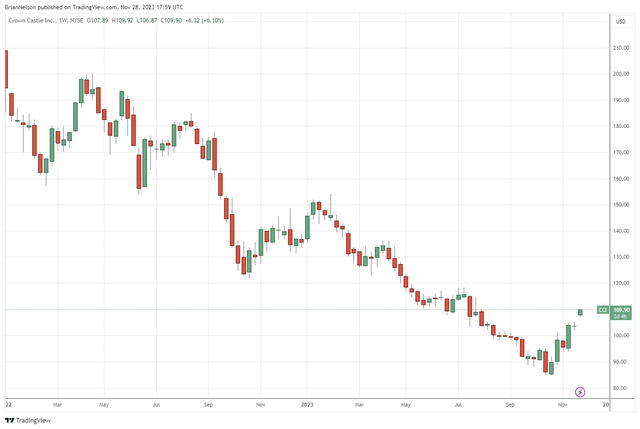

Image: Crown Castle’s shares have not fared well through 2023, and we’ll be looking to remove them from the High Yield Dividend Newsletter portfolio in coming months.

By Brian Nelson, CFA

Equity REITs have had a difficult 2023, and we continue to look to phase out of them in the newsletter portfolios over time, as we believe the group will continue to struggle, “REITs Will Likely Continue to Underperform.” We’ve generally viewed the tower operators as somewhat immune to the challenges that office and retail REITs are facing these days, but Crown Castle’s (CCI) performance thus far in 2023 hasn’t been great.

The company benefits from attractive tower economics as it can scale customers across its shared infrastructure to drive increased profitability, but Crown Castle’s massive net debt position continues to weigh on our enthusiasm of the company. Shares of the firm may get a bounce as spot interest rates may continue to ease in the near term, but we’ll be looking to remove it from the simulated High Yield Dividend Newsletter portfolio in the coming months. We also plan to remove the Vanguard Real Estate ETF (VNQ) from that portfolio, too.

We think the derivative income plays such as the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) and the JPMorgan Equity Premium Income ETG (JEPI) are much more attractive income vehicles. These income-oriented ETFs target broad diversification across the Nasdaq 100 and S&P 500, respectively, as they sell calls on their equity exposures for income. That income investors can gain exposure to these equity indices while reaping an ultra-high dividend yield is nothing short of a breakthrough in modern finance, in my opinion. We’ll be looking for more derivative income plays for members to consider.

When Crown Castle reported its third quarter results for the period ending September 30, site rental revenues nudged up modestly on a year-over-year basis, but net income dropped 37%. Adjusted funds from operations also fell in the period. The company continues to restructure its business as activist investors turn up the heat, but the company has far more complexity with respect to its business at the moment than we’d prefer in an income idea. Adjusted funds from operations is also expected to fall to $6.91 at the midpoint for 2024 from its target of $7.54 in 2023. Things aren’t going great at Crown Castle at the moment, and we don’t have high hopes for a turnaround anytime soon.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and range.