Image Source: 3M’s second quarter results were better than feared.

By Brian Nelson, CFA

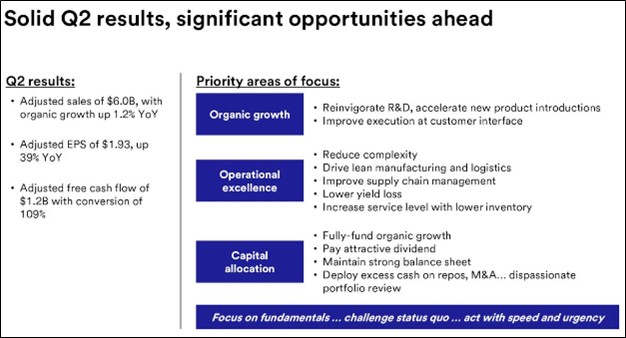

On July 26, 3M (MMM) reported better-than-expected second quarter results with both revenue and non-GAAP earnings per share coming in higher than the consensus forecast. Though reported sales dropped 0.5%, adjusted organic sales advanced 1.2% on a year-over-year basis. Its adjusted operating income margin expanded 4.4 percentage points from the same period a year ago, to 21.6%. Adjusted earnings per share from continuing operations came in at $1.93, up 39% on a year-over-year basis. New CEO William Brown was upbeat on the results:

We delivered another strong quarter with adjusted earnings growth up double-digits and robust cash generation. I want to thank 3M employees for their exceptional execution, which we expect to continue in the second half of the year. As I look ahead, I am focused on three priorities: driving sustained organic revenue growth, increasing operational performance, and effectively deploying capital. I have long admired 3M’s track record of innovation and am excited to be leading this great company and by the opportunities ahead.

3M experienced strength in electronics, while industrial end markets were mixed, and consumer retail discretionary spending remained “soft.” In its ‘Safety & Industrial’ segment, the company experienced 1.1% organic growth with an adjusted operating margin of 22.6%, up 40 basis points year-over-year. In its ‘Transportation & Electronics’ segment, the firm experienced adjusted organic growth of 3.3% and an adjusted operating margin of 22.3%, up 250 basis points year-over-year. Organic growth fell 1.4% in its ‘Consumer’ division as the firm experienced a 2.7 percentage point headwind from portfolio/geographic prioritization, while its segment operating margin dropped 80 basis points from last year’s quarter.

3M’s operating cash flow was $1 billion in the quarter, while adjusted free cash flow was $1.2 billion, revealing 109% conversion. Though the firm recently cut its dividend, 3M still returned $786 million to shareholders in the form of dividends and buybacks in the quarter. Looking to all of 2024, management reiterated its guidance for adjusted total sales growth in the range of -0.25% to +1.75% and adjusted organic sales growth flat to +2%, while it raised the bottom end of its adjusted earnings per share, to $7.00-$7.30 (was $6.80-$7.30).

3M’s stock rallied more than 20% following its second quarter earnings report, as the firm works to put settlements for faulty earplugs and PFAS pollution as well as its spin-off of Solventum (SOLV) behind it. With most of its troubles in the rear-view mirror, 3M can now focus more of its efforts on organic performance, which was solid in the second quarter, despite some portfolio/geographic shifts in its ‘Consumer’ division. 3M’s free cash flow conversion remains robust, and its net debt stood at a manageable ~$3 billion at the end of the quarter. Shares of 3M yield 2.2% at the time of this writing.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.