Member LoginDividend CushionValue Trap |

Latest Report Updates Reveal Tremendous Dividend Strength at Walmart

publication date: Sep 5, 2023

|

author/source: Brian Nelson, CFA

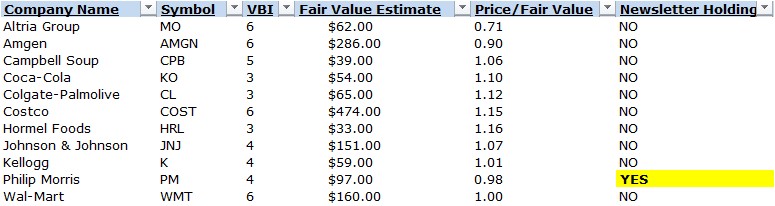

By Brian Nelson, CFA Our latest report updates showcased one very big observation, and that was the tremendous dividend strength of Walmart (WMT). The big box retailer’s Dividend Cushion ratio is rock-solid, and improved inventory management has worked wonders on operating cash flow this year, driving it to $18.2 billion during the six months ended July 31 from $9.24 billion in the same period a year ago, all the while organized retail theft remains a huge industry-wide problem. Though shares of Walmart are widely followed and are fairly valued on the basis of our discounted cash-flow process, we stand in awe of the company’s resurgence in free cash flow generation and believe that the firm offers a nice foundation to the markets. Walmart is on a short list of entities that we’d be looking to add to the Dividend Growth Newsletter portfolio at the right price, near the lower end of our updated fair value estimate range. As for the balance of consumer staples (XLP) names in this latest update, we reiterate that we’re not expecting much from the group. Most consumer staples equities are burdened with substantial net debt positions, while their long-term growth prospects are relatively muted. Their free cash flow generation may be robust, but most of their excess cash flow is absorbed by dividend liabilities that mitigate their long-term capital appreciation potential. [Remember, when it comes to the payment of a dividend, the stock price is adjusted down by the payment on the ex-dividend date. The dividend is capital appreciation that otherwise would have been achieved had the dividend not been paid.] Hormel Foods (HRL), Colgate-Palmolive (CL), Campbell Soup (CPB), Kellogg (K), and Coca-Cola (KO) are great companies, but we won’t be pulling the trigger on any of them with respect to the newsletter portfolios. What we also found to be intriguing in this latest series of report updates is the resilience of Altria’s (MO) free cash flow margins in the wake of its JUUL fiasco and the ongoing pressure from declining cigarette volumes. We continue to expect strong free cash flow performance at the company, and its equity stakes in Anheuser Busch-Inbev (BUD) and Cronos (CRON) offer additional financial capacity to continue to grow the dividend payout, despite what is becoming a rather ominous net debt position after several miscues. Phillip Morris (PM) is more capital-intensive than Altria, but the firm has a homerun with its ZYN nicotine pouch line-up, in our view, and it is becoming increasingly evident that Phillip Morris’ purchase of Swedish Match was a big win. Altria’s shares look cheap, in our view, while shares of Phillip Morris look about fairly valued. We include Phillip Morris as an idea in the High Yield Dividend Newsletter portfolio. The data for these companies will be updated on their respective web pages this weekend. Download their updated 16-page reports (pdf) by selecting the link below. ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment