Member LoginDividend CushionValue Trap |

Large Cap Growth Dominates, MLPs Have Suffered

publication date: Dec 1, 2021

|

author/source: Brian Nelson, CFA

---

---

$1,000/year. 4 ideas per month and more!

---

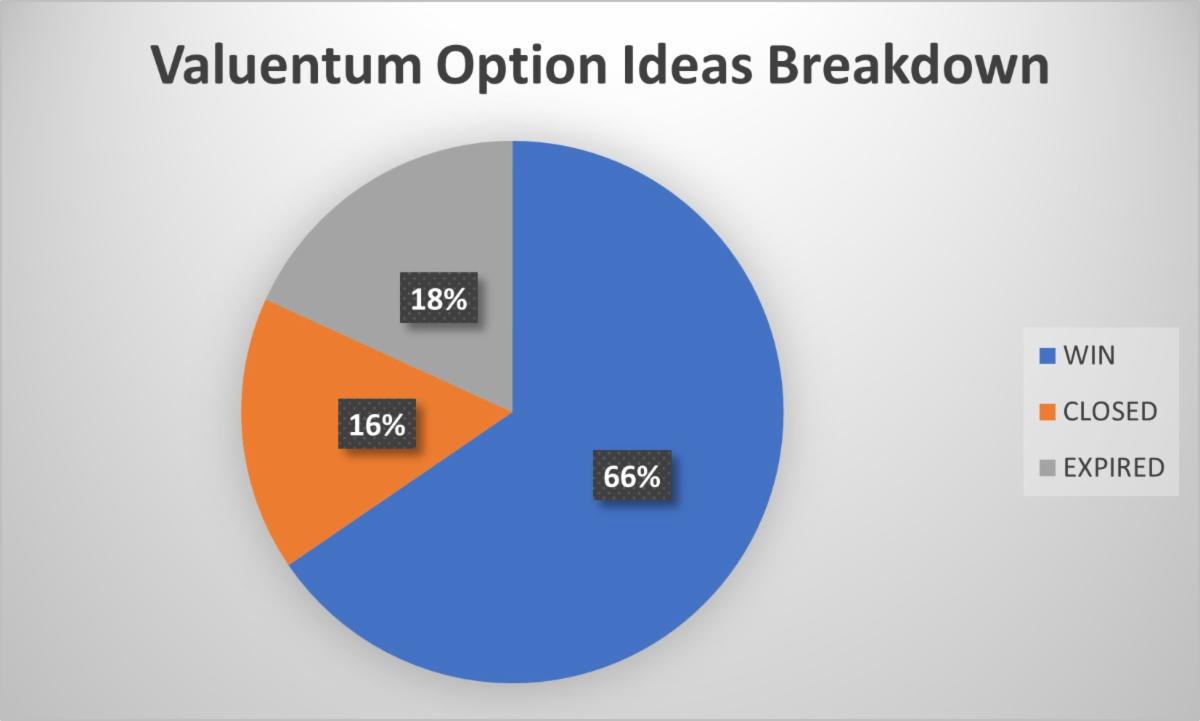

Image: Win = The options contract was closed as a win. Closed = the options contract was closed at a loss. Expired = The options contract expired worthless. Pie chart above does not consider ideas still open. Data through October 26, 2021. Results are hypothetical. No trading is taking place. Past performance is not indicative of future performance.

---

Please note that with options trading, investors can lose their entire premium. Don't ever trade with money that you can't afford to lose. Valuentum is an investment research publisher and accepts no liability for how readers may choose to utilize the content. By continuing with an additional options commentary membership, you accept our Terms and Conditions. If you do not agree with the Terms and Conditions, you must stop using this service and cancel your additional options commentary membership.

---

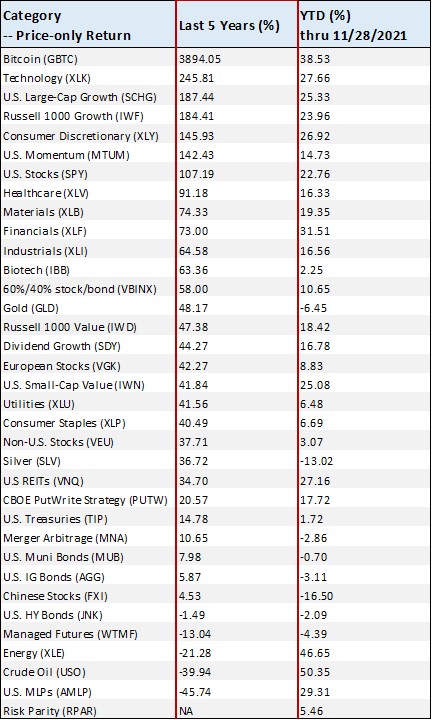

Image source: Seeking Alpha, retrieved November 28. Our call to overweight areas of large cap growth and underweight overleveraged areas such as MLPs have served members quite well the past 5 years. Chinese equities and bonds have also languished relative to more attractive large cap growth in recent years.

---

Hi everyone:

---

Hope you are doing great!

---

We just finished sending out an email that houses the second set of options ideas for the month of November and another email regarding the Exclusive publication, closing one of our short ideas for a very nice "hypothetical gain." If you're a member to these services and have not received them, please just let us know, and we can look into your membership.

---

The monthly options ideas continue to deliver for members to our additional options commentary (this is an add-on to your existing membership), and frankly, the win rates* for the Exclusive publication have been better than we could have ever imagined, clocking in at ~89% and 90%+ for capital appreciation and short ideas, respectively (through August 2021). It's hard to believe that this type of "performance" is happening behind the scenes if you're not a member to these services, but those that are paying attention have been reaping the rewards.

---

As for the premium Valuentum service, it's very clear just how much value we've added the past 5 years when taking a broad look at the performance of certain strategies (as shown in the image immediately above). You'd be hard-pressed not to find our newsletter portfolios heavily exposed to the area of large cap growth at any time during the past 5 years, and you'd have to be living under a rock to not have heard about our "call heard 'round the world" on MLPs in 2015 (1).

---

You'll find large cap growth, an area that includes some of our favorites including Facebook (FB), Apple (AAPL), Alphabet (GOOG) and Microsoft (MSFT), right about near the top, as we would expect, and MLPs (AMLP) right about near the bottom, as we would expect. The hunt for interesting ideas won't ever stop of course, but we think it is valuable to identify the best ideas, even if they are right in front of you. This sometimes is the hardest thing to do.

---

Alphabet, for example, has advanced an incredible 65-70% so far this year!!! The stock has been right on top of the Best Ideas Newsletter portfolio and has been there for a long time! We continue to believe that large cap growth has a lot of room to run, and we wouldn't have written the book Value Trap: Theory of Universal Valuation if we thought all you had to do was buy stocks with low P/E ratios to be successful. Some of those stocks are quintessential value traps!

---

One doesn't have to look too far to see large cap growth outperforming small cap value in the image above either, by some 145+ percentage points the past 5 years. All of this during one of the most volatile periods in market history that was followed by one of the strongest bull markets in market history, too. It seems like so long ago now, but do you remember when we called the COVID-19 crash the weekend before the fallout (2), and then pretty much went all-in in April 2020 (3). A lot of advisors have mentioned how grateful they were for the conviction we had following the crash to stay bullish on the equity markets when we did.

---

But that may be neither here nor there. Great options ideas, fantastic win rates in the Exclusive, identifying the best and worst areas for our premium members, calling the crash of 2020 and the quickest bull market in history, but how can we forget -- the continued income generation for High Yield Dividend Newsletter members! We've hit the ball out of the park in that publication with some of our high yield dividend ideas, not the least of which are the storage REIT plays such as Public Storage (PSA) and CubeSmart (CUBE), which have advanced more than 40% and 60%, respectively, thus far this year.

---

2021 has been a fun year thus far, but it hasn't been easy. We compete with a lot of other blogs out there that scream louder and make more noise that we do. Some of those blogs have steered investors awry. Can you imagine being long small cap value, or holding MLPs all the way down, or what about holding the wrong REITs? The number of REIT dividend cuts, including those from mortgage REITs, have devastated so many portfolios during the COVID-19 meltdown.

---

Interestingly, almost all of the capital appreciation corresponding to REIT equities the past 5 years has come in 2021. We simply couldn't stomach the idea of readers missing out on one of the biggest bull markets in history led by large cap growth by holding REITs that cut their payouts. Even those REITs that managed to eek by with their dividends didn't do particularly well. Sure, REITs are a great asset class, but investors have to be realistic. Their dividend payouts aren't as safe as many believe they are (4).

---

REITs pay out 90% of annual taxable income and therefore are unable to meaningfully reinvest internally-generated funds, resulting in external capital-market dependence. The weak internal cash-flow retention of most REITs translates into poor raw, unadjusted Dividend Cushion ratios, which could become severe during the depths of the real estate cycle (as was witnessed during the COVID-19 meltdown). Even though a REIT's operating cash flow may be robust, the lack of cash accumulation on the balance sheet and the massive debt needed to purchase/develop new properties can become restrictive. The adjusted Dividend Cushion ratio accounts for expectations of continued access to the capital markets, which while "normal," cannot be guaranteed in times of tight credit.

---

The Valuentum Buying Index continues to perform as expected, with two of the biggest winners being Korn Ferry (KFY) and Alphabet -- both ideas being in the Best Ideas Newsletter portfolio. We like to use the Valuentum Buying Index as a screening tool to add ideas to the newsletter portfolios. We don't ever use the index by itself and always apply an important qualitative portfolio management overlay. KFY registered a 9 on the Valuentum Buying Index in the low $40s (December 2020) and has catapulted north of $70 of late. GOOG registered a 10 at ~$1,100 (January 2019) and is now trading at ~$2,855. It's important to pay attention to what we're doing because the performance has been awesome.

---

We've said the same thing to our options commentary members and Exclusive publication members that we're not reading much into the Omicron variant, and a more hawkish Jerome Powell isn't much to worry about. Benchmark 10-year Treasury rates are ~1.44%, which is ultra low and below the highs of this year, while inflationary pressures will result in pricing power by many, pushing nominal earnings higher. All things considered, higher earnings and lower discount rates is a positive for equities, even if the Fed starts tapering bond purchases a bit earlier than expected.

---

What gives us confidence that this bull market still has legs, and large cap growth, in particular, is that large cap growth (made up of the largest companies in the market) is full of moaty, competitively-advantaged companies with tremendous balance sheets (with huge net cash positions) and fantastic free cash flow generation (net cash from operations less all capital spending) that are tied to long-term secular growth trends. Facebook and Alphabet are severely underpriced, while Apple and Microsoft couldn't be healthier. The stock prices of these entities may have run significantly, but just because their price advances have been great doesn't mean that they still aren't underpriced.

---

The secret to market success the past decade has been rather simple, and the discounted cash flow (DCF) model and enterprise valuation have explained most all of it. Those entities with substantial cash-based sources of intrinsic value -- net cash on the books and tremendous free cash flow generation (in excess of dividends, where applicable) -- or more appropriately labeled large cap growth have trounced the opposite, those with net debt positions and free cash flow that barely covers cash dividends paid or doesn't, as in MLPs and REITs (and arguably the consumer staples and utilities sectors).

---

It's very easy to pick a stock we don't cover to talk about its performance (for every one that does well, there may have been 100 others with similar characteristics that failed) or another stock we might not have done as well with this year, but at the end of the day, one is stretching for reasons unknown. We're all on the same team here, and with everything we do, we put investors first. We're not selling you anything, but rather preaching about the realities of the stock market and what truly drives prices and returns. Value Trap hopefully opened your eyes to a great many things, but I have to tell you something: You ain't seen nothing yet! (5)

---

On behalf of our team at Valuentum, we hope you had a wonderful Thanksgiving holiday weekend, and we wish you the very best this holiday season. We're hoping for a nice Santa Claus rally! Godspeed, and thank you for your membership and attention these past many years!

---

---

Kind regards,

---

---

Brian Nelson, CFA

President, Investment Research

brian@valuentum.com

---

---

(1) The Bear Case Against Kinder Morgan, Barron's (June 11, 2015)

---

(2) Is a Stock Market Crash Coming? -- Coronavirus Update and P/E Ratios (February 22, 2020)

---

(3) ALERT: Going to “Fully Invested” -- The Fed and Treasury Have Your Back (April 29, 2020)

---

---

(5) Asset Allocators Fail, Advisors Should Pick Stocks, Save Investors $34 Billion Annually (November 17, 2021)

---

* Win rate: The percentage of ideas highlighted in the Exclusive that have moved in the direction of our thesis (i.e. up for capital appreciation ideas and down for short idea considerations) through the current price or closed price, with consideration of cash and stock dividends. Success rates do not consider trading costs or tax implications. Trading is simulated. Past results are not a guarantee of future performance.

----------

Image Source: Value Trap ---------- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment