|

|

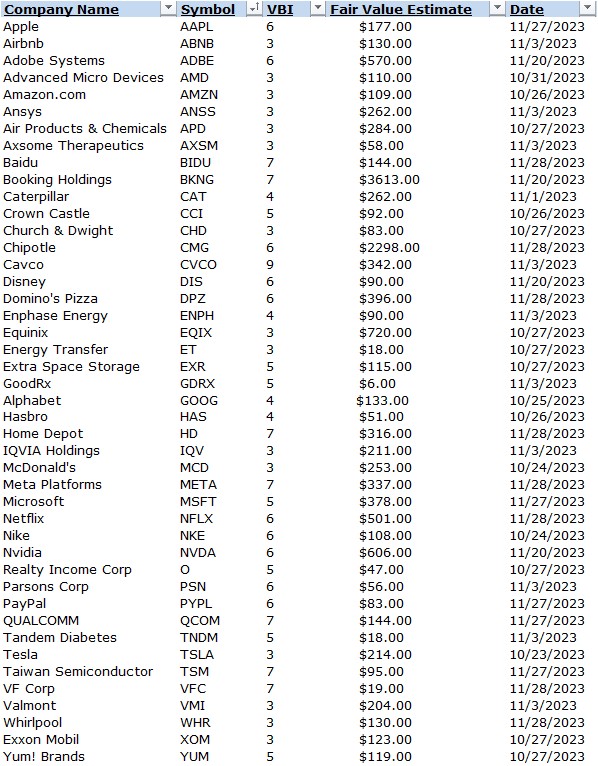

Recent Articles

-

3 Dividend Growth Stocks For The Long Run

3 Dividend Growth Stocks For The Long Run

Nov 29, 2023

-

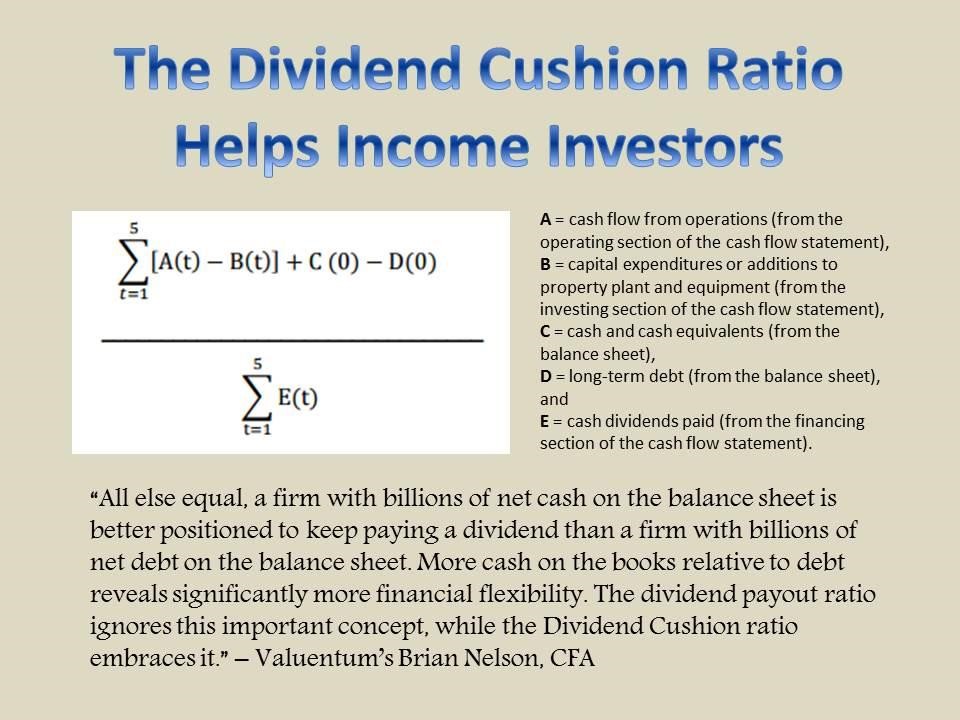

We think dividend growth investors should focus on total return first, and then move on to the evaluation of a company's dividend health. We believe that total return is a function of a company's net cash position and future expectations of free cash flow, and in this article, we have highlighted three strong, net-cash-rich, free cash flow generators that also have increased their dividends consistently over the years. Though these names are not hidden by any stretch, the strong performance of the Magnificent 7 reveals that investors don't need to look very far to find some of the best-performing ideas. Make sure that you know the Dividend Cushion ratio for companies in your dividend growth portfolio!

-

Latest Report Updates

Latest Report Updates

Nov 28, 2023

-

Check out the latest report refreshes on the website.

-

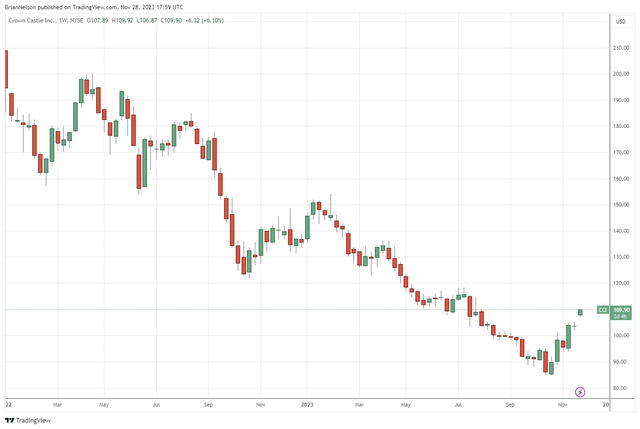

Crown Castle Continues to Languish

Crown Castle Continues to Languish

Nov 28, 2023

-

Image: Crown Castle’s shares have not fared well through 2023, and we’ll be looking to remove them from the High Yield Dividend Newsletter portfolio in coming months.

Crown Castle benefits from attractive tower economics as it can scale customers across its shared infrastructure to drive increased profitability, but the company's massive net cash position continues to weigh on our enthusiasm of the company. Shares of the firm may get a bounce as spot interest rates may continue to ease in the near term, but we’ll be looking to remove it from the simulated High Yield Dividend Newsletter portfolio in the coming months. We also plan to remove the Vanguard Real Estate ETF from that portfolio, too.

-

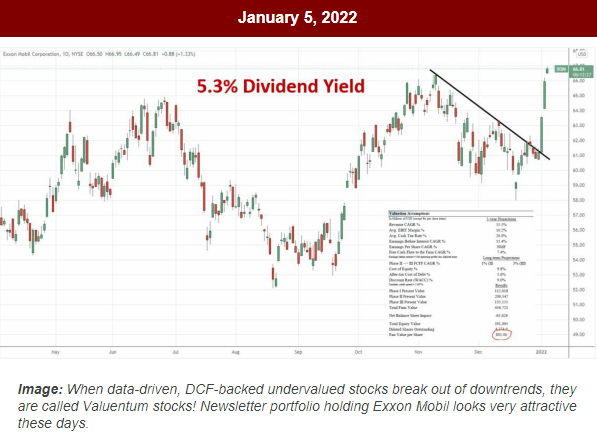

How Do We Use the Valuentum Buying Index?

How Do We Use the Valuentum Buying Index?

Nov 27, 2023

-

Image: We highlighted Exxon Mobil to start 2022, and the stock was one of the best performers in the S&P 500 last year. Exxon Mobil became a “Valuentum” stock last year, with shares being undervalued, exhibiting a strong technical breakout, and sporting an attractive dividend yield to boot. The stock became a huge winner. Note: Exxon is no longer included in the simulated newsletter portfolios. The image is an excerpt from an email sent to members January 5, 2022.

We answer one of the most frequently asked questions about the Valuentum Buying Index.

|