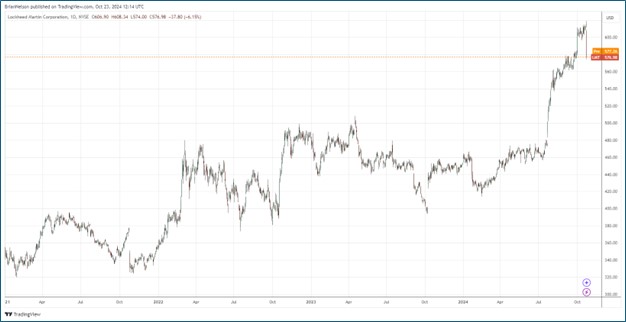

Image: Lockheed Martin’s shares have done well of late.

By Brian Nelson, CFA

On October 22, Lockheed Martin (LMT) reported mixed third quarter results with revenue coming up short relative to the consensus forecast but non-GAAP earnings per share beating what the market had been expecting. Net sales advanced 1% on a year-over-year basis, while net earnings of $1.6 billion fell from $1.7 billion in the third quarter of last year. Net earnings per share came in at $6.80, up from $6.73 per share in the year-ago period. Cash flow from operations was $2.4 billion, down from $2.9 billion in the same period last year, while free cash flow was $2.1 billion in the third quarter of 2024, down from $2.5 billion in the comparable period last year.

Management was upbeat in the press release:

In the third quarter, we advanced our strategic, operational and financial priorities, as demonstrated by our record backlog of more than $165 billion, 48 F-35 deliveries, increased production on missile programs, and $2.1 billion of free cash flow generation.

As a result of our strong year-to-date results and confidence in our near-term performance, we are raising the outlook for full year 2024 sales, segment operating profit, EPS and free cash flow. Looking forward, we continue to make progress on the three key initiatives of our 21st Century Security strategy of strengthening the resiliency and scalability of our production system, accelerating cutting edge digital and physical technologies into all our mission solutions and our internal operations, and expanding international partnerships to broaden our production capacity and drive more international sales. We are making substantial investments in these areas, while continuing to focus on our fundamental financial objective of driving free cash flow per share growth to generate returns for shareholders. Given our confidence in the company’s ability to deliver on these objectives, our Board has also approved a five percent increase in our quarterly dividend, the 22nd consecutive year of increases.

During the quarter, Lockheed Martin paid cash dividends of $749 million and spent $850 million buying back 1.5 million shares. The company authorized a $3 billion increase to its buyback program, and it now has total authorization for potential future stock repurchases of $10.3 billion. Lockheed Martin also recently increased its dividend by $0.15 to a quarterly dividend payment of $3.30 per share, which equates to a forward estimated dividend yield of 2.3%. Total backlog stood at $165.7 billion, as of September 29, up from $160.6 billion at the end of last year.

Looking to 2024, Lockheed Martin increased its annual sales guidance to $71.25 billion, up from the midpoint of its previous range of $70.5-$71.5 billion. Business segment operating profit for the year is now expected at $7.475 billion, up from the midpoint of its prior range of $7.35-$7.5 billion. Diluted earnings per share is expected at $26.65 for the year, above the prior range of $26.10-$26.60 per share. Free cash flow for 2024 is targeted at $6.2 billion, up from the midpoint of its prior range of $6-$6.3 billion.

We liked Lockheed Martin’s guidance revisions for 2024, but we’re keeping a watchful eye on its F-35 program revenues, which experienced lower sales in the quarter due to delays in receiving additional contractual authorization and funding under its Lots 18-19 contract. The company’s Missiles and Fire Control (MFC) segment and Rotary and Mission Systems (RMS) segment experienced sales increases of 8% and 6%, respectively, in the quarter. Operating profit growth was most pronounced in its MFC division. The high end of our fair value estimate range stands at $649 per share, and we continue to like shares as an idea in the Dividend Growth Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.