Member LoginDividend CushionValue Trap |

PepsiCo May Be A Rare Winner in This Inflationary Environment

publication date: Oct 20, 2022

|

author/source: Callum Turcan

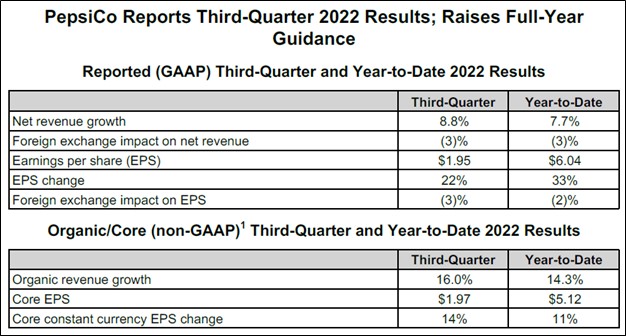

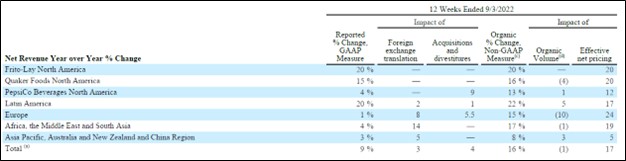

Image Source: PepsiCo Inc – Third Quarter of Fiscal 2022 Earnings Press Release By Callum Turcan On October 12, PepsiCo Inc (PEP) reported third quarter earnings for fiscal 2022 (period ended September 12, 2022) that beat both consensus top- and bottom-line estimates, primarily due to the enormous price increases the consumer staples giant pushed through. The company also raised its full-year guidance for fiscal 2022 in conjunction with its latest earnings report, which sent shares of PepsiCo sharply higher during the following trading days. We assign PepsiCo a fair value estimate of $164 per share and the upper end of our fair value estimate range stands at $197 per share. With shares trading at ~$173 each, we think the company's intrinsic value is resilient and offers investors upside to the top end of the fair value estimate range. Shares of PEP yield a nice ~2.7% as of this writing. Earnings Update PepsiCo’s GAAP revenues rose 9% year-over-year in the fiscal third quarter to reach $22.0 billion. Net pricing increases were key. For instance, at PepsiCo’s Frito-Lay North America segment, its organic volumes were flat though a 20% increase in its effective net pricing saw its reported GAAP revenues grow by 20% year-over-year last fiscal quarter. Pivoting to its Europe segment, a 24% increase in its effective net pricing offset a 10% decline in organic volumes along with headwinds arising from foreign currency movements and A&D activity to drive 1% year-over-year growth in its reported GAAP revenues last fiscal quarter. A similar situation played out at PepsiCo’s other business reporting segments in the fiscal third quarter.

Image Shown: PepsiCo has pushed through substantial effective net pricing increases across all its business reporting segments in recent fiscal quarters. Image Source: PepsiCo – Third Quarter of Fiscal 2022 Earnings Press Release During the fiscal third quarter, PepsiCo’s GAAP gross margin came in at 53.1%, down ~40 basis points year-over-year as sharp input cost increases offset substantial net pricing increases. The firm’s GAAP operating income rose 6% year-over-year in the fiscal third quarter to reach $3.4 billion, with revenue growth offset to a degree by its declining gross margin and a 9% increase in its SG&A expenses. PepsiCo’s GAAP operating margin stood at 15.3% in the fiscal third quarter, down ~40 basis points year-over-year. A large reduction in its provision for corporate income taxes along with decent operating income growth saw PepsiCo’s GAAP diluted EPS climb higher by 22% year-over-year in the fiscal third quarter to reach $1.95. Furthermore, its outstanding diluted share count declined marginally during this period, which supported growth in its GAAP diluted EPS. During the first three quarters of fiscal 2022, PepsiCo generated $3.8 billion in free cash flow while spending $4.6 billion covering its dividend obligations along with $1.2 billion buying back its common stock. Large working capital builds held down its net operating cash flows during this period. PepsiCo exited the fiscal third quarter with $6.7 billion in cash, cash equivalents, and short-term investments on hand versus $3.1 billion in short-term debt and $36.1 billion in long-term debt. Its net debt load is a concern, though that burden appears manageable for now as PepsiCo has ample liquidity on hand to meet its near term funding needs. Juice Transaction In August 2021, PepsiCo announced it was selling its operations involving Tropicana, Naked, and other juice brands across North America along with an irrevocable option to sell certain juice businesses in Europe to the private equity firm PAI Partners through a transaction worth ~$3.3 billion. The North American portion of this deal closed in January 2022 and the European portion of the deal closed in February 2022. PepsiCo significantly reduced its exposure to the juice market through this transaction while raising ~$3.5 billion in cash proceeds. Demand for juice in the US has been steadily declining in recent years as consumers have pivoted to beverage options with less sugar. PepsiCo retained a 39% interest in the Tropicana JV. The firm noted that “in the United States, PepsiCo acts as the exclusive distributor for Tropicana JV’s portfolio of brands for small-format and foodservice customers with chilled direct-store-delivery” according to its 10-Q SEC filing covering the fiscal third quarter. PepsiCo’s 39% stake in the Tropicana JV is recorded as an equity method investment. Guidance Update As noted previously, PepsiCo raised its full-year guidance for fiscal 2022 in conjunction with its latest earnings report. Now PepsiCo aims to generate 12% annual organic revenue growth (up from 10% previously) and 10% core constant currency EPS growth (up from 8% previously) this fiscal year. Please note that these are non-GAAP metrics that are meant to provide a snapshot of the performance of PepsiCo’s underlying business, which has performed well of late in the face of major exogenous headwinds. PepsiCo now expects that foreign currency movements will represent a 250 basis point headwind to its reported net revenues and core EPS growth (up from 200 basis points) this fiscal year as the US dollar remains quite strong. These factors are expected to drive PepsiCo’s core EPS in fiscal 2022 up to a forecasted ~$6.73 (versus $6.63 previously), which if achieved represents ~7.5% annual growth. PepsiCo also raised its full-year guidance for fiscal 2022 during its first and second fiscal quarter earnings updates. The company intends to return ~$7.7 billion in cash to shareholders via dividends ($6.2 billion) and share repurchases ($1.2 billion) this fiscal year. PepsiCo had largely completed its targeted share buybacks for fiscal 2022 by the end of its fiscal third quarter. Management remains very shareholder friendly. PepsiCo continues to expect that its core annual effective corporate tax rate will come in at 20% in fiscal 2022, a forecast that the firm has not changed since publishing its initial fiscal 2022 guidance during its fourth quarter of fiscal 2021 earnings update. Concluding Thoughts PepsiCo is leaning heavily on net pricing increases to offset cost input and foreign currency headwinds, and its strategy is paying off. The consumer staples giant remains a nice free cash flow generator and management is incredibly shareholder friendly, though in our view, we think it would be wise for PepsiCo to pare down its net debt load. We recently added PepsiCo to the simulated Best Ideas Newsletter portfolio on October 18, 2022. In our September 2022 articles Nelson Nailed Food Price Inflation Risks; Markets Heading Lower (link here) and Fed Raises 75 Basis Points; Food Price Inflation Continues to Wreak Havoc on Consumer Budgets (link here), we noted how rampant food price inflation represented one of the major factors driving up headline inflation figures that are forcing the Fed to aggressively raise interest rates. The read through from PepsiCo’s latest earnings update indicates that food (and drink) inflationary pressures are here to stay. ----- Recession Resistant Industry - BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT, CHD, SYY, ADM, LANC, CASY Tickerized for PEP, KO, KDP, MNST, CELH, MDLZ, FIZZ, COCO Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE. Philip Morris International Inc (PM) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment