Member LoginDividend CushionValue Trap |

Lockheed Martin Boosts Guidance

publication date: Apr 23, 2021

|

author/source: Callum Turcan

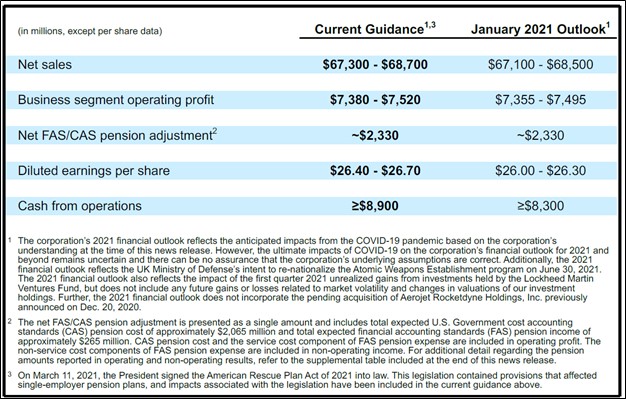

Image Source: Lockheed Martin Corporation – First Quarter of Fiscal 2021 IR Earnings Presentation By Callum Turcan Geopolitical tensions are on the rise worldwide. In recent weeks, Russian forces started massing on the border with Ukraine (though reportedly, those forces are beginning to pull back) as acrimony between Western governments and Russia continues to grow while the situation in Ukraine (i.e., Russia’s annexation of Crimea and involvement in eastern regions of Ukraine) remains in paralysis. Tensions between the US and China are building as well with an eye towards trading relations, espionage of all kinds, and cyber-attacks. The geopolitical backdrop indicates that the trajectory of defense spending is likely to continue growing in key developed and developing nations worldwide going forward. Lockheed Martin Corporation (LMT), maker of missile systems, space offerings, radar systems, jet fighters (including the F-35), and other advanced weaponry, will play a leading role in keeping Western armed forces (and the militaries of Western allies) ahead of the curve. The creation of the US Space Force which is part of the US Armed Forces (created by the United States Space Force Act that was signed into law in December 2019) indicates that demand for Lockheed Martin’s space offerings (including satellites and spacecraft) will likely grow at a significant clip over the coming years and decades. We include Lockheed Martin as an idea in the Dividend Growth Newsletter portfolio, and shares of LMT yield ~2.7% as of this writing. Lockheed Martin’s dividend growth trajectory is impressive, its free cash flow generating abilities are stellar, and it has an enormous backlog which provides a high degree of visibility as it concerns its future cash flow generating abilities. Earnings Update On April 20, Lockheed Martin reported fiscal first quarter 2021 earnings (period ended March 28, 2021) that beat consensus bottom-line estimates but missed consensus top-line estimates. Net sales increased at each of Lockheed Martin’s four core business operating segments (Aeronautics, Missile and Fire Control, Rotary and Mission Systems, and Space) which enabled the firm to grow its GAAP net sales by 4% year-over-year in the fiscal first quarter. The company’s GAAP operating income rose by 3% year-over-year and Lockheed Martin generated $1.5 billion in free cash flow last fiscal quarter, which fully covered $0.7 billion in dividend payouts during this period. Lockheed Martin spent $1.0 billion buying back its stock in the fiscal first quarter, some of which was funded by its balance sheet. The firm exited the first quarter of fiscal 2021 with $2.9 billion in cash and cash equivalents on hand versus $0.5 billion in short-term debt and $11.7 billion in long-term debt. We view its net debt load as manageable given its ample liquidity on hand, promising growth outlook, strong free cash flow generating abilities, and sizable backlog. Lockheed Martin’s total backlog stood at a whopping $147.4 billion at the end of the fiscal first quarter, up modestly on a sequential basis. Guidance Update Management raised Lockheed Martin’s full-year guidance for fiscal 2021 during the firm’s latest earnings report, raising the midpoint of the firm’s diluted EPS guidance to $26.55 from $26.15 previously. The upcoming graphic down below highlights Lockheed Martin’s latest guidance for fiscal 2021. Please note Lockheed Martin also increased its net sales, business segment operating profit, and cash from operations guidance for fiscal 2021 during its latest earnings report versus its pervious outlook.

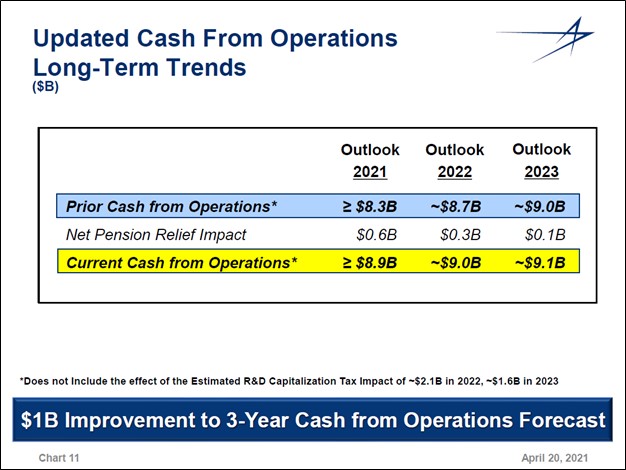

Image Shown: Lockheed Martin’s fiscal 2021 guidance received a nice boost during its latest earnings report. Image Source: Lockheed Martin – First Quarter of Fiscal 2021 Earnings Press Release Additionally, Lockheed Martin boosted its medium-term cash from operations forecast versus previous expectations during its latest earnings report. We are big fans of Lockheed Martin’s improving outlook as that speaks very favorably towards its free cash flow growth potential over the coming years. Its medium-term cash from operations outlook can be viewed in the upcoming graphic down below.

Image Shown: Lockheed Martin recently increased its cash from operations guidance from fiscal 2021 to fiscal 2023. We view the company’s free cash flow growth outlook quite favorably, which underpins our expectations that Lockheed Martin will significantly grow its dividend over the coming years. Image Source: Lockheed Martin – First Quarter of Fiscal 2021 IR Earnings Presentation Acquisition Update Pivoting to Lockheed Martin’s pending all-cash acquisition of Aerojet Rocketdyne Holdings Inc (AJRD), Lockheed Martin’s management team noted that “as expected, both companies received a request for additional information or a second request from the Federal Trade Commission as part of the regulatory review process” during the Lockheed Martin’s latest earnings call. This effectively extended the regulatory review period under the Hart-Scott-Rodino Act as noted by management, though Lockheed Martin remains confident that this process will be completed by the second half of this year. After taking special dividend and net cash considerations into account, the deal has a total transaction value of $4.4 billion according to Lockheed Martin, though as an aside, Aerojet sees the transaction as having a total equity value of $5.0 billion (due to each firm using different calculation methods as part of their respective communication process with investors). During Lockheed Martin’s latest earnings call, management had this to say regarding the pending acquisition (emphasis added): “I'll begin today with a quick update on the strategic acquisition of Aerojet Rocketdyne that we announced in December, a transaction we believe will enhance Lockheed Martin's ability to develop and supply advanced products in support of national security and our civil space objectives. We also plan to strengthen Aerojet Rocketdyne's capabilities as a merchant supplier with improved offerings for all of its industry and government customer, which is a critical component of closing our acquisition business case.” --- James Taiclet, CEO of Lockheed Martin We like this deal given the highly complementary nature of Aerojet’s operations with Lockheed Martin’s (there is substantial operational overlap in the realm of missile systems, space, and aerospace offerings), and previously covered the pending acquisition in this article here. Given the national security significance and highly strategic nature of both Lockheed Martin’s and Aerojet’s operations, it is not surprising that regulatory bodies are scrutinizing the deal closely. We are keeping an eye on this acquisition. Space Update Lockheed Martin has and continues to play a crucial role in supporting the Mars Exploration Program run by the National Aeronautics and Space Administration (‘NASA’). This includes the work Lockheed Martin did on the Perseverance Rover that recently landed on Mars. Here is what Lockheed Martin had to say on the issue during its latest earnings call (emphasis added): “Lockheed Martin Space designed and built the Mars 2020 Aero Shell, which encapsulated both the Perseverance Rover and the innovative Ingenuity drone helicopter, protecting them during entry and decent through the Martian atmosphere. Lockheed Martin also designed and built the Mars helicopter delivery system, which transported Ingenuity on the Rover and successfully deployed the helicopter for its historic first flights on Mars. We've built aeroshell systems for every one of NASA's Mars Rovers and Landers, and we've been part of every NASA Mars mission, beginning with the Viking program in the 1970s.” --- CEO of Lockheed Martin We are incredibly intrigued by the potential upside Lockheed Martin has in the realm of space. Recently, Lockheed Martin teamed up with satellite start-up Omnispace to explore the potential for the duo to build out of a 5G network using a hybrid network that would be based around a global satellite network. Concluding Thoughts Lockheed Martin’s latest earnings report and nice guidance boost further strengthens our favorable view towards the name and its incredibly promising dividend growth potential. Though the market is anxious as it concerns the trajectory of domestic defense spending in the coming years, regardless of which political party is in control of Congress and/or the White House, defense spending will remain resilient going forward given the geopolitical backdrop, in our view. The outlook for space-related spending from both the public and private sector remains robust as well. We continue to like Lockheed Martin as an idea in the Dividend Growth Newsletter portfolio. Lockheed Martin's 16-page Stock Report (pdf) >> Lockheed Martin's Dividend Report (pdf) >> ----- Disruptive Innovation Industry – W, ZM, SPCE, ROKU, WORK, MNST, SAM, SPLK, PENN, VRSK, ICE, LULU, ESTY, DOCU, UBER, BYND Industrial Leaders Industry - MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW Tickerized for holdings in the ITA. Related ETFs: XAR, ARKX, DFEN, FITE Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT) and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment