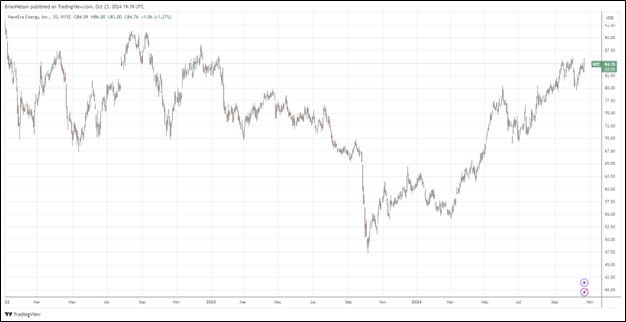

Image: NextEra Energy’s shares have bounced back nicely from their October 2023 lows.

By Brian Nelson, CFA

On October 23, NexEra Energy (NEE) reported solid third-quarter results with net income attributable to NextEra Energy on a GAAP basis of $1.852 billion, or $0.90 per share, which compares to $1.219 billion, or $0.60 per share, for the third quarter of last year. On an adjusted basis, third quarter earnings came in at $2.127 billion, or $1.03 per share, compared to $1.92 billion, or $0.94 per share, in the third quarter of last year.

Management had a lot to say in the press release:

NextEra Energy delivered strong third-quarter results, increasing adjusted earnings per share by approximately 10% year-over-year, reflecting continued solid financial and operational performance at both our businesses. Over the last several weeks, our customers in Florida have been affected by Hurricanes Helene and Milton, and our thoughts go out to all those impacted. FPL’s valuable investments in hardening and smart-grid technology prevented hundreds of thousands of outages, and together with the efforts of our team and mutual assistance partners, we restored service to roughly 95% of affected customers after the second full day of restoration after Hurricane Helene’s landfall and after the fourth full day of restoration after Hurricane Milton’s landfall. For the second consecutive quarter, NextEra Energy Resources added approximately 3 gigawatts of new renewables and storage projects to its backlog, delivering another strong renewables origination quarter. We are also pleased to announce incremental framework agreements with two Fortune 50 customers for the potential development of renewables and storage projects, totaling up to 10.5 gigawatts between now and 2030. The continued strong performance of our businesses and our scale, experience and technology will allow us to capitalize on the opportunity that increased power demand is bringing to our sector. We will be disappointed if we are not able to deliver financial results at or near the top of our adjusted earnings per share expectations ranges each year through 2027, while maintaining our strong balance sheet and credit ratings.

NextEra Energy reaffirmed its outlook, which we like quite a bit. This year, NextEra Energy continues to expect adjusted earnings per share in the range of $3.23-$3.43. For 2025, 2026, and 2027, the company expects adjusted earnings per share in the ranges of $3.45-$3.70, $3.63-$4.00 and $3.85-$4.32, respectively. NextEra Energy also continues to expect to grow its dividends per share at roughly a 10% rate per year through at least 2026, off a 2024 base. We like NextEra Energy as a core holding in the ESG Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.