Image Source: PepsiCo

By Brian Nelson, CFA

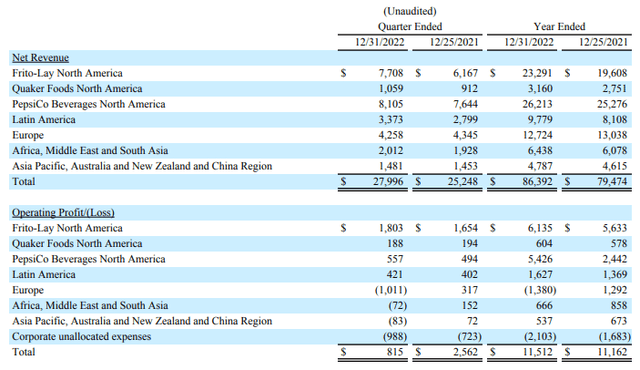

On February 9, PepsiCo, Inc. (PEP) reported impressive fourth-quarter 2022 results that showed organic revenue growth of 14.6% and core constant-currency earnings-per-share expansion of 10%. The company also added to its long streak of consecutive annual dividend increases, raising the payout by 10%, to $5.06 per share on an annualized basis, starting with the June 2023 payment. PepsiCo has rewarded dividend growth investors with 51 consecutive years of dividend growth, and we have no reason to believe that the streak will be broken anytime soon. The firm expects to buy back $1 billion worth of its shares during 2023.

PepsiCo showcased tremendous product pricing power. During the fourth quarter, volumes across its portfolio fell 2%, with volumes in its Quaker Foods North America segment and PepsiCo Beverages North America falling 7% and 2%, respectively. The company still generated tremendous organic top-line growth thanks to pricing actions, however. Pricing power was so instrumental to the quarter that its Quaker Foods North America segment still drove 1% core constant currency operating-profit expansion, while PepsiCo Beverages North America experienced 24% core constant currency operating-profit growth. Only Europe proved to be weak across the board experiencing both declining volumes and negative core constant currency operating-profit performance.

Image Source: PepsiCo

The beverage and snacks giant experienced inflationary pressures across its business during the fourth quarter. In its Frito-Lay North America segment, input costs for cooking oil, seasoning and potatoes contributed to a 19 percentage-point higher impact from higher commodity costs, while its Quaker Foods North America division faced pressures from higher costs for grains and packaging materials, which contributed to a 48 percentage-point impact from higher commodity costs in that division.

Fuel and resin costs drove a 53 percentage-point increase in commodity costs in its PepsiCo Beverages North American segment during the fourth quarter. Meanwhile, the company’s European operations were hit by a 141 percentage-point increase in commodity costs, but impairment charges related to its SodaStream brand were the biggest source of profit weakness there. Impairment charges also rattled its ‘Africa, Middle East and South Asia’ division, as well as its ‘Asia Pacific, Australia, and New Zealand and China’ region.

Looking to 2023, PepsiCo expects organic revenue growth of 6% and core constant currency earnings per share to grow 8%, to $7.20 per share (was $6.79 per share in 2022), with total cash returned to shareholders for the year expected to be $7.7 billion (with $6.7 billion of that coming in the form of dividends). We’ll have to see how operating cash flow and capital spending shakes out during 2023, but free cash flow has averaged about $6.3 billion during the past couple years. Over that same time, PepsiCo paid ~$6 billion in dividends, on average, during 2021 and 2022.

In 2022, PepsiCo’s free cash flow, however, was $5.6 billion while cash dividends paid on the year were $6.17 billion, meaning free cash flow came up a bit short last year. PepsiCo will need to drive meaningfully higher free cash flow in 2023 to cover the recently-hiked dividend payout. The firm ended 2022 with cash and cash equivalents of $4.95 billion and short-term investments of 0.4 billion on the balance sheet, while short- and long-term debt obligations stood at $3.4 billion and $35.7 billion, respectively.

Concluding Thoughts

PepsiCo revealed tremendous product pricing power during its fourth quarter of 2022, but inflationary pressures were still present across its business operations. The beverage and snacks giant raised its dividend 10%, marking the 51st consecutive year the company has upped its payout. However, PepsiCo will have to step up its free cash flow generation during 2023 in order to cover the increased payout obligations. During 2022, for example, free cash flow came up short in covering cash dividends paid. PepsiCo also has a rather large net debt position, even as it plans to spend $1 billion in buybacks during 2023. We still like PepsiCo as an idea in the Best Ideas Newsletter portfolio, however, and peg its fair value estimate at $187 per share. Shares yield ~2.8% at the time of this writing.

Tickerized for PEP, KO, MDLZ, KDP, MNST, FIZZ, PRMW, BGS, CVGW, DANOY, LANC, MMMB, CALM, NOMD, LWAY, KHC, SMPL, BRBR, HAIN, BYND, HSY, LW, WEST, STKL, CPB, POST, GIS, K, CAG, VITL, CELH, PFGC, IBA, ASAI

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.