Member LoginDividend CushionValue Trap |

Public Storage Breaks Out!

publication date: Apr 30, 2021

|

author/source: Brian Nelson, CFA

Image Shown: Public Storage’s chart looks mighty attractive, with shares having experienced a powerful breakout recently. Its dividend is equally attractive, in our view. Brian Nelson, CFA On Wednesday, April 28, Public Storage (PSA) reported excellent first-quarter 2021 results. The self-storage giant grew core funds from operations (FFO) 9.3% in the period, to $2.82 per diluted share. Same store direct net operating income advanced 6.5% as same store sales increased while same store direct cost of operations fell. Everything seems to be going right for Public Storage at the moment. Here’s what Public Storage’s CEO Joe Russell had to say about the quarter and outlook in the press release: Public Storage’s focus on the customer experience, operating model innovation, and portfolio expansion funded with a growth-oriented balance sheet produced strong results during the quarter. Our momentum has accelerated into the second quarter as indicated by our inaugural Core FFO guidance and the acquisition of ezStorage, one of the highest quality self-storage portfolios in the United States. We love the self-storage space because many of the REITs that operate within the area generate strong traditional free cash flow that is in excess of the cash dividends they pay. Other REITs often come up short when it comes to traditional free cash flow coverage of the dividend, necessitating uninterrupted access to the equity and credit markets to retain the payout. This means that many self-storage companies are less capital-market dependent than other REITs, making their payouts more resilient, in our view.

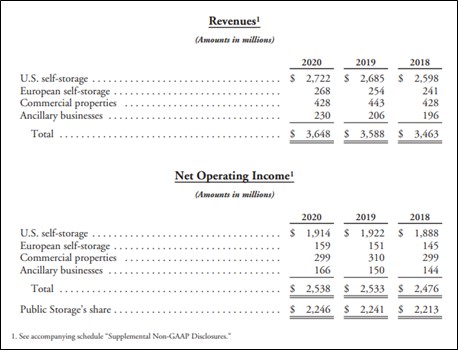

Image Shown: Public Storage’s financial performance is resilient during crises, as evidenced by the strength of its revenue and net operating income performance during the COVID-19 pandemic in 2020. Image Source: Public Storage’s 2020 Annual Report. Note: PSA has a ~42% stake in PS Business Parks (PSB) and a 35% stake in Shurgard (SSSAF). Public Storage’s Chairman Ronald Havner probably summed up the company’s prospects the best when he wrote in the firm’s 2020 Annual Report: Public Storage has an outstanding business model comprising the industry-leading brand, an efficient operating platform, high quality properties located in growing markets, and very talented leadership in Joe Russell and his team. This exceptional company should deliver solid returns to shareholders for years to come. Public Storage’s credit health is also among the best when it comes to REITs. The company garners an investment-grade A2/A rating from Moody’s and S&P -- just one of two REITs to do so. Strong free cash flow generation, low leverage, a resilient business model, international scale and growth opportunities, and a solid credit profile support Public Storage’s promising future and dividend health, in our view. Concluding Thoughts There's a lot to like about Public Storage. The company's unique financial position relative to other REITs when it comes to traditional free cash flow covering dividends makes its payout comparatively less risky, while its strength during the COVID-19 meltdown has revealed the durability of its free cash flow stream through thick and thin. Perhaps the only thing more attractive than its fantastic chart is the health of its dividend, which is further backstopped by an A2/A investment-grade credit rating, one of the highest ratings for any REIT. We continue to like Public Storage as an idea in the High Yield Dividend Newsletter portfolio, with shares yielding a solid ~2.9% at this time. PSA's 16-page Stock Report (pdf) >> PSA's Dividend Report (pdf) >> Tickerized for PSA, PSB, SSSAF ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, and IWM. Brian Nelson's household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

1 Comments Posted Leave a comment