On April 29, Deutsche Bank reported another measly quarter in a long string of them. While Deutsche Bank is well-capitalized with a Common Equity Tier I ratio of 12.8% and its Investment Banking segment grew earnings nicely this quarter during rapid client trading and bond origination activity as the markets melted down in March, it suffers from a lack of earnings power at this stage. We blame this on the bank itself, but also on the overcapacity in European banking in general, which pressures margins across the entire industry.

By Matthew Warren

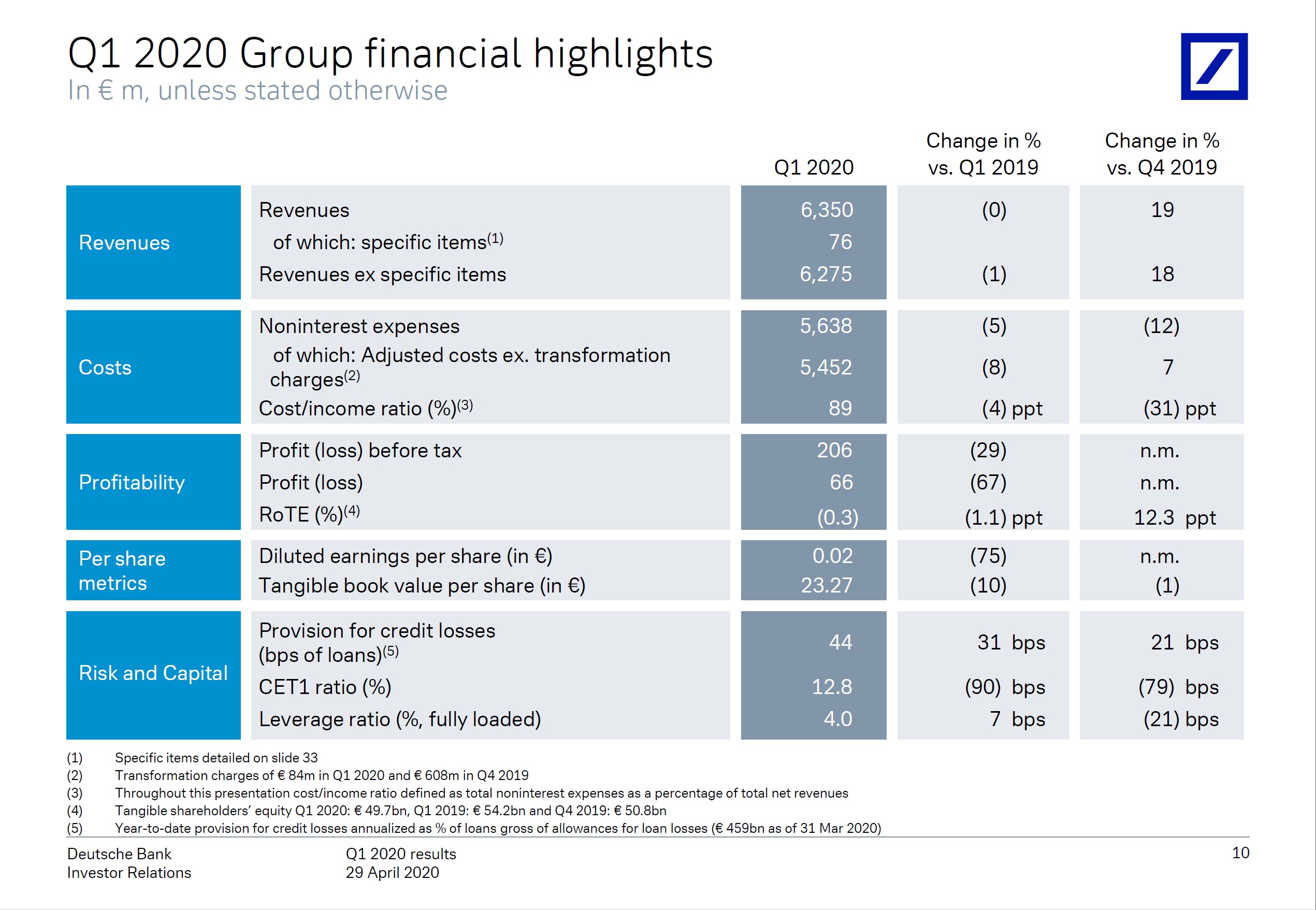

On April 29, Deutsche Bank (DB) reported another measly quarter in a long string of them, with revenue in the first period of 2020 flat at EUR 6.350 billion and profit of only EUR 66 million. As one can see in the graphic below, Deutsche has one of the worst cost/income ratios amongst all the big global banks at 89%, and is in the process of a multi-year cost-cutting exercise with nine quarters in a row of year over year cost reduction. Having put head count reduction on hold during the Covid-19 pandemic, this task will become harder, though management continues to promise delivery of non-comp cost reductions on things like travel & entertainment and real estate. While T&E is easy to reduce right now, we are skeptical about the longevity and sustainability of such cost reductions.

Image Source: Deutsche Bank 1Q2020 Earnings Presentation

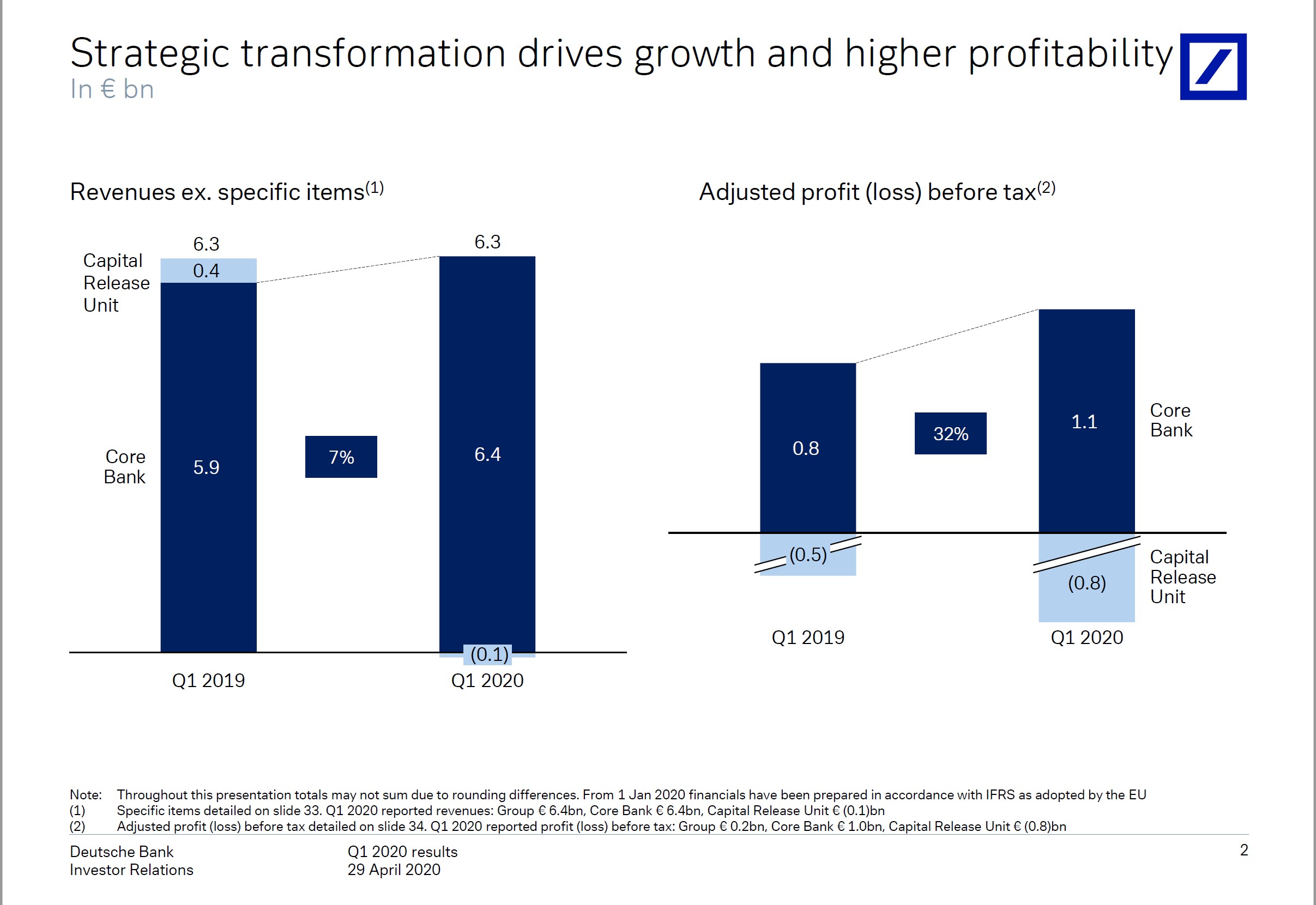

In an effort to convey hope to its listless investor base, Deutsche Bank likes to present its revenue and profit for its “Core Bank” and “Capital Release Unit,” which is basically the portion of the bank that management is trying to wind down. As one can see in the graphic below, this paints a better picture of underlying profitability, though only time will tell if the firm can successfully wind down the Capital Release Unit and get rid of the costs allocated to it.

Image Source: Deutsche Bank 1Q2020 Earnings Presentation

Though Deutsche Bank is well-capitalized with a Common Equity Tier I ratio of 12.8% and its Investment Banking segment grew earnings nicely this quarter during rapid client trading and bond origination activity as the markets melted down in March, it suffers from a lack of earnings power at this stage. We blame this on the bank itself, but also on the overcapacity in European banking in general, which pressures margins across the entire industry.

The other main risk with European banks (EUFN) is that periphery country bond spreads could blow out again and damage the banks that hold them. Because Germany (EWG) is relatively stronger, the risk for Deutsche Bank is more that its periphery banking peers become a big enough problem that it spills across the broader continent. This is a key risk that bears watching as we continue to navigate the pandemic-dented global economy.

Related: SCGLF, CRARF, UNCFF, BNPQF, SAN, ING, UBS, CS, BBVA, SC, ALIZF, BPESF, BSAC, EUFL

—

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.