Image Source: ExxonMobil Corporation – 2021 Investor Day Presentation

By Callum Turcan

On June 27, we added shares of ExxonMobil Corporation (XOM) as an idea to the Best Ideas Newsletter portfolio and the Dividend Growth Newsletter portfolio (link here). The backdrop for the energy complex has improved considerably in recent months. Raw energy resources pricing has surged in the wake of demand for refined petroleum products beginning to recover in earnest, while demand for various petrochemical products is also on the rise. Near-term Brent and WTI futures are trading north of $70 a barrel as of this writing, keeping in mind Brent averaged ~$60-61 per barrel and WTI averaged ~$57-$58 per barrel during the first three months of 2021.

On the basis of stronger upstream performance alone (upstream activities involve the extraction of raw energy resources from the ground), ExxonMobil’s financials should show significant improvement in the second quarter onwards versus its performance in the first quarter of this year. The company published an 8-K SEC filing on June 30 highlighting that this was estimated to be the case in the second quarter. Combined with the improving landscape for downstream (refineries) and petrochemical (includes the production of plastics, detergents, lubricants, oils, and numerous other products) operations in recent months, ExxonMobil’s outlook is incredibly bright as it concerns both its capital appreciation and dividend growth upside.

Financial Snapshot

ExxonMobil generated $6.9 billion in free cash flow during the first quarter of 2021, up from just $0.3 billion in the same period the prior year when the coronavirus (‘COVID-19’) pandemic began to slow the global economy to a crawl. Please note that working capital movements and the timing of capital expenditures often have an outsized influence on an energy firm’s quarterly financials, though the trajectory is crystal clear, ExxonMobil is well on its way to recovering from the COVID-19 pandemic. ExxonMobil spent $3.8 billion covering its total dividend obligations in the first quarter of 2021 and spent a negligible amount buying back its stock during this period. Both of these activities were fully covered by its free cash flows with room to spare, highlighting the company’s potential dividend growth upside going forward.

Though ExxonMobil’s net debt load stood at roughly $59.8 billion at the end of March 2021 (inclusive of short term debt), we view its burden as manageable given its impressive free cash flow generating abilities and bright outlook. In our view, ExxonMobil would be wise to take advantage of the current favorable pricing environment for raw energy resources and pare down its net debt load over time.

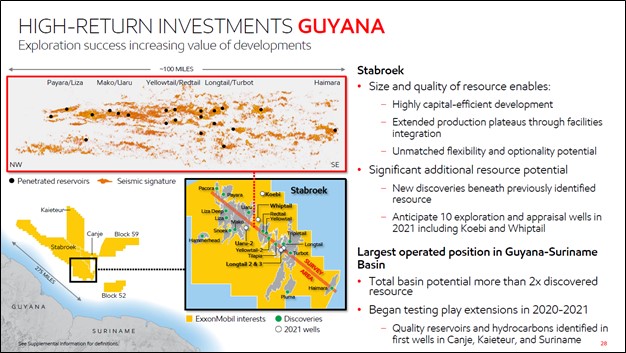

Guyana

One of ExxonMobil’s most promising assets is its upstream position in Guyana, a country in the northern portion of South America. Back in 2015, an ExxonMobil-led venture struck oil off the coast of Guyana, the first discovery of its kind in the country. Since then, the venture has had 15+ exploration successes in the offshore Stabroek Block, which encompasses 6.6 million acres of Guyanese waters, locating billions upon billions of extractable crude oil resources (with a relatively low breakeven cost).

ExxonMobil owns 45% of the venture and acts as the operator of the endeavor, with Hess Corporation (HES) and CNOOC Limited owning the remainder. The Liza field is currently one of the biggest opportunities in the region, though there are several others the venture aims to bring online over the coming years.

Image Shown: An overview of ExxonMobil’s intriguing upstream opportunities in Guyana. Image Source: ExxonMobil – 2021 Investor Day Presentation

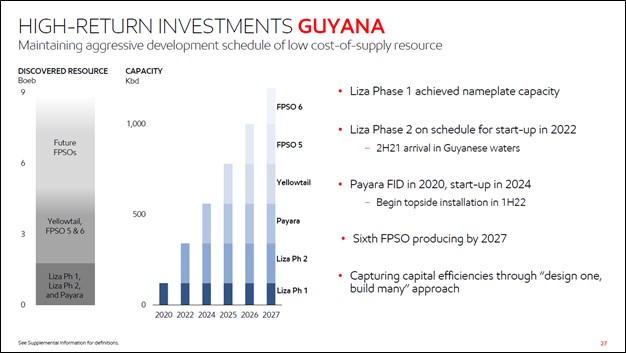

In late 2019, the Liza field achieved first-oil when the first phase of the Liza development came online. At its peak, this development phase will bring 120,000 barrels of gross crude oil production capacity online however, we must stress that this is only the beginning. The Liza Phase Two project remains on track to achieve first-oil by 2022, which will add an additional 220,000 barrels of gross crude oil production capacity to the region at its peak.

By 2027, ExxonMobil aims to bring at least six upstream developments in the region online, made possible by deploying floating production storage and offloading (‘FPSO’) vessels to the area. That could see the ExxonMobil-led venture’s total gross production capacity surge past one million barrels of oil equivalent per day (most of which would be represented by crude oil production) before the end of the decade. ExxonMobil sees room for possibly ten FPSO vessels in the region with the Payara, Yellowtail, and Redtail fields representing additional development opportunities. The current Payara field development plan involves utilizing an FPSO with the ability to produce 220,000 barrels of crude oil per day on a gross basis, with ExxonMobil targeting first-oil by 2024.

Image Shown: ExxonMobil’s upstream production upside in Guyana is enormous and needle-moving, even for a firm as giant as ExxonMobil. The oil-rich nature of its upstream operations in Guyana underpins the lucrative economics of the company’s ambitions in the region. Image Source: ExxonMobil – 2021 Investor Day Presentation

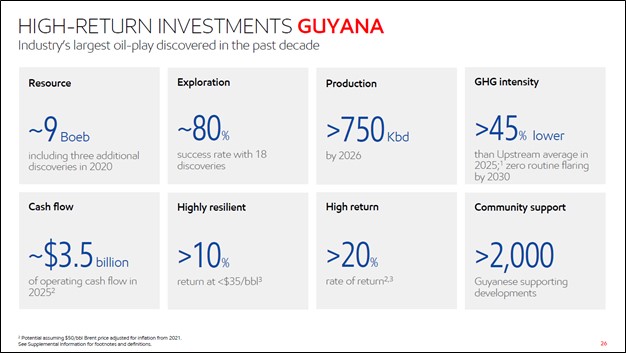

Guyana is quickly becoming a heavyweight in the world of oil production and ExxonMobil has played a key role in making this story possible. Even for a company as large as ExxonMobil, the opportunities in the Stabroek Block are needle-moving. By 2025, ExxonMobil views its upstream Guyanese assets generating approximately $3.5 billion in operating cash flow assuming that its current development timetable is met and a $50 per barrel Brent price, adjusted for inflation from 2021 levels. Should realized crude oil prices come in better than these assumptions, there is room for an immense amount of additional upside.

In our view, $50 Brent is a rather conservative estimate as ExxonMobil is attempting to highlight how its upstream ambitions in Guyana are a “winning” strategy in almost any raw energy resources pricing environment. ExxonMobil sees its upstream Guyanese assets generating a 10%+ return when crude oil prices are trading around $35 per barrel, meaning that these assets are effectively breaking even at that price point. Though the true breakeven level is debatable, the stellar economics these assets offer ExxonMobil and ultimately its investors is straightforward. Large oil-rich upstream production streams and economies of scale make Guyana a top tier energy producing region, and one that is incredibly appealing to energy giants like ExxonMobil.

Image Shown: An overview of some of the key financial and operational metrics of ExxonMobil’s upstream assets in Guyana. Image Source: ExxonMobil – 2021 Investor Day Presentation

Concluding Thoughts

Over the past decade, one of ExxonMobil’s biggest struggles is managing its upstream production levels as natural declines from mature fields have steadily seen its company-wide output shift lower. As development activity ramps up in Guyana and elsewhere, including the prolific Permian Basin region in the US where ExxonMobil has an enormous presence, the company should be able to reverse that trajectory. Having greater exposure to the energy complex space better positions our newsletter portfolios to navigate potential headwinds from inflationary pressures, and we like ExxonMobil as a heavyweight in this arena. Our fair value estimate for ExxonMobil sits at $83 per share, comfortably above where shares of XOM are trading at as of this writing.

Downloads

ExxonMobil’s 16-page Stock Report >>

ExxonMobil’s Dividend Report >>

—–

Oil and Gas Complex Industry – BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Related: BNO, HES, USO, XLE, XOP

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.