|

|

Recent Articles

-

Energy Transfer Now Covers Distributions with Free Cash Flow

Energy Transfer Now Covers Distributions with Free Cash Flow

Feb 22, 2025

-

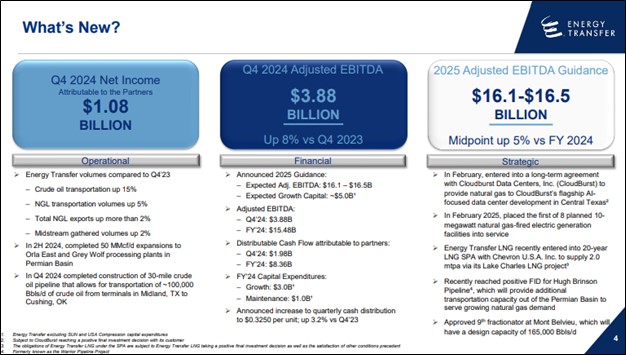

Image Source: Energy Transfer.

Energy Transfer announced a quarterly cash distribution of $0.3250 per common unit during the fourth quarter (3.2% higher than the fourth quarter of 2023), a distribution that was well-covered by distributable cash flow in the period. At the end of the quarter, Energy Transfer had $2.21 billion of available borrowing capacity. For 2024, Energy Transfer hauled in $11.5 billion in cash from operating activities and spent $4.2 billion in capital expenditures, resulting in free cash flow of $7.3 billion, in excess of the $6.4 billion it distributed to partners, noncontrolling interests, and redeemable noncontrolling interests. We like Energy Transfer’s newfound free cash flow coverage of the payout.

-

Booking Holdings' Revenue Accelerates in Fourth Quarter

Booking Holdings' Revenue Accelerates in Fourth Quarter

Feb 21, 2025

-

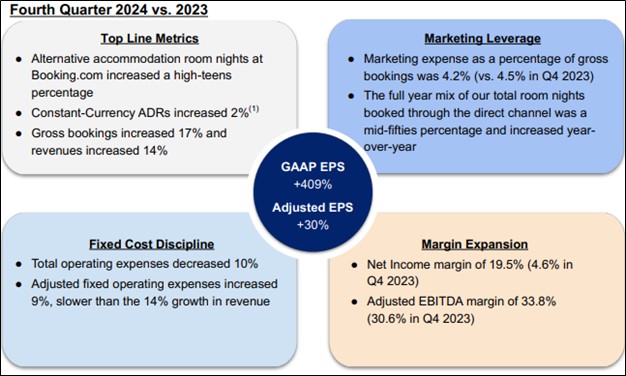

Image Source: Booking Holdings.

Booking Holdings is doing a great job returning cash to shareholders. The company declared a quarterly cash dividend of $9.60 per share, a 10% increase from its quarterly cash dividend of $8.75 per share in 2024. The company repurchased $1.1 billion of stock during the fourth quarter of 2024, and the firm has remaining buyback authorization of $7.7 billion. For the full year 2024, free cash flow was $7.9 billion, roughly 33.3% of sales. Cash and long-term investments were $16.7 billion at the end of the year, about in line with short- and long-term debt of $16.6 billion. We liked Booking Holdings’ accelerated performance in the fourth quarter of 2024 and remain huge fans of its free cash flow generating prowess.

-

Walmart’s Earnings Outlook Falls Short of Expectations

Walmart’s Earnings Outlook Falls Short of Expectations

Feb 21, 2025

-

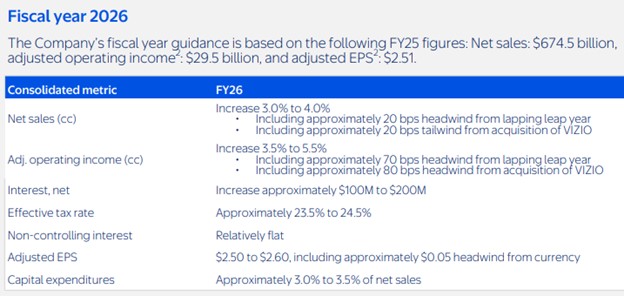

Image Source: Walmart.

Walmart ended its fiscal year with cash and cash equivalents of $9.0 billion and total debt of $45.8 billion. Operating cash flow for fiscal 2025 was $36.4 billion, an increase of $0.7 billion from last year, while free cash flow remained robust at $12.7 billion. Looking to the first quarter of fiscal 2026, net sales are expected to increase 3%-4%, while adjusted operating income is expected to advance 0.5%-2%, with adjusted earnings per share targeted in the range of $0.57-$0.58, below the $0.65 consensus estimate. For all of fiscal 2026, net sales are anticipated to increase 3%-4%, with adjusted operating income expected to increase 3.5%-5.5%. Adjusted earnings per share is targeted in the range of $2.50-$2.60 for the full year (consensus was at $2.76), inclusive of a $0.05 headwind from currency. Shares yield 0.9%.

-

Dividend Increases/Decreases for the Week of February 21

Dividend Increases/Decreases for the Week of February 21

Feb 21, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

|