Member LoginDividend CushionValue Trap |

Meta’s Free Cash Flow Generation Has Returned, But TikTok Has Permanently Changed the Competitive Landscape

publication date: Feb 2, 2023

|

author/source: Brian Nelson, CFA

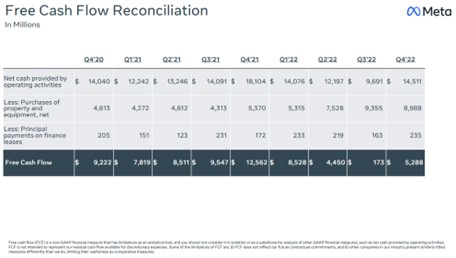

Image: Meta Platforms’ free cash flow has bounced back a bit, but the firm’s top-line growth remains challenged as it transitions away from a secular growth powerhouse into a cyclical story with encroaching competition. Image Source: Meta Platforms By Brian Nelson, CFA As we outlined in our introductory note in the February edition of the Dividend Growth Newsletter (pdf), the Federal Reserve is slowing its pace of benchmark rate increases as signs of inflation start to slow. Though there may still be pockets of input cost pressures, particularly with respect to prices at the pump and food-at-home expenses, for the most part, the negative wealth effect from falling asset prices around the globe is successfully working itself through the system. There are three reasons to be optimistic about equity prices: 1) the pace of inflation has likely peaked in June 2022, and this has increased investor risk appetite, 2) fourth-quarter earnings season, while mixed, has been coming in better-than-feared, and 3) we’ve witnessed impressive technical breakouts of the equal-weight S&P 500 (RSP), market-cap weighted S&P 500 (SPY), and the triple-Q’s (QQQ), which heavily weight some of out favorite tech names. These breakouts have had strong follow-throughs as well. On the back of strong fundamental performance from Tesla (TSLA) and more expected capital-spending discipline from Meta Platforms (META), we continue to believe large cap growth remains the favored stylistic area for long-term investors, and we are hugely skeptical of the foundation of empirical quantitative research based on realized historical data, “What So-Called Statistical ‘Value Premium?” We talked about several earnings reports in our January 26 note, “Market-Cap Weighted S&P 500 Breaks Out; Have We Already Seen the Bottom?,” and here are some more big developments from fourth-quarter 2022 earnings season.

Concluding Thoughts We’re loving this nice move higher in the stylistic area of large cap growth, and for those investors seeking broad-based exposure, we think this area is the place to be in the long run. Tesla’s strong financial performance coupled with Meta Platforms’ return to financial discipline are propelling large cap growth higher, but risks to the broader equity markets and economy remain. In any case, with inflation likely peaking in June 2022, fourth-quarter 2022 earnings season coming in better-than-feared, and technical breakouts of key indices across the board from the equal-weighted and market-cap weighted S&P 500 to the NASDAQ-100, equity investors have a lot to cheer about. Tickerized for RSP, SPY, QQQ, TSLA, META, FB, HON, MO, AMD, INTC, SCHG NOW READ: What So-Called Statistical “Value Premium?” ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment