|

|

Recent Articles

-

Dividend Aristocrat Enterprise Products Partners Showcases Strong Earnings Growth in Second Quarter

Dividend Aristocrat Enterprise Products Partners Showcases Strong Earnings Growth in Second Quarter

Jul 30, 2024

-

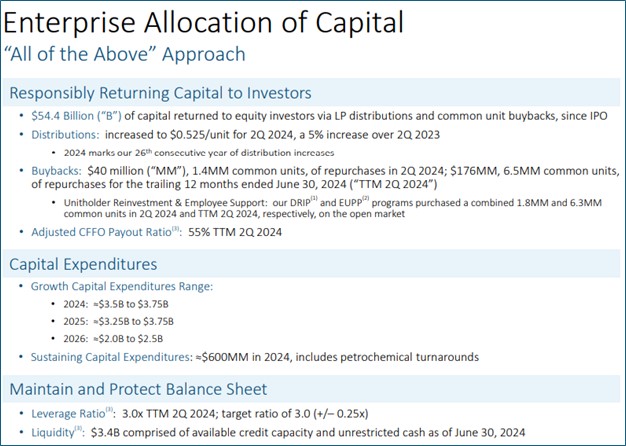

Image Source: 2Q 2024 Enterprise Products Partners Earnings Slides.

On July 30, Enterprise Products Partners reported decent second quarter results. During the quarter, the midstream energy company generated net income attributable to common unitholders of $1.4 billion, or $0.64 per unit on a fully diluted basis, a 12% increase from the same period a year ago. Distributable cash flow [DCF] came in at $1.8 billion, up from $1.7 billion in last year’s quarter and covered its distribution 1.6 times. Enterprise increased its distribution 5% in the second quarter, to $2.10 per common unit on an annualized basis, marking the 26th consecutive year it has raised its payout.

-

Phillips 66 Records Strong Free Cash Flow in Second Quarter

Phillips 66 Records Strong Free Cash Flow in Second Quarter

Jul 30, 2024

-

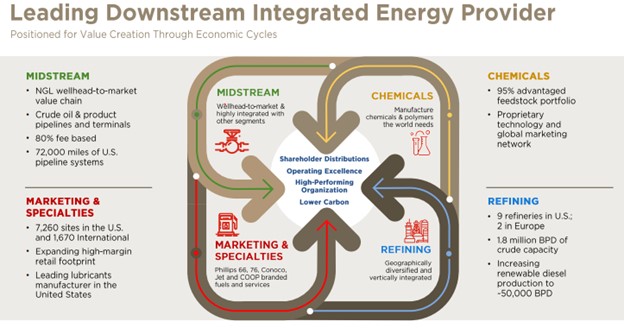

Image Source: Phillips 66 Investor Update.

We like Phillips 66’s investment prospects. The company recently raised its mid-cycle adjusted EBITDA target to $14 billion by 2025. It has a strong investment-grade credit rating of A3/BBB+, with a net debt-to-capital ratio target between 25%-30%. Maintaining capital discipline is par for the course for Phillips 66, as it has generated 12% average ROCE since 2012. The company targets returning more than 50% of operating cash to shareholders, too. Its shares yield 3.3% at the time of this writing.

-

McDonald’s Speaks of Cautious Consumer But Traction with $5 Meal Deal

McDonald’s Speaks of Cautious Consumer But Traction with $5 Meal Deal

Jul 29, 2024

-

McDonald’s second quarter results weren’t great. Comparable store sales and consolidated operating income fell during the period, but McDonald’s lapped a very strong second quarter of 2023, which included a double-digit comp. Diluted earnings per share also declined at a mid-single-digit pace. That said, however, McDonald’s $5 meal deal is gaining traction, and we think it is part of the solution for lower guest counts driven by its recent strategic pricing actions. McDonald’s hasn’t been a strong performer in the Best Ideas Newsletter portfolio of late, but we remain optimistic on its prospects in the current inflationary environment. Shares yield 2.6%.

-

3M Looks to a Brighter Future, Shares Rally 20%+

3M Looks to a Brighter Future, Shares Rally 20%+

Jul 28, 2024

-

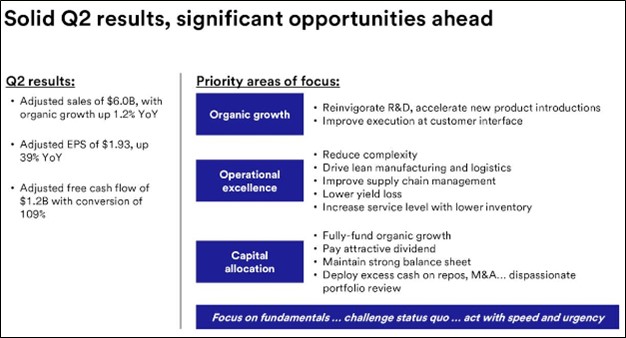

Image Source: 3M’s second quarter results were better than feared.

3M’s stock rallied more than 20% following its second quarter earnings report, as the firm works to put settlements for faulty earplugs and PFAS pollution as well as its spin-off of Solventum behind it. With most of its troubles in the rear-view mirror, 3M can now focus more of its efforts on organic performance, which was solid in the second quarter, despite some portfolio/geographic shifts in its ‘Consumer’ division. 3M’s free cash flow conversion remains robust, and its net debt stood at a manageable ~$3 billion at the end of the quarter. Shares of 3M yield 2.2% at the time of this writing.

|