|

|

Recent Articles

-

Apple iPhone Supply Disruptions Not Likely to Hurt Markets with Overall Holiday Sales Reportedly Strong

Apple iPhone Supply Disruptions Not Likely to Hurt Markets with Overall Holiday Sales Reportedly Strong

Dec 4, 2022

-

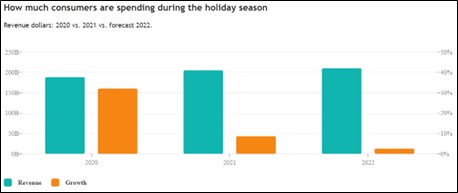

Image: Holiday sales are expected to expand ~2.5% in 2022 over very strong growth in 2021 and 2020. Image Source: Adobe.

Apple's sales of the iPhone 14 Pro and iPhone 14 Pro Max will come in lower than expected this holiday season due to labor unrest in Zhengzhou, but holiday sales for 2022 overall look fairly solid with Adobe Analytics estimating 2.5% growth over 2021, which, itself, was a fantastic year. A prior warning about holiday sales from Target Corp. appears to have been overblown given the sales strength witnessed during Black Friday and Cyber Monday across the retail landscape this year. It may be too early to say that the markets have definitely bottomed as economic data remains inconclusive, but holiday sales so far in 2022 and an overall resilient job market are giving investors something to cheer about in what has turned into an otherwise loathsome year.

-

Dollar General Resets Expectations; We’re Watching Free Cash Flows Closely

Dollar General Resets Expectations; We’re Watching Free Cash Flows Closely

Dec 4, 2022

-

Image Source: Valuentum.

Though comparable store sales have been consistent over the years at Dollar General, we think the concept is getting “tired” as inflation eats into its value offerings. Inventories are ballooning at the firm and internal supply chain problems will eat into earnings during the fourth quarter of fiscal 2022, while the firm continues its aggressive store expansion efforts (with 1,050 new stores expected in fiscal 2023). Dollar General remains an idea in the simulated Best Ideas Newsletter portfolio, but it could become a source of “cash” if inventories and free cash flow generation become a bigger issue.

-

Dividend Increases/Decreases for the Week of December 2

Dividend Increases/Decreases for the Week of December 2

Dec 2, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

-

UnitedHealth Group Sets Bar Low with Newly Issued 2023 Guidance; We Expect Upward Revisions Throughout the Year

UnitedHealth Group Sets Bar Low with Newly Issued 2023 Guidance; We Expect Upward Revisions Throughout the Year

Dec 1, 2022

-

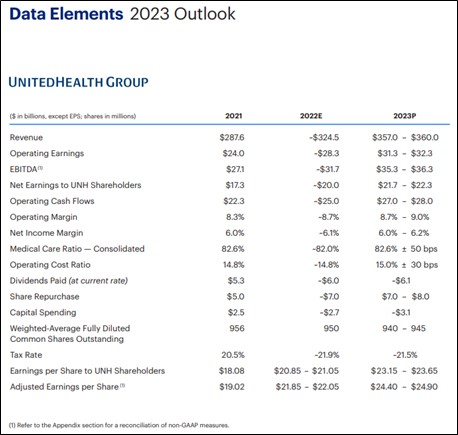

Image: UnitedHealth Group issued a strong outlook for 2023. We continue to like shares in the simulated Dividend Growth Newsletter portfolio. Image Source: UnitedHealth.

We are huge fans of UnitedHealth Group, and its dividend growth potential remains immense. Since 2010, UnitedHealth Group has increased its dividend at a double-digit pace each year. The top end of our fair value estimate range sits at $618 per share of UnitedHealth Group, indicating that the health care giant also possesses substantial capital appreciation upside potential as well. Looking ahead, we expect that UnitedHealth Group will grow its dividend at a robust pace, aided by its strong free cash flow generating abilities and pristine balance sheet. Shares yield ~1.2% at the time of this writing.

|