Member LoginDividend CushionValue Trap |

Deutsche Bank is Muddling Along, Aiming for Self Help

publication date: Aug 6, 2020

|

author/source: Matthew Warren and Brian Nelson, CFA

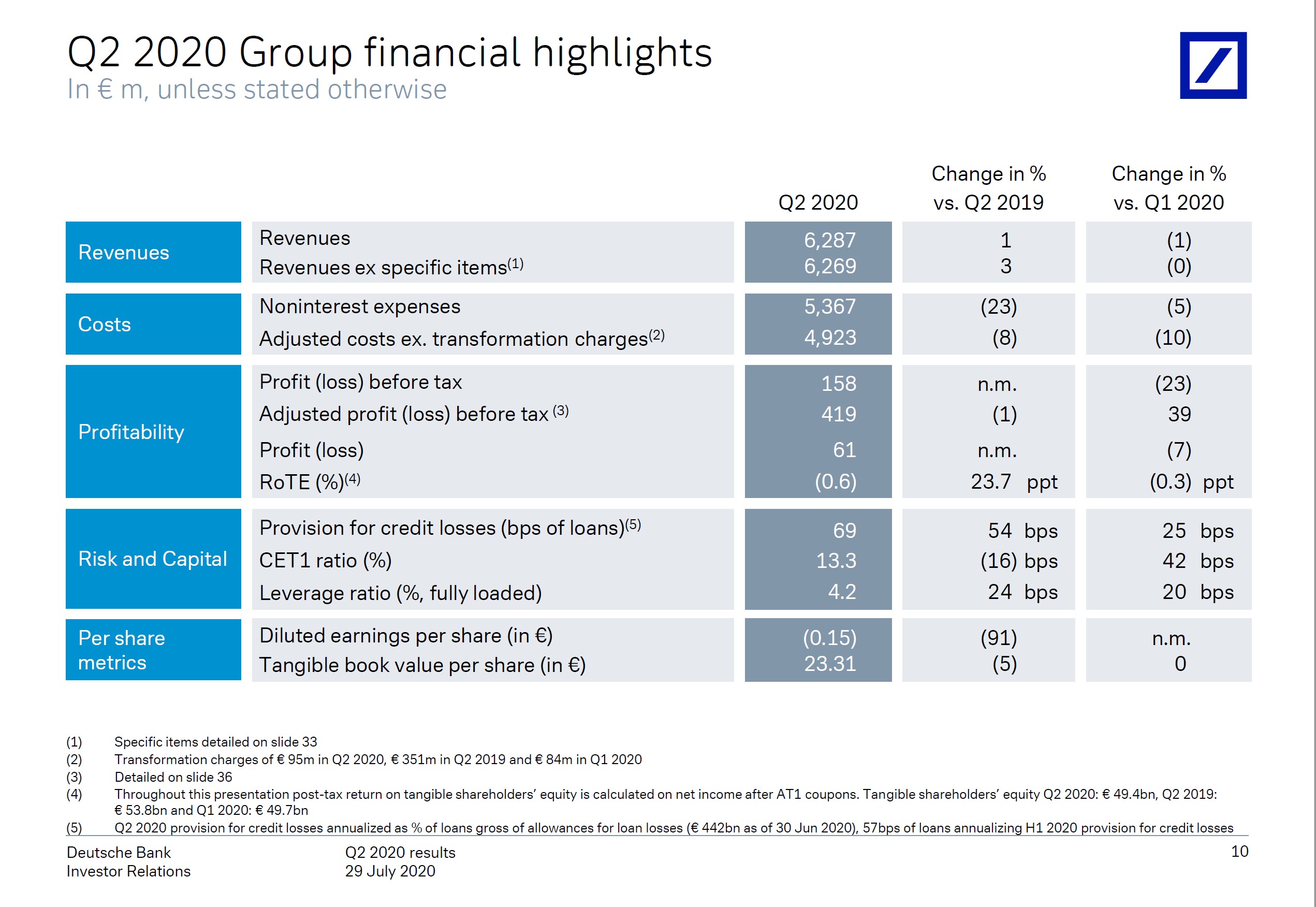

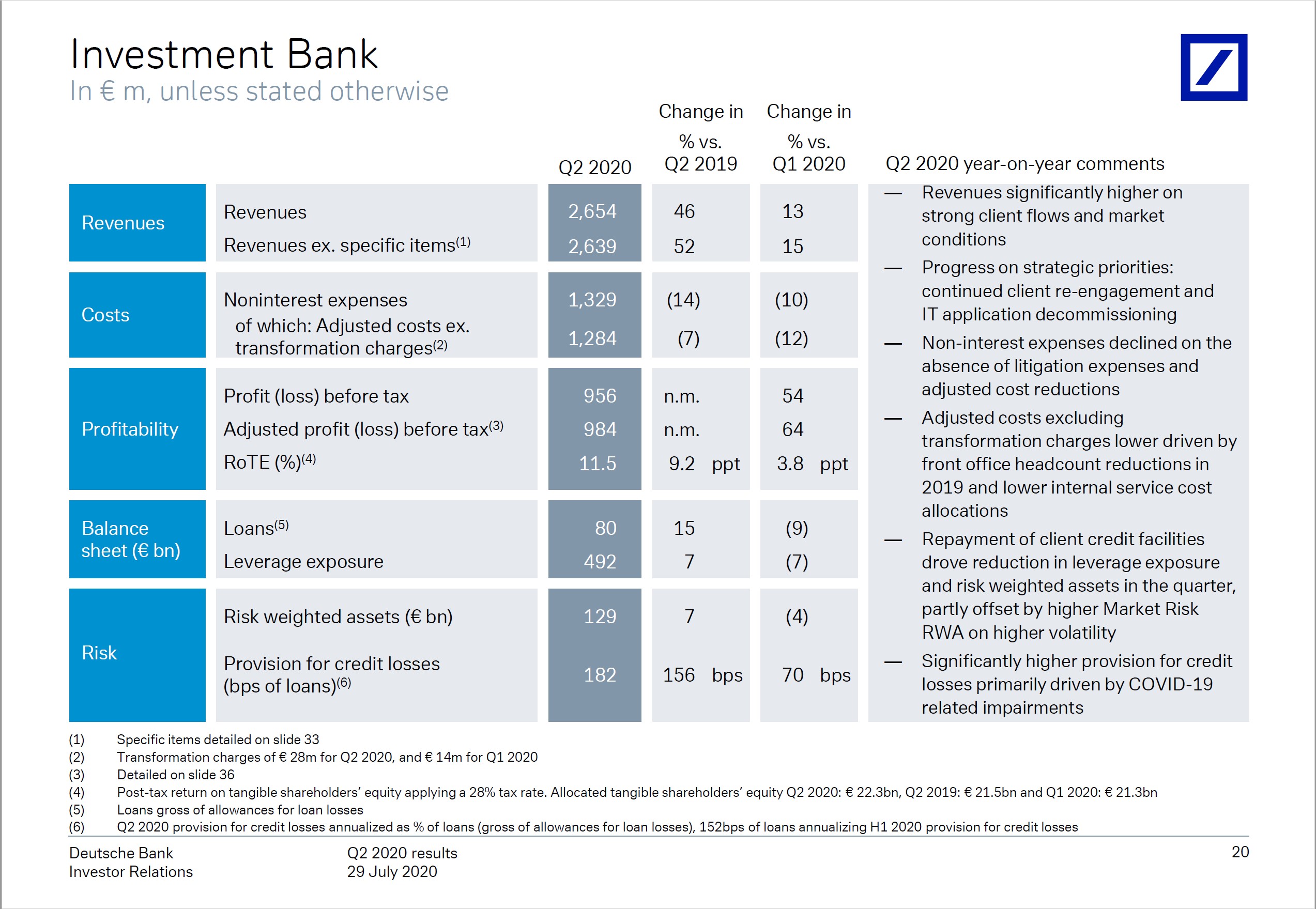

Image Shown: Deutsche Posted Meager Second Quarter Results. Image Source: Deutsche Bank 2Q2020 Earnings Presentation While Deutsche Bank is working on a five pillar self-help plan with the goal of an 8% return on tangible equity by 2022, and seems to be making some progress on these fronts, the fact that the end goal is so timid shows just how overbanked the German and greater European markets are. The CEO is calling for consolidation in the medium term, but it cannot come fast enough, especially for those banks with very little in the way of earnings power, which must deal with a pandemic and the broad effect on the economy and the client base in the meantime. By Matthew Warren and Brian Nelson, CFA Deutsche Bank (DB) posted an unimpressive set of second-quarter results July 29, though the bank seems to be making some progress on its self-help initiatives. Revenue was up 1% versus last year thanks to booming investment banking results, but profits were only $61 million euros in the quarter. As one can see in the graphic above, there simply is not much earnings power under the hood at this bank (diluted earnings per share was negative in the quarter). The upcoming graphic down below shows it was Deutsche Bank’s Investment Bank that saved the performance in quarter, with revenue up 46% versus last year and nearly one billion euro of profit before tax. Unfortunately, this profitability was largely washed away by the Private Bank segment’s loss as well as the Capital Release unit’s loss. This bank is not firing on all cylinders!

Image Shown: Deutsche Bank Investment Bank Revenues were up 46% versus last year. Image Source: Deutsche Bank 2Q2020 Earnings Presentation

While Deutsche Bank is working on a five pillar self-help plan with the goal of an 8% return on tangible equity by 2022, and seems to be making some progress on these fronts, the fact that the end goal is so timid shows just how overbanked the German and greater European markets are. The CEO is calling for consolidation in the medium term, but it cannot come fast enough, especially for those banks with very little in the way of earnings power, which must deal with a pandemic and the broad effect on the economy and the client base in the meantime. Concluding Thoughts We've grown less and less excited about the prospects of the global banking system following COVID-19. There have been high-profile dividend cuts among the U.S. financials sector to shore up their capital bases, and more recently, the European Central Bank has asked that many of the European banks stop returning capital to shareholders until 2021. These days, the banking system is regulated to the point where the government is making, or at least pressuring many firm-specific decisions. In light of many of the government programs launched to support the economy during this pandemic, especially in the U.S., the banks have largely become extensions of government policy, for better or worse. We generally don't like the banking sector due to regulatory intervention, the arbitrary nature of their cash flows, and their lack of resilience during times of economic crises. We're steering far clear of Deutsche Bank. View our latest video on how banks/financials performed during the COVID-19 crisis here.

--- Related: BNPQF, IITOF, SAN, ING, CRARF, SCGLF, BBVA, UNCFF, CRZBF, BCS, EUFN Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment