoginDividend CushionValue Trap |

Public Storage and Philip Morris Are Stellar High-Yielding Opportunities

publication date: Jun 9, 2021

|

author/source: Callum Turcan

Image Shown: Shares of Public Storage (depicted by the orange line) and Philip Morris International Inc (depicted by the blue line) have outperformed the S&P 500 (depicted by the yellow line) year-to-date as of midday trading on June 9, before taking dividend considerations into account. We continue to be huge fans of Public Storage and Philip Morris and include both firms as ideas in our High Yield Dividend Newsletter portfolio. By Callum Turcan Public Storage (PSA), the self-storage real estate investment trust (‘REIT’) primarily focused on the US, and Philip Morris International Inc (PM), the global tobacco giant behind the Marlboro brand and the IQOS offering, are two of our favorite high-yielding ideas. As one can see in the graphic at the top of this article, shares of PSA and PM have outperformed the S&P 500 (SPY) year-to-date, as of midday trading on June 9, before taking dividend considerations into account. We include both Public Storage and Philip Morris as ideas in the High Yield Dividend Newsletter portfolio. Public Storage At the end of March 2021, Public Storage had an equity stake in over 2,500 self-storage properties across 38 US states along with a ~35% equity stake in Shurgard Self Storage. Please note Public Storage’s asset base has since expanded due to acquisition activity and organic investments. Shurgard trades on the Brussels Euronext and owns economic interests in self-storage properties in Western Europe. Additionally, Public Storage had a ~42% equity stake in PS Business Parks Inc (PSB) at the end of March 2021. PS Business Parks owns economic interests in commercial properties in the US with a focus on multi-tenant industrial, flex, and office space properties. We are huge fans of the self-storage space given the ability for REITs operating in this industry to generate positive free cash flows after dividends paid. Public Storage generated roughly $1.6 billion in annual free cash flows on average from 2018-2020, an impressive feat. Please note Public Storage remains a capital market dependent entity given its sizable net debt load. This means the REIT needs to retain access to debt and equity markets (ideally at attractive rates) to keep refinancing its debt position and making good on its dividend obligations while funding its capital expenditure requirements. Recent capital market activity indicates that is the case. In April 2021, Public Storage announced it was acquiring ezStorage for $1.8 billion, strengthening its position in the Mid-Atlantic region (specifically Maryland, Virginia, and Washington DC). Public Storage closed the acquisition of ezStorage later that month. Public Storage closed the first phase of a different acquisition in December 2020, when the firm paid $0.5 billion for three dozen self-storage properties (the second phase is expected to be completed sometime this year and involves additional self-storage properties). On June 7, Public Storage reported that its square foot occupancy rate stood at 96.5% as of May 31, 2021. For comparison, Public Storage’s square foot occupancy rate stood at 92.7% as of March 31, 2020, and at 94.2% as of December 31, 2020. We appreciate the apparent strong demand for Public Storage’s offerings and see room for additional upside. Secular tailwinds support Public Storage’s outlook as an increasing number of US households are turning to self-storage offerings to maximize their living spaces in an economical manner. Having healthy occupancy rates speaks favorably towards Public Storage’s ability to push through rental increases and grow its same-store net operating income (‘NOI’) over time.

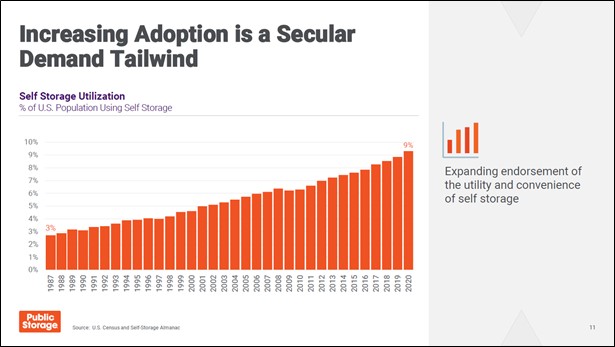

Image Shown: Demand for self-storage offerings in the US has grown at a steady clip since the late-1980s with room for additional upside. Image Source: Public Storage – May 2021 Investor Day Presentation Public Storage has received some attention from activist investors recently with Elliott Associates, led by Paul Singer, pushing for the company to invest more in its business while also better engaging with its shareholders. The REIT’s recent acquisition activity and its $0.5 billion “Property of Tomorrow” investment program highlight how Public Storage is responding to these pressures. Though a combination of rental rate increases, asset base growth, a revamp of some of its properties, and efficiency initiatives, Public Storage aims to reward shareholders over the long haul via cash flow and ultimately dividend growth.

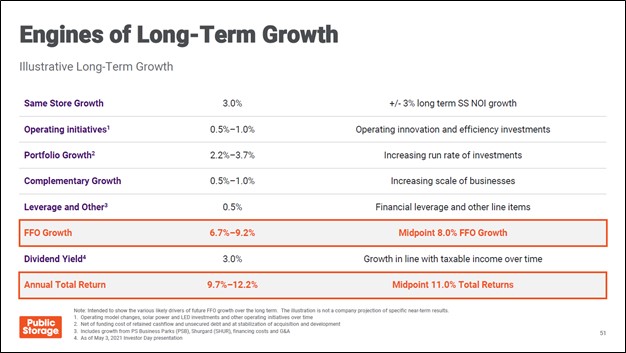

Image Shown: Public Storage’s long-term financial growth and shareholder return targets. Image Source: Public Storage – May 2021 Investor Day Presentation We continue to be huge fans of Public Storage and view the REIT as well-positioned to capitalize on the reopening of the US economy in the wake of coronavirus (‘COVID-19’) vaccine distribution efforts. Shares of PSA yield ~2.7% as of this writing. Public Storage’s forward-looking dividend coverage is strong as it has an adjusted Dividend Cushion ratio of 1.6, which takes its ability to tap capital markets into account. Public Storage’s unadjusted Dividend Cushion ratio is near parity (~1.0). We are also big fans of CubeSmart (CUBE), another self-storage REIT focused on the US, and include shares of CUBE as an idea in our High Yield Dividend Newsletter portfolio. Philip Morris On June 8, Philip Morris reiterated its full-year 2021 guidance that among other things calls for 5%-7% net organic revenue growth, ~$11.0 billion in operating cash flow, and ~$0.8 billion in capital expenditures. While the news disappointed some investors that were hoping for a guidance boost, we appreciate the resilience of Philip Morris’ free cash flow generating abilities. The COVID-19 pandemic weighed on the company’s performance in 2020, though its outlook indicates that Philip Morris is on the rebound. As we have covered in the past (link here), Philip Morris owns the popular IQOS heat-not-burn (‘HTU’) tobacco offering, and sales of these products have grown at a brisk pace over the past few years. Going forward, growth at its IQOS offering combined with pricing strength at its traditional cigarette businesses underpins Philip Morris’ promising outlook.

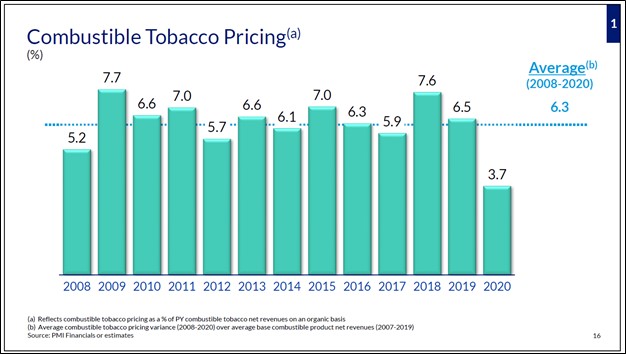

Image Shown: Philip Morris utilizes its brand power to push through continuous price increases at its traditional cigarette offerings, such as those sold under its Marlboro brand. This enables the firm to maintain and even grow its cash flows, even though unit volumes of its traditional cigarette offerings are in secular decline. Image Source: Philip Morris – April 2021 IR Presentation In terms of unit volumes, IQOS and its other HTU offerings now represent a low double-digit percentage of the firm’s company-wide volumes (up from virtually nothing in 2015). By 2025, Philip Morris estimates that HTU offerings will represent over half of its unit volumes. Philip Morris’s HTU operations better positions the firm for the future as unit volumes of its traditional cigarette offerings are in secular decline. Philip Morris recently lost its challenge in Saudi Arabia regarding customs duties that are allegedly owed from the 2014-2018 period which is expected to weigh on the company’s near-term financial performance. However, this news does not materially impact Philip Morris’ longer term outlook. We are monitoring the ongoing legal battle regarding Philip Morris’ popular IQOS offering and a challenge from British American Tobacco Plc (BTI) over patents covering HTU devices. In the UK, Philip Morris received a nice legal win after the UK High Court revoked two of British American Tobacco’s patents covering HTU offerings in March 2021. However, Philip Morris and Altria Group Inc (MO), its partner in the US, suffered a legal setback in May 2021 after an initial determination by a judge at the US International Trade Commission (‘ITC’) ruled that the IQOS device infringed on patents owned by British American Tobacco. Now the legal battle goes before the full ITC tribunal. Philip Morris remains a stellar high-yielding income generation idea. From 2018-2020, Philip Morris generated roughly $8.8 billion in annual free cash flows on average which fully covered its run-rate dividend obligations of $7.4 billion as of 2020. This year, Philip Morris is guiding to generate around $10.2 billion in free cash flow (before taking working capital movements and other considerations into account). Shares of PM yield ~4.9% as of this writing and its forward-looking dividend coverage is quite strong as Philip Morris has a Dividend Cushion ratio near parity (~1.0). Through 2023, Philip Morris aims to realize material cost savings while steadily growing its organic revenues, which supports its cash flow growth outlook.

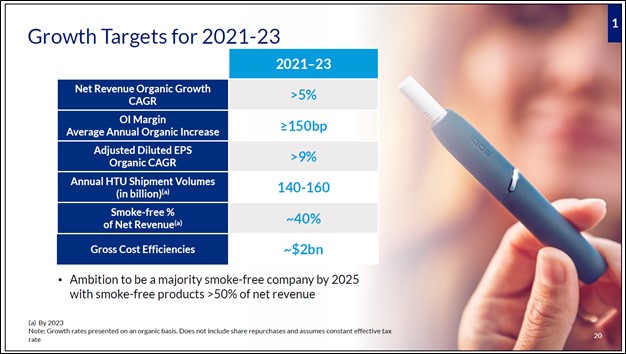

Image Shown: Philip Morris’ revenue growth trajectory is underpinned by expected sales growth at its IQOS offering. Beyond expected revenue growth, Philip Morris’ cash flow growth trajectory is further supported by its ongoing cost structure improvement initiatives. Image Source: Philip Morris – April 2021 IR Presentation Concluding Thoughts In the current low interest rate environment, locating high-quality companies with strong cash flow generating abilities and promising outlooks is essential to avoiding Value Traps when searching for high-yielding opportunities. The High Yield Dividend Newsletter seeks to do just that by highlighting solid income generation ideas via the High Yield Dividend Newsletter portfolio and the High Yield Spotlight. To learn more about this newsletter, please check out this link here. ----- Tickerized for PSA, PBS, CUBE, PM, MO, BTI, VNQ Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Public Storage (PSA), CubeSmart (CUBE), Philip Morris International Inc (PM), and Vanguard Consumer Staples ETF (VDC) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment