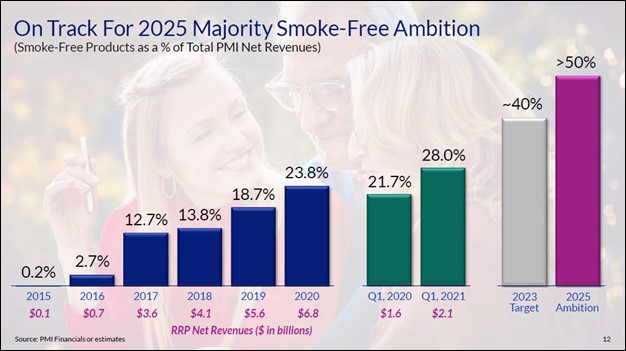

Image Shown: Philip Morris International Inc has been steadily growing its alternative tobacco product sales during the past several years and its growth outlook on this front is quite bright. RRP stands for reduced-risk products according to Philip Morris. Image Source: Philip Morris International Inc – First Quarter of 2021 IR Earnings Presentation

By Callum Turcan

Back in 2008, Philip Morris International Inc (PM) spun off Altria Group Inc (MO). The move separated the international business (Philip Morris) from the US business (Altria) that is behind the popular Marlboro brand and various other tobacco brands. The two companies have been working together on marketing Philip Morris’ IQOS heated tobacco unit (‘HTU’) offering in the US during the past couple years, selling alternative tobacco products that have already received approval from the US Food and Drug Administration (‘FDA’). Please note that while the FDA is reportedly moving to ban menthol cigarettes and flavored cigars in the US, that will not have an impact on Philip Morris in any meaningful way.

Philip Morris is included as an idea in the High Yield Dividend Newsletter portfolio (more on that here), and shares of PM yield ~5.1% as of this writing. The company’s net debt load is rather large, though in our view its payout is still well-covered on a forward-looking basis due to its impressive free cash flow generating abilities and promising growth outlook. Sales volumes of traditional cigarette products are on a secular decline worldwide; however, given the inelastic demand curve for most tobacco products, pricing power has helped the industry offset those headwinds to varying degrees.

As the Marlboro cigarette brand is the most popular brand in the world (outside of China), Philip Morris has ample pricing power, but there is more to the story. The company is also a leader in alternative tobacco products that replicate the traditional cigarette smoking experience, including its IQOS offering (and the related HEETS HTU insert) which first launched back in 2014. Pricing power at its traditional cigarette business has helped Philip Morris navigate the ongoing secular decline in traditional cigarette sales volumes, while ongoing growth in alternative tobacco sales volumes continues to offer the company a way to potentially grow its revenues and ultimately free cash flows over the long haul.

Earnings Update and Guidance Boost

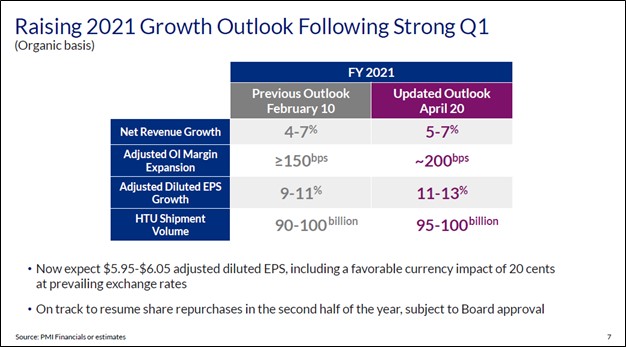

On April 20, Philip Morris reported first-quarter 2021 earnings that beat both consensus top- and bottom-line estimates. The company raised its full-year guidance for 2021 during its latest earnings update in large part due to ongoing strength at its HTU offerings, which includes its IQOS and related products. Now, Philip Morris expects to ship 95-110 billion HTU units this year, up from its previous forecast of 90-100 billion HTU units.

Greater economies of scale, pricing power, and past initiatives aimed at improving its cost structure are expected to drive Philip Morris’ adjusted non-GAAP operating margin higher by ~200 basis points this year, up from previous forecasts. The firm expects its adjusted non-GAAP diluted EPS on a constant currency basis to grow by 11%-13% in 2021, hitting $5.75-$5.85, aided by “a gradual improvement in the general operating environment” and various other factors according to the earnings press release.

Ongoing vaccine distribution efforts should enable public health authorities to eventually get the coronavirus (‘COVID-19’) pandemic under control, and Philip Morris’ guidance incorporates its expectations that quarantine measures in key geographical markets will ease during the second half of 2021, though nothing is for certain.

Image Shown: Philip Morris boosted its full-year guidance for 2021 during its latest earnings report. Image Source: Philip Morris – First Quarter of 2021 IR Earnings Presentation

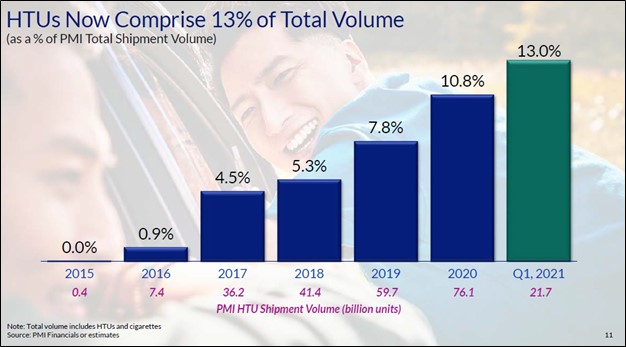

As one can see in the upcoming graphic down below, unit volume growth at Philip Morris’ HTU offerings has simply been stellar over the past several years with ample room for upside going forward. In the first quarter of 2021, the company’s total unit volumes were down just under 4% year-over-year, though its HTU offerings posted unit sales growth of roughly 30% year-over-year.

Image Shown: Philip Morris’ HTU sales volumes, led by growth at its IQOS offering, have grown at a brisk pace of late. Image Source: Philip Morris – First Quarter of 2021 IR Earnings Presentation

News regarding a more restrictive regulatory landscape for US tobacco companies could benefit Philip Morris by supporting sales of its IQOS offering, given that the product is marketed as an alternative to traditional cigarettes. By 2025, Philip Morris aims to generate the majority of its sales from “smoke-free” products (see graphic at the very top of this article). During the company’s latest earnings call, management noted (emphasis added):

“Most impressive was the continued strong growth of IQOS, which made up 13% of our volumes and 28% of our net revenues compared to 21.7% in the prior year quarter. We continued converting adult smokers at a very good pace and reached an estimated total of 19.1 million users, of which 14 million have switched to IQOS and stopped smoking. HTU shipment volumes grew plus 30% compared to the prior year quarter with record market shares in key IQOS geographies, 12 markets with double-digit national share and the share of 7.6% overall in IQOS markets excluding the U.S…

Gross margin expansion was also accompanied by strong SG&A efficiencies with our adjusted marketing administration and research costs 200 basis points lower as a percentage of net revenue on an organic basis.This reflects the ongoing digitalization and simplification of our business processes, including our IQOS commercial engine and more efficient ways of working. We delivered around $60 million towards our ’21-’23 target of $1 billion in gross SG&A savings before inflation and reinvestments. The pandemic also impacted SG&A costs in the quarter through the later timing of certain projects and reduced commercial and overhead costs due to ongoing restrictions. These latter factors accounted for around $100 million of the organic improvement.” — Emmanuel Babeau, CFO of Philip Morris

The executive suite appears confident that Philip Morris’ organic revenues and adjusted operating margins will continue to move in the right direction going forward. We view Philip Morris’ cash flow growth outlook quite favorably, especially as the world begins to emerge from pandemic-related lockdowns.

Financial Update

Philip Morris forecasts it will generate ~$11.0 billion in operating cash flow this year at exchange rates seen recently, before taking year-end working capital movements into account, while spending ~$0.8 billion on its capital expenditures (this guidance did not change from its previous forecast). The company’s free cash flow generating abilities continue to impress. For reference, the firm generated ~$8.8 billion in annual free cash flow on average from 2018-2020, exceeding run-rate dividend obligations of ~$7.4 billion at the end of 2020. Based on its current guidance, Philip Morris expects to generate around $10.0 billion or more in free cash flow this year.

The company exited March 2021 with a net debt load of roughly $25.5 billion (inclusive of short-term debt), which weighs negatively on its Dividend Cushion ratio. However, Philip Morris has ample liquidity on hand ($3.9 billion in cash and cash equivalents on the books at the end of last quarter) and a reasonable leverage ratio. At the end of March 2021, its net debt to adjusted (non-GAAP) EBITDA ratio stood at ~1.9x. Due to its impressive free cash flow generating abilities, Philip Morris’ Dividend Cushion ratio is near parity (~1), and we give it a GOOD Dividend Safety rating. Please note that these metrics incorporate our expectations that Philip Morris will steadily grow its dividend in the coming years.

As an aside, Philip Morris’ ‘equity investments’ line-item is primary represented by strategic assets. That figure stood at $4.6 billion at the end of March 2021, though we would not consider these assets to be “cash-like” in nature.

Concluding Thoughts

Philip Morris is a high-yielding income generator with a promising growth outlook. Historically, the firm hasn’t allocated a significant amount of capital (or any) towards share repurchases, highlighting management’s commitment to income seeking shareholders.

Though we understand that some investors may shy away from the company due to ESG-related considerations, for those that do not have such investment restrictions, we continue to like Philip Morris as an idea in the High Yield Dividend Newsletter portfolio. We view its forward-looking dividend coverage quite favorably, though we would like for management to pare down the firm’s net debt load over the long haul.

Recently, shares of PM have been on a nice upward climb indicating investors continue to warm up to Philip Morris’ promising free cash flow growth outlook, supported in part by its alternate tobacco products (and what they imply regarding long-term resiliency versus traditional cigarettes).

We expect to take a close look at our valuation model of Philip Morris in light of its recent performance and guidance boost. Readers should expect our fair value estimate to be revised higher.

Philip Morris’ 16-page Stock Report (pdf) >>

Philip Morris’ Dividend Report (pdf) >>

—–

Tickerized for PM, MO, BTI, IMBBY, GLLA, VAPE, JAPAY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) and Vanguard Consumer Staples ETF (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.