|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of July 26

Dividend Increases/Decreases for the Week of July 26

Jul 26, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Honeywell Adjusts Full Year 2024 Guidance on Margin Pressures

Honeywell Adjusts Full Year 2024 Guidance on Margin Pressures

Jul 25, 2024

-

Image: Honeywell’s shares have traded sideways for the past 12-18 months.

Honeywell is a fantastic company, and we continue to like shares in the Dividend Growth Newsletter portfolio. Second quarter results were better than expected, but the quarterly beat was overshadowed by lowered adjusted earnings per share and free cash flow guidance for 2024. Though the news wasn’t great, we’re not making any changes to our newsletter portfolios at this time. Shares of Honeywell yield 2% at the time of this writing.

-

IBM’s Free Cash Flow Generation on the Up and Up

IBM’s Free Cash Flow Generation on the Up and Up

Jul 25, 2024

-

Image: IBM’s shares have staged a nice recovery since the beginning of 2023.

Looking ahead to full-year 2024 expectations, IBM continues to expect constant currency revenue growth in the mid-single-digit range, while it now expects free cash flow to be in excess of $12 billion on the year. IBM ended its second quarter with $56.5 billion in total debt and $13.7 billion in cash and marketable securities. We like IBM’s improvement in free cash flow generation and exposure to AI, but we prefer other ideas in big cap tech, namely Alphabet and Microsoft. Shares yield 3.6%.

-

Republic Services Showcases Pricing Strength, Raises Dividend

Republic Services Showcases Pricing Strength, Raises Dividend

Jul 25, 2024

-

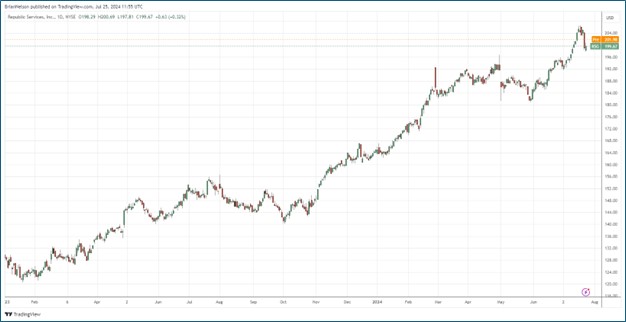

Image: Republic Services’ stock has been consistently strong since the beginning of 2023.

For 2024, Republic expects revenue in the range of $16.075-$16.125 billion, adjusted EBITDA in the range of $4.9-$4.925 billion, and adjusted diluted earnings per share in the range of $6.15-$6.20. Adjusted free cash flow is expected to be in the range of $2.15-$2.17 billion on the year. Management continues to be shareholder friendly buying back stock, and the firm raised its quarterly dividend by $0.045, to $0.58 per share. We like Republic’s pricing strength, its attractive disposal assets, as well as its free cash flow generation. The company remains a holding in the newsletter portfolios.

|