|

|

Recent Articles

-

Great Year for (Our) High Yield Dividend Ideas! Inquire about the High Yield Dividend Newsletter!

Great Year for (Our) High Yield Dividend Ideas! Inquire about the High Yield Dividend Newsletter!

Nov 30, 2022

-

Image: The year-to-date simulated estimated performance of the High Yield Dividend Newsletter portfolio, which continues to hold up well during 2022, while offering an attractive forward estimated dividend yield. Simulated estimated performance is calculated by Valuentum and has not been externally audited. Inquire about the High Yield Dividend Newsletter. The next edition will be released December 1, 2022.

Based on our estimates, the simulated High Yield Dividend Newsletter portfolio is down ~4.4% on a price-only basis so far in 2022 on an interim basis, using data from the trading session November 29 (retrieved from Seeking Alpha). By comparison, according to data from Morningstar, the Vanguard 60/40 stock/bond portfolio (VBIAX) is down more than 15% so far this year (on a price-only basis), the Vanguard Real Estate ETF (VNQ) is down 26% year-to-date (on a price-only basis), while the iShares Mortgage Real Estate Capped ETF (REM) is down ~30% on a year-to-date basis. Each simulated newsletter portfolio at Valuentum targets a different strategy, whether long-term capital appreciation, dividend growth, income/high yield, and the like. Generally, for the simulated Best Ideas Newsletter portfolio, it targets long-term capital appreciation potential (not in one year or a couple years, but in the long run). During the past five years...an ETF that tracks the area of large cap growth is up more than 70%, while an ETF that tracks the area of dividend growth has advanced ~40%, an ETF that tracks small cap value is up ~17% during the past five years, while an ETF that tracks the area of the highest-yielding S&P 500 companies is up just 12% -- according to data from Morningstar. REITs, as measured by the VNQ, are up just 3% over the past five years. We nailed the call on the drawdown in the 60/40 stock/bond portfolio this year, and readers should continue to question the merits of modern portfolio theory, not merely state that now the 60/40 stock/bond is cheap (after the huge decline)! It's extremely important to continue to test whether something makes sense or not. If interest rates continue to rise, we think bond prices will continue to face pressure. Sometimes, a few of our best ideas don't work out (as in any year), but that's why we use the simulated (and diversified) Best Ideas Newsletter portfolio to measure the success of the VBI. We're not a quant shop. We believe in the qualitative overlay. For example, there are highly-rated ideas that don't make the cut for the simulated Best Ideas Newsletter portfolio and there are low-rated ideas that find their way into the newsletter portfolio because they add a diversification benefit. Given the massive up years in the broader markets in 2019, 2020 and 2021, with the simulated Best Ideas Newsletter portfolio estimated to be down in the low-double-digits so far this year (approximately ~10%-12%, by our latest tally) -- and this estimate includes the missteps in Meta Platforms (META), PayPal (PYPL), and Disney (DIS) -- this is actually pretty awesome, in our view -- especially considering all that went wrong in other areas such as crypto, REITs, mortgage REITs, disruptive innovation stocks, Chinese equities, and the list goes on and on. A low double-digit estimated percentage decline, as that "experienced" in the simulated Best Ideas Newsletter portfolio so far in 2022 after huge up years, can be viewed as just part of a long-term journey that targets capital appreciation. For context, Berkshire Hathaway's stock price was nearly halved in 1974. It's okay to time the markets a bit as we did last August, but staying engaged with investing over the long haul is a key part of the recipe for success, as it was for Berkshire investors. For readers seeking income and high yield dividend ideas, please consider subscribing to our High Yield Dividend Newsletter. 2022 hasn't been an up year for a lot of investors, but it shouldn't have been a disaster either, and we've done a really great job avoiding the worst areas. We're interested in hearing how you are using our service, so that we can continue to get better. All told, we're excited about 2023, and we hope you are too!

-

Deere’s Incredible Pricing Power Shines Through in Fiscal Fourth Quarter

Deere’s Incredible Pricing Power Shines Through in Fiscal Fourth Quarter

Nov 28, 2022

-

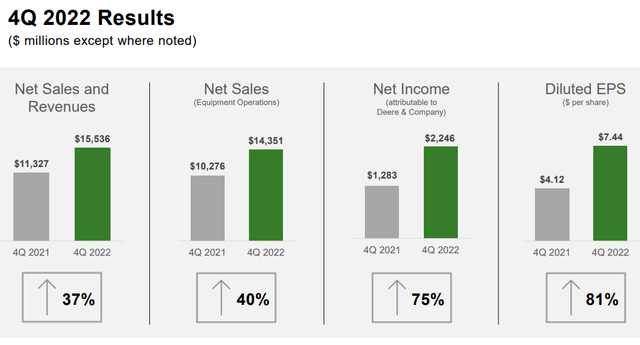

Image: Deere put up excellent fiscal fourth-quarter results for the period ending October 30, 2022. The company's pricing power is phenomenal. Image Source: Deere.

Deere & Company put up excellent fiscal fourth quarter results November 23, and the highlight of the quarter was the firm’s tremendous pricing power. Its outlook for fiscal 2023 was solid, too, and we expect considerable operating income expansion on the back of strong double-digit top-line growth as supply chain issues fall to the wayside in the coming quarters as economic conditions normalize. Deere has a sizable net debt position and traditional free cash flow faced pressure on a year-over-year basis during fiscal 2022, but the company may be one of the best ways to combat inflation through equities. Management also expects operating cash flow to bounce back to the range of $9-$9.5 billion in fiscal 2023 from $4.7 billion in the recently completed fiscal 2022. For us, however, Deere isn’t a great fit for the simulated newsletter portfolios given its pricey stock and comparatively small dividend yield of ~1%, but its outlook bodes well for the agricultural supply chain for fiscal 2023. The high end of our fair value estimate for Deere still resides below its current price of $440 per share, meaning investors are paying up to own Deere at the moment.

-

2022 Showcased the Value of a Valuentum Membership

2022 Showcased the Value of a Valuentum Membership

Nov 27, 2022

-

In bull markets, almost everyone is a winner. But 2022 was different. This year was a big test for Valuentum, and we passed with flying colors. We delivered across the board during the year from ideas in the Exclusive publication and the efficacy of the dividend growth methodology to the resilience of high yield ideas and simulated Best Ideas Newsletter portfolio relative performance--despite setbacks from Meta Platforms, PayPal, and beyond. Tune in to the latest video installment from Valuentum. Thanks for listening!

-

Dividend Increases/Decreases for the Week of November 25

Dividend Increases/Decreases for the Week of November 25

Nov 25, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

|