Image: UnitedHealth Group issued a strong outlook for 2023. We continue to like shares in the simulated Dividend Growth Newsletter portfolio. Image Source: UnitedHealth

By Valuentum Analysts

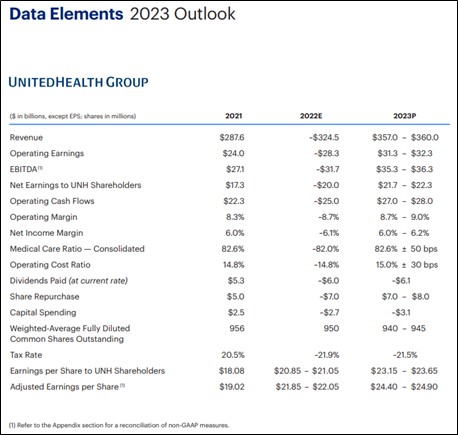

On November 28, UnitedHealth Group (UNH) reiterated its guidance for fiscal 2022 in advance of its 2022 Investor Conference and issued what we believe to be a conservative outlook for 2023. UnitedHealth Group operates two complementary businesses, Optum, which provides technology and data to health providers to offer guidance and tools, and UnitedHealthcare, which offers health benefits. The company is a key “position” in the simulated Dividend Growth Newsletter portfolio and yields ~1.2% at the time of this writing.

When UnitedHealth Group reported third-quarter 2022 results October 14, “Dividend Growth Idea UnitedHealth Outperforming,” the health benefits giant raised its full-year 2022 guidance after increasing its outlook for the year during both the first and second quarters. In advance of its November Investor Conference, the company reiterated its annual GAAP and non-GAAP adjusted diluted EPS targets. At the midpoint of its latest guidance for 2022, UnitedHealth Group is forecasting that its reported diluted EPS will grow by 16% and its adjusted diluted EPS will grow by 15% on an annual basis this year.

UnitedHealth Group’s recently issued guidance for non-GAAP adjusted diluted EPS to come in a range of $24.40-$24.90 per share in 2023 further implies bottom-line growth of 12%-13% next year. We like the pace of expected expansion, by itself. However, on the basis of management’s conservative nature, having raised its guidance throughout 2022, we think the firm’s target for 2023 may be low, and our valuation model reflects this. Our bottom-line EPS estimate for 2023 is $25.17, per our latest report update.

Here’s what UnitedHealth Group had to say about its long-term financial performance outlook:

We anticipate our enterprise will continue to grow as a result of delivering differentiated value to our customers, consumers and society as a whole. We maintain a long-term outlook for earnings per share growth of 13% to 16% on average, with about two-thirds of this growth driven by earnings from operations and the remainder from capital deployment. Earnings growth rates inherently vary year to year, due to changes in economic conditions, health program funding and regulatory changes, investments to drive future organic growth, and capital allocation activities such as business combinations, share repurchases and our dividend…

Overall, we expect Optum to sustain a long-term double-digit revenue growth rate, primarily by serving more people, more comprehensively. Margins are expected to range from above 20% for technology products, to low- to mid-single-digit margins for some pharmacy care services…

We expect UnitedHealthcare to continuously increase value delivered to customers, driving growth in people served across its businesses, and resulting in an 8% to 10% long-term revenue growth rate. The operating margin profile of each business is expected to continue generally stable over the long-term.

We will continue to deploy capital through targeted acquisitions, seek to maintain a market-leading dividend and expect to continue ongoing share repurchase activity. We expect these will contribute in the range of 3 to 5 percentage points to our annual earnings per share growth rate.

We expect our business performance and capital deployment will yield a return on equity of 20% or higher and a return on invested capital in the mid-teens percent or greater.

At the end of September 2022, UnitedHealth Group had $42.6 billion in cash and short-term investments along with $41.6 billion in long-term investments on the books versus $3.2 billion in short-term debt and $45.4 billion in long-term debt. Please note that the company also had substantial medical cost payable liabilities on the books at the end of this period. We are huge fans of UnitedHealth Group’s net cash position, which sat at ~$35.4 billion at the end of the third quarter. Net cash offers dividend payers tremendous financial flexibility.

During the first three quarters of 2022, UnitedHealth Group generated $28.8 billion in free cash flow and spent $4.5 billion covering its dividend obligations along with $6.0 billion buying back its common stock. There is an enormous amount of room for UnitedHealth Group to further boost its dividend going forward, and its payout is well-covered by its stellar free cash flows and fortress-like balance sheet. As of our latest report update, UnitedHealth Group garners a Dividend Cushion ratio of 3.5, a very impressive tally that reflects its fantastic financials.

Concluding Thoughts

We are huge fans of UnitedHealth Group, and its dividend growth potential remains immense. Since 2010, UnitedHealth Group has increased its dividend at a double-digit pace each year. The top end of our fair value estimate range sits at $618 per share of UnitedHealth Group, indicating that the health benefits giant also possesses substantial capital appreciation upside potential as well. Looking ahead, we expect that UnitedHealth Group will grow its dividend at a robust pace, aided by its strong free cash flow generating abilities and pristine balance sheet. Shares yield ~1.2% at the time of this writing.

Tickerized for various health beneifts and healthcare providers.

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.